简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

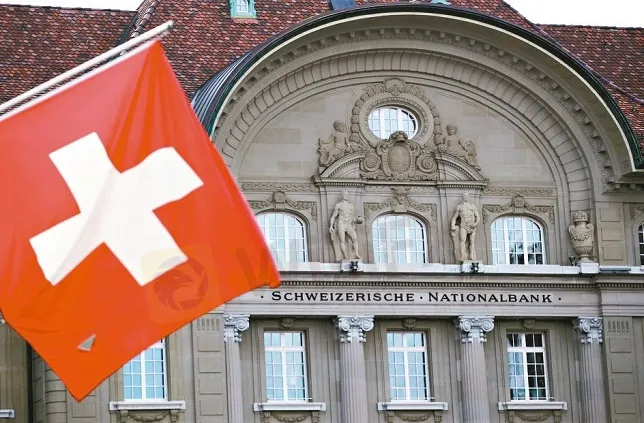

Swiss National Bank says ready to intervene to stem franc's rise

Abstract:The Swiss franc is currently sought after as a refuge currency, along with the US dollar and the yen.

The Swiss National Bank repeated on Monday its pledge to intervene on the currency markets after safe-haven inflows pushed the Swiss franc above parity in its valuation versus the euro.

“The Swiss franc is currently sought after as a refuge currency, along with the US dollar and the yen,” the central bank said in a statement.

“The Swiss franc continues to be highly valued,” it added. “The SNB remains prepared to intervene in the foreign exchange market if necessary.”

For more Forex news, please download WikiFX- the Global Forex Regulatory Inquiry APP.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Want to Deposit in the EVM Prime Platform? Stop Before You Lose It ALL

Contemplating forex investments in the EVM Prime platform? Think again! We empathize with those who have been bearing losses after losses with EVM Prime. We don't want you to be its next victim. Read this story that has investor complaints about EVM Prime.

Sigma-One Capital Scam? Investors Say They Can’t Withdraw Funds

Sigma-One Capital, where forex scams happen almost every day, has grabbed everyone’s attention. Investors are crying for withdrawal denials, unethical approach of bringing in deposits, and a complete loss of invested capital. Explore this story where we have exposed Sigma-One Capital for their scamming acts.

Is Your Forex Strategy Failing? Here’s When to Change

Have you been encountering frequent forex losses? Finding it hard to gain the trading momentum? Can’t understand whether your current forex strategy is in line with the shift in economic indicators or the geopolitical climate? Overcomoming these will require a change to your forex investment strategy. Learn those smart strategic changes here.

The Startling Differences Between Hedging and Arbitrage

The two risk management investment tools - hedging vs arbitrage - have been helping investors achieve their respective financial goals. Explore this comparision to understand their functionalities, the investment purpose they serve, the risk attached, and several other aspects.

WikiFX Broker

Latest News

Is Your Forex Strategy Failing? Here’s When to Change

FSMA Warns That Some Firms Operate as Pyramid Schemes

Apex Trader Funding is an Unregulated Firm | You Must Know the Risks

Sigma-One Capital Scam? Investors Say They Can’t Withdraw Funds

Federal Reserve likely to hold interest rates steady despite pressure from Trump. Here's what that means for your money

WEEKLY SCAM BROKERS LIST IS OUT! Check it now

Intel drops 9% as chipmaker's foundry business axes projects, struggles to find customers

Palantir joins list of 20 most valuable U.S. companies, with stock more than doubling in 2025

Textiles to whisky: U.K.–India 'historic' deal is set to boost bilateral trade by over $34 billion a year

Thailand-Cambodia border clashes: Cambodia's economy has more to lose, analysts say

Currency Calculator