简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

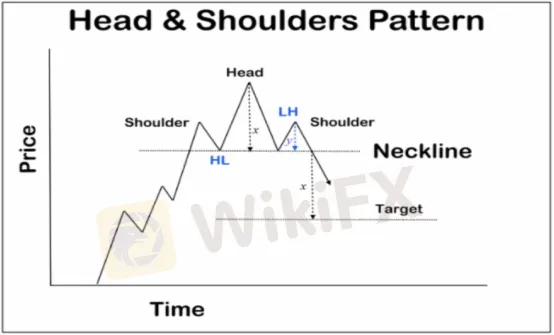

Pattern for the Head and Shoulders

Abstract:There are a few trading patterns that the technical trader seems to return to time and time again. The "head and shoulders pattern" is without a doubt one of the most popular. In fact, some traders would exclusively trade this pattern, but there are a few factors to take in mind before using it, as with everything else.

There are a few trading patterns that the technical trader seems to return to time and time again. The “head and shoulders pattern” is without a doubt one of the most popular. In fact, some traders would exclusively trade this pattern, but there are a few factors to take in mind before using it, as with everything else.

Defining the pattern is the first step.

The first step is to figure out what pattern we're dealing with. The left shoulder, the head, and the right shoulder are the three sections of the head and shoulders pattern. It's a pattern in which a high arises, then a retreat, a higher high, and finally a low or high. In other words, the right shoulder, the third section of the pattern, is a lower height from the head.

It is not necessary for all head and shoulders patterns to be negative.

There is an inverse pattern, as is the case with many technical patterns. This is essentially a sequence of three lows, beginning with a rebound back to the upside on the left hand shoulder, then a break down to create the head, a bounce back to the upside, and finally a “higher low” producing the third shoulder. It's a “upside down head and shoulders design,” to put it simply. This indicates that the selling are losing steam, and the market might be poised for a strong rally. Take a look at the graph below to understand how this works in reverse. It should be obvious that it is the exact same thing, only inverted.

Head and shoulders patterns don't have to be negative all of the time.

An inverse pattern exists, as it does with many technical patterns. This is merely a sequence of three lows, beginning with a rebound back to the upside on the left hand shoulder, then a break down to create the head, a bounce back to the upside, and finally a “higher low” producing the third shoulder. It's a “inverted head and shoulders pattern,” to put it simply. This indicates that the sellers' impetus is fading, and the market may be poised for a strong rally. See how this works in an inverted pattern in the graphic below. It's the same thing, but inverted.

Remember, if you require other people to go along with you, simplicity is one of the features of a strong trading method. These clear patterns are beneficial since the rest of the market can be pushed in the same direction as you.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

He Lost RM275,000 to a Fraudulent "Moomoo" Scam

A 57-year-old engineer lost RM275000 in an online investment scam that misused the name of a well-known trading platform, Moomoo. The scam was promoted through a Facebook advertisement in April and led the victim to believe he was engaging in a credible investment opportunity.

The Hidden Dangers of Viral Trading Advice

Do you turn to social media for trading advice? If yes, do you know that much of what you are consuming could be doing more harm than good?

Understanding the Advantages and Disadvantages of a Forex Profit Calculator

Forex Profit Calculator is a useful tool, especially since many traders depend on tools to make accurate, informed decisions. Whether you are an experienced trader or a newbie, it is necessary to know how this tool works for long-term success.

What Are the Best Forex Trading Hours for Maximum Profit?

Maximize forex profits by understanding optimal trading hours. Learn about market overlaps, liquidity, and volatility for strategic trading decisions.

WikiFX Broker

Latest News

The Dollar Keeps Falling: How Should We View Exchange Rate Volatility?

Asia-Pacific markets mostly rise as investors parse a slew of data releases

Asia-Pacific markets rise as investors parse a slew of data releases

WikiFX Gala Night Malaysia Concludes Successfully

IG Group Unlocks Over £425 Million amid a Capital Reduction

Gold Prices Fall by INR 39,300 in the Last Week? What's Next Week's Outlook?

European stocks open slightly higher as UK-U.S. trade deal cuts autos, aviation tariffs

Treasury yields tick lower as Trump's spending bill in focus

European stocks mixed as UK-U.S. trade deal cuts autos, aviation tariffs

Ripple and SEC Drop Appeals, Bringing 5-Year Legal Saga to a Close

Currency Calculator