简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Trading Support and Resistance

Abstract:Get our trading strategies with our monthly & weekly forecast of currency pairs worth watching using support & resistance for the week of February 21, 2022.

This week I will begin with my monthly and weekly forecasts of the currency pairs worth watching. The first part of my forecast is based upon my research of the past 20 years of Forex prices, which show that the following methodologies have all produced profitable results:

Trading the two currencies that are trending the most strongly over the past 6 months.

Trading against very strong weekly counter-trend movements by currency pairs made during the previous week.

Carry Trade: Buying currencies with high interest rates and selling currencies with low interest rates.

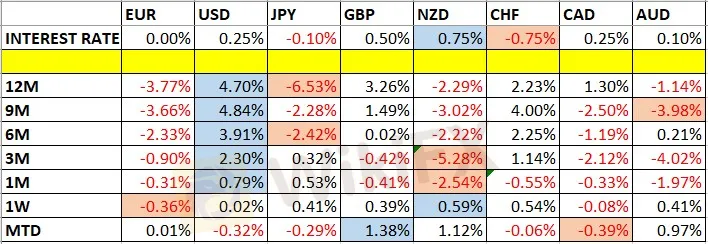

Let us look at the relevant data of currency price changes and interest rates to date, which we compiled using a trade-weighted index of the major global currencies:

Monthly Forecast February 2022

For the month of February, I forecasted that the EUR/USD currency pair will fall in value. The performance to date of this forecast is as follows:

| Currency Pair | Forecast Direction | Interest Rate Differential | Performance to Date |

| EUR/USD | Short ↓ | +0.25% (0.25% - 0.00%) | -0.76% |

Weekly Forecast 20th February 2022

In my previous forecast last week, I made no weekly forecast. I again make no forecast this week.

The Forex market saw its level of directional volatility fall last week, with only 3% of all the important currency pairs or crosses moving by more than 1% in value. Directional volatility is likely to increase or remain the same over this coming week, especially if military conflict between Russia and Ukraine begins.

Last week was dominated by relative strength in the New Zealand Dollar, and relative weakness in the Euro, but the numbers were so small as to be negligible.

You can trade our forecasts in a real or demo Forex brokerage account.

Key Support/Resistance Levels for Popular Pairs

I teach that trades should be entered and exited at or very close to key support and resistance levels. There are certain key support and resistance levels that can be watched on the more popular currency pairs this week.

| Currency Pair | Key Support / Resistance Levels |

| AUD/USD | Support: 0.7157, 0.7082, 0.7006, 0.6963Resistance: 0.7191, 0.7293, 0.7321, 0.7344 |

| EUR/USD | Support: 1.1279, 1.1195, 1.1183, 1.1089Resistance: 1.1418, 1.1671, 1.1688, 1.1711 |

| GBP/USD | Support: 1.3458, 1.3401, 1.3375, 1.3340Resistance: 1.3664, 1.3769, 1.3852, 1.3898 |

| USD/JPY | Support: 114.80, 114.55, 114.23, 113.07Resistance: 115.34, 115.56, 115.71, 115.95 |

| AUD/JPY | Support: 82.41, 81.89, 80.79, 80.40Resistance: 84.35, 84.83, 84.96, 85.20 |

| EUR/JPY | Support: 130.00, 129.31, 128.30, 127.44Resistance: 131.16, 131.51, 131.91, 132.35 |

| USD/CAD | Support: 1.2645, 1.2535, 1.2498, 1.2372Resistance: 1.2812, 1.2901, 1.2959, 1.3025 |

| USD/CHF | Support: 0.9159, 0.9072, 0.9000, 0.8969Resistance: 0.9213, 0.9228, 0.9291, 0.9370 |

That is all for this week. You can trade my forecasts in a real or demo Forex brokerage account to test the strategies and strengthen your self-confidence before investing real funds.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

FCA Plans to Transform Financial Regulations in the UK

The Financial Conduct Authority (FCA) has revealed plans to reform its regulatory framework to support economic growth in the United Kingdom.

Is eToro Leaving London to Focus on a $5B U.S. IPO in 2025?

eToro plans a $5B U.S. IPO in 2025, shifting focus from London to the U.S. market. Discover details on eToro's valuation, SEC filing, and future in fintech.

Naira Falls Against Dollar as Nigeria Reshapes Economic Blueprint

As Nigeria's foreign exchange reserves gradually decrease, the value of the Naira in the foreign exchange market continues to decline, and the exchange rate of the Naira against the US dollar has been consistently dropping, becoming one of the major challenges facing Nigeria's economy.

Project Manager Loses Over RM138,000 in Shocking Investment Scam

A 37-year-old project manager lost over RM138,000 to an investment scam after being lured by promises of 20% returns. The victim was deceived by a fraudulent caller posing as a bank employee and transferred funds through 30 online transactions. The scam involved a mule account, leading to an investigation under Sections 420 and 424 of the Penal Code. Authorities urge the public to verify investment opportunities with trusted organizations to avoid similar schemes.

WikiFX Broker

Latest News

IG Japan Extends US Stock CFD Trading Hours in 2025

ALERT! Warning against Livaxxen

Which Zodiac Sign Makes the Best Trader?

Plus500 Collaborates with Topstep, Prop firm

Robinhood Launches Crypto Trading Services in Spain

Archax Secures FCA Approval to Oversee Crypto Promotions in the UK

CLS Global Admits to Crypto Fraud

Philippine SEC Urges Caution Regarding Ecomamoni

Become Women Brand Ambassador of Yamarkets

Naira Falls Against Dollar as Nigeria Reshapes Economic Blueprint

Currency Calculator