简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Conservative Investment VS Forex

Abstract:Inflation negatively affects the purchasing power of it

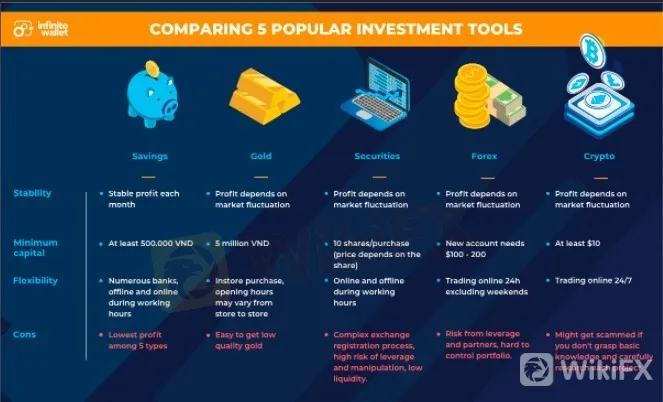

It is hard to decide what option to choose when it comes to investments. To help you set a clear investment strategy in our new content series, we will try to shed light on some of the most popular investment opportunities and compare them with trading. Lets start with the pros and cons of savings accounts compared with the ones of Forex.

# Savings account

Pros: Offers stable yet modest return on money, safe in the sense of a shallow risk of losing money, most accounts are secured by the government and can be compensated

Cons: Inflation negatively affects the purchasing power of it

# Forex

Pros: Offers higher profits, not dependent on inflation or financial institutions' policies

Cons: Needs in-depth learning and daily practice to guarantee stable and positive results

Have you invested in savings accounts? What was your experience with them?

#investing #forex #savings

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

OctaFX Back in News: ED Attaches Assets Worth INR 134 Cr in Forex Scam Case

The Enforcement Directorate (ED) in Mumbai has attached assets worth around INR 131.45 crore. This included a luxury yacht and residential properties in Spain. Read this interesting story.

OANDA Rebrands TMS Brokers in Lithuania and Latvia Forex Markets

OANDA upgrades Baltic forex with TMS Brokers rebranding and new mobile app for enhanced trading technologies in Europe.

ActivTrades returns to profitability

London-based broker ActivTrades has released its financial results for 2024, signaling a robust turnaround following a challenging 2023. The broker recorded notable improvements in profitability, client acquisition, and capital reserves, marking a year of renewed momentum and strategic recalibration.

Admiral Markets: A Mix of Regulation and Risk

Despite multiple licenses, Admiral Markets presents potential red flags that traders should not ignore, including a suspicious clone alert and disclosure by Malaysia’s Securities Commission.

WikiFX Broker

Latest News

He Thought He Earned RM4 Million, But It Was All a Scam

CryptoCurrency Regulations in India 2025 – Key Things You Should Know

OctaFX Back in News: ED Attaches Assets Worth INR 134 Cr in Forex Scam Case

Trump inaugural impersonators scammed donors out of crypto, feds say

Ethereum is powering Wall Street's future. The crypto scene at Cannes shows how far it's come

Forex Hedging: Is It a Trader’s Safety Net or Just an Illusion?

US debt is now $37trn – should we be worried?

OPEC+ members agree larger-than-expected oil production hike in August

US Jobs Data Out: Boom in Government Sector, Not So in Private Sector

HSBC: Wealthy investors' gold holdings more than double

Currency Calculator