简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

【MACRO Insight】Financial markets in the vortex of US economic policy: the triple game of debt, curre

Zusammenfassung:1. High debt and political game: a “stress test” of fiscal sustainabilityThe debt problem of the U.S. federal government has entered the critical point of quantitative change to qualitative change. Th

1. High debt and political game: a “stress test” of fiscal sustainability

The debt problem of the U.S. federal government has entered the critical point of "quantitative change to qualitative change". The current debt interest expenditure has exceeded federal health insurance and defense spending. According to the forecast of the "Committee for a Responsible Federal Budget", interest expenditure will reach 1 trillion US dollars next year, second only to social security as the largest expenditure item. The core of this change lies in the "inversion" of debt costs and economic growth - since the early 2000s, the inflation-adjusted 10-year U.S. Treasury yield has long been lower than the expected economic growth rate, and now both have risen to more than 2%, forming what Bernstein (former Biden economic adviser) calls a "game changer for debt sustainability."

In the face of the crisis, the policy level has fallen into politicization. Bernstein called on Congress to preset an "emergency" fiscal response mechanism, but avoided the impact of Biden's government spending and focused on Trump's policies. Trump, on the other hand, tried to ease debt pressure by pressuring the Federal Reserve to cut interest rates. This idea of "covering up fiscal imbalances with monetary easing" laid the groundwork for subsequent market fluctuations.

2. Monetary policy fog: the "expectation tug-of-war" between the Federal Reserve and the market

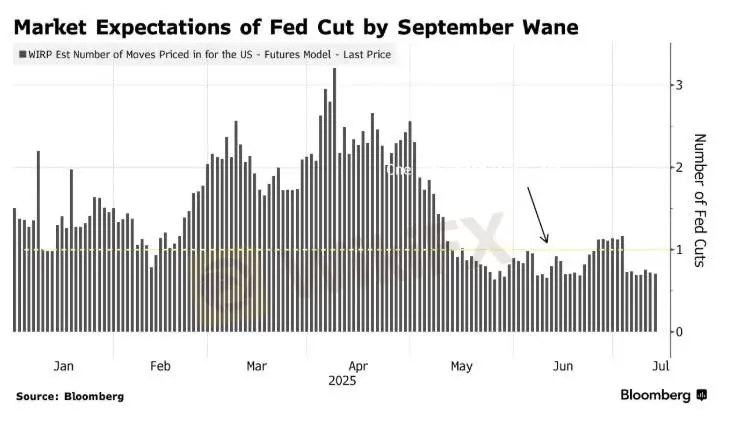

The Fed's policy path is becoming a core variable in market fluctuations. At the beginning of the year, traders were almost certain that interest rate cuts would resume in September, but strong employment data in July and uncertainty about tariff policies have reduced this probability from "a sure thing" to about 70%. The June CPI data has therefore become the "decisive factor" - Barclays pointed out that the June CPI has deviated from expectations by the largest margin in history. If it shows that price pressures are heating up (especially driven by Trump's tariffs), it may completely shake expectations of interest rate cuts and push up US bond yields; if the data is mild, it may restart easing bets.

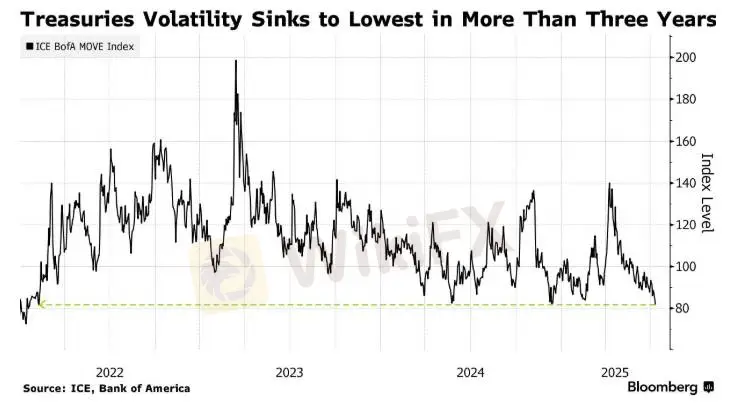

There are also differences within the Fed: Powell emphasized the "moderately restrictive" interest rate stance, and the dot plot showed that there might be two rate cuts before the end of the year, but seven officials believed that there would be no rate cuts in 2025, and Waller and other directors hinted that rate cuts would be restarted as early as this month. This disagreement, combined with political pressure, has caused the U.S. bond market to fluctuate within a range - the two-year yield has fluctuated between 3.7% and 4%, and volatility has dropped to a three-year low. Traders continue the short-term strategy of "buy on dips and sell on rallies."

三、Corporate earnings and the stock market paradox: differentiation and opportunities under low expectations

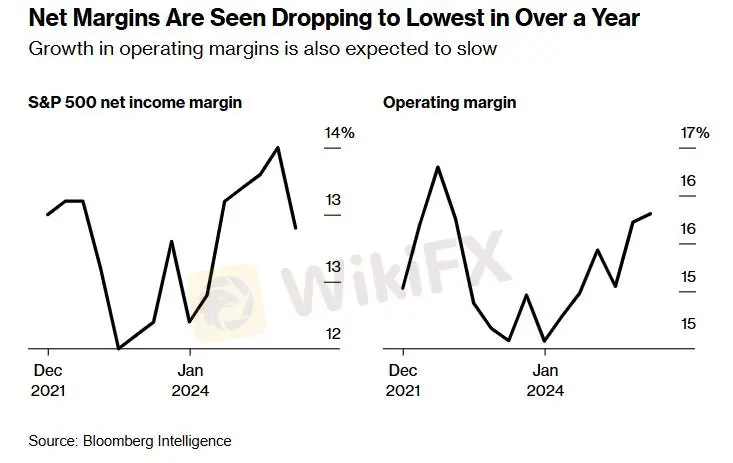

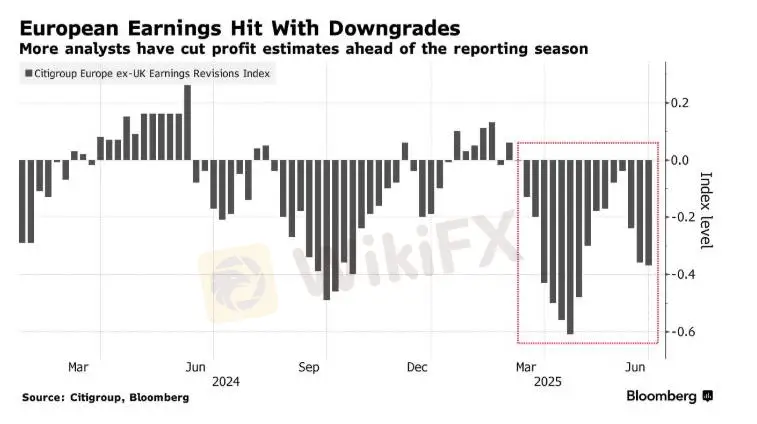

Compared with the cautiousness of the bond market, U.S. stocks hit a record high after the sell-off in April, but it is doubtful whether the "report card" of the second quarter earnings season can match the optimistic sentiment. According to Bloomberg Intelligence data, the profits of S&P 500 components in the second quarter are expected to grow by only 2.5%, the weakest performance since mid-2023. Among the 11 sectors, 6 are expected to see a decline in profits, and the full-year growth forecast has dropped from 9.4% in early April to 7.1%.

This "low expectation" has become a potential positive. Charles Schwab pointed out that the current expectation threshold is extremely low, and it is easier for companies to exceed expectations. The key lies in whether the gross profit margin can withstand tariff pressure. The performance of technology giants is particularly critical: the "seven major technology giants" are expected to increase profits by 14% in the second quarter. If they are excluded, the S&P 500 profit may drop slightly by 0.1%. Despite the uncertain trade environment, Microsoft, Meta and others still plan to increase capital expenditures to US$337 billion in fiscal 2026. AI investment has become a core growth point. BlackRock believes that "AI is the most persistent dominant theme."

Conclusion: Reconstructing market logic in the policy vortex

If the Fed succumbs to political pressure and cuts interest rates too early, it may push up long-term inflation and interest rates and increase the debt burden; if it insists on fighting inflation, it will directly amplify the pressure of interest expenditures. This "double helix trap" is intertwined with the differentiation of corporate profits and the weakening of the US dollar, causing the market pricing logic to shift from "economic fundamentals driven" to "policy game driven". This game across fiscal, monetary and corporate levels is reshaping the confidence boundary of global capital in US dollar assets.

Haftungsausschluss:

Die Ansichten in diesem Artikel stellen nur die persönlichen Ansichten des Autors dar und stellen keine Anlageberatung der Plattform dar. Diese Plattform übernimmt keine Garantie für die Richtigkeit, Vollständigkeit und Aktualität der Artikelinformationen und haftet auch nicht für Verluste, die durch die Nutzung oder das Vertrauen der Artikelinformationen verursacht werden.

WikiFX-Broker

Aktuelle Nachrichten

Nach Trumps Brief: EU legt neue Liste für Gegenzölle vor – so geht es jetzt weiter

LVMH-Luxus-Marke wird jetzt vom Staat überwacht: Was Loro Piana vorgeworfen wird

Gute Nachrichten für Deutschland: Nächster US-Konzern investiert Milliarden in deutsche Cloud

Bundesbank: Deutsche Wirtschaft verliert wieder an Fahrt – drittes Jahr ohne Wachstum droht

Wechselkursberechnung