简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

SmartFX Exposed: 4 Warning Signs Traders Can’t Ignore

Abstract:Facing losses due to manipulative forex trading that takes centre stage at SmartFX? Move out of this ship before it sinks and leaves you with virtually no capital on hand. In this article, we will expose SmartFX by showcasing its four red flags that traders like you cannot ignore.

Facing losses due to manipulative forex trading that takes centre stage at SmartFX? Move out of this ship before it sinks and leaves you with virtually no capital on hand. Many of your fellow traders have been experiencing trading issues with this scam forex broker. They fail to receive withdrawals, face trade losses, and have an overall worse trading experience with this broker. In this article, we will expose SmartFX by showcasing its four red flags that traders like you cannot ignore.

Revealing the Red Flags for SmartFX

1. Unregulated Forex Broker

The biggest risk of trading with SmartFX is that it is an unregulated forex broker despite operating for more than five years. Imagine the numerous customers this Vanuatu-based forex broker would have scammed through its journey. Unregulated forex brokers, such as SmartFX, do not need to share records with the regulator, which minutely checks every detail before allowing regulated brokers to continue their operations.

2. Manipulative Trading Hurts Traders

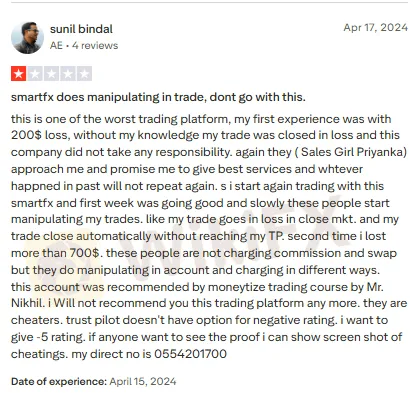

Keeping the traders unaware, SmartFX carries out its financial mayhem. Closing the trade at a loss for traders is increasingly becoming the norm for this scam forex broker. When traders complain about it, SmartFX admits its mistake and assures them of no foul play going forward. However, the company officials keep committing trading mistakes intentionally to pile losses for the traders. One such investor shared his anguish over the manipulative trade that affected him. Take a look at the complaint screenshot.

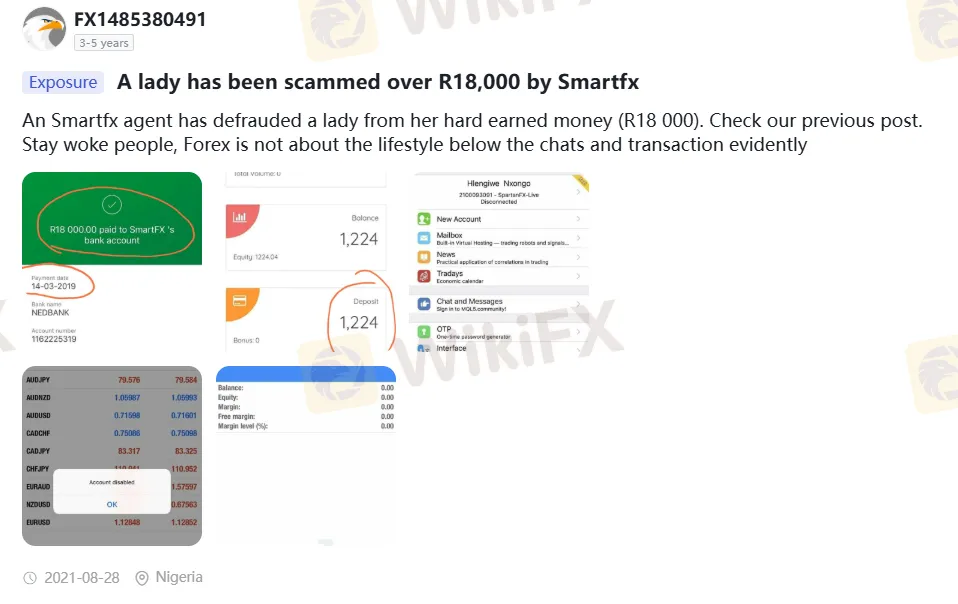

3. Losses Worth Over R18000

The agents at SmartFX are not kind and empathetic to traders who invest a significant sum to boost the company's deposit balance. Some years ago, a lady was duped by a SmartFX agent of an amount exceeding R18,000. Here is the screenshot supporting this complaint.

4. Overall Ratings

Given the numerous scams SmartFX has inflicted on traders, the rating has not been good for the broker. WikiFX, a leading forex broker regulation inquiry app, has assigned it a poor score of 2.27 out of 10.

Join the WikiFX Masterminds Community, Where You Stay Updated About Forex Scams and Other Financial News.

Here is the gateway to this growing community.

1. Scan the QR code placed right at the bottom.

2. Download the WikiFX Pro app.

3. Afterward, tap the ‘Scan’ icon placed at the top right corner

4. Scan the code again.

5. Congratulations, you are part of the community.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Stunning Revelation: OXShare Disallows Withdrawals When Traders Make Profits

The revelation that OXShare disallows withdrawals to traders when they make profits is stunning but true. Many traders have complained about it on forex broker review platforms, but to no avail. They may receive assurances, but company officials do not live up to their promises. What’s more, these officials manipulate trades, forge vital details, and eventually scam traders who put their hard-earned capital on it. In this article, we will expose OxShare with proof. Read on to check them.

WikiFX Broker Assessment Series | Windsor Brokers: Is It Trustworthy?

In this article, we will conduct a comprehensive examination of Windsor Brokers, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

How to Choose a Forex Broker in Just 5 Minutes?

Interested in forex trading and seeking a broker who can help you make the most of different currency pair price movements? You are in the right place to find the right forex broker. In this article, we will help you choose the broker based on several factors such as regulatory compliance, leverage, margin, trading platform, etc.

IBKR Lite Singapore Debuts with Zero-Commission US Stock Trading

Interactive Brokers launches IBKR Lite Singapore, offering zero-commission trading on US stocks and ETFs with global market access and flexible plan options.

WikiFX Broker

Latest News

ASIC Regulated Forex Brokers: A Comprehensive 2025 Guide

Is TradeEU Reliable in 2025?

Professional Forex Trading: Skills, Tools, & Strategies for Success

Investing in OnFin? Absurd Withdrawal Conditions & Trade Manipulation May Spoil Your Trading Mood

How Commodity Prices Affect Forex Correlation Charts

TopFX Launches Synthetic Indices Trading on cTrader Platform

Is CBCX a Safe and Trustworthy Broker for Traders?

Quotex Broker Review 2025: Is It a High-Risk Broker?

Top 5 Warning Signs- Why You Should Avoid MTrading Broker?

PrimeXBT Expands FSCA Licence and Enhances Crypto Services in 2025

Currency Calculator