简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Crude Oil Prices: EIA Data in Focus as WTI Trades at Steep Discount to Brent

Abstract:CRUDE OIL, BRENT OIL, PRICE SPREAD, EIA, INVENTORY, EXPORTS - TALKING POINTS

Crude oil is trading at a steep discount versus Brent crude oil, driving US exports

EIA data in focus as traders assess global oil flows amid Russia-Ukraine conflict

A large US inventory draw may see WTI prices rise faster relative to Brent prices

Brent and WTI crude oil prices are moving lower in Wednesdays Asia-Pacific session. A renewed sense of hope about a cease-fire agreement between Ukraine and Russia may be helping to cool prices. Earlier this week, oil prices sank more than 8% as China announced a two-stage lockdown in Shanghai, a major Asian finance hub.

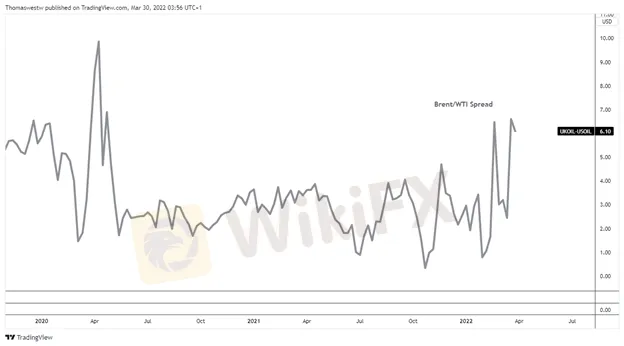

The economic sanctions levied on Russia have thrown energy markets into disarray recently. The global benchmark, Brent oil, has outpaced the rise in WTI crude prices, the US benchmark. That is likely explained by the fact that Russias supply is more influential on Brent, given the geographic nature of the global oil market. The US prices are inherently more insulated from Russian flows being cut off, as Canada, the United States, and Mexico are all substantial producers.

However, the difference in price movements resulting from those factors has pushed Brent prices to trade at the highest premium versus WTI prices since May 2020. That discount is encouraging a preference for buyers to source US oil, evidenced by a recent uptick in exports from the United States, according to data from the Energy Information Administration (EIA). In fact, exports hit the highest level since July 2021 for the week ending March 18 (see chart below).

Tonight, the EIA will report updated information on inventory and exports for the week ending March 25. The data will spread further light on the global energy situation. If the increase in exports continues, that could lead to a larger-than-expected draw in inventory levels. If so, that could shrink WTIs discount over Brent prices. Analysts see crude oil stocks decreasing by just over 1 million barrels. Moreover, the ongoing situation in Ukraine and the Covid outbreak in China may have a larger impact on broader price direction.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

What WikiFX Found When It Looked Into BCR

In the complex world of online trading, verified licenses and confirmed operational presence offer important reference points for evaluating a broker. BCR is one such firm that has undergone regulatory registration and address verification.

Pocket Option: The Broker With No License and Plenty of Risk

No regulation. No oversight. No safety net. Pocket Option is a trap too many traders walk into, only to lose their funds with no way back.

Pocket Option: The Broker With No License and Plenty of Risk

No regulation. No oversight. No safety net. Pocket Option is a trap too many traders walk into, only to lose their funds with no way back.

Forex VS Futures: Which One Should You Choose?

If you could only trade in one market for the next five years, would you choose forex or futures?

WikiFX Broker

Latest News

Elon Musk's xAI raises $10 billion in debt and equity as it steps up challenge to OpenAI

European Central Bank's tightening cycle is done,' chief economist says

ACY Securities Expands Crypto CFD Offering with 24/7 Trading Access

Revelation: Makeup Artist, Social Media Influencer Involved in INR 1.62 Cr Forex Trading Scam

Social Trading Goes Mobile at M4Markets

Capital.com Strengthens UK FinTech Ties with Key Memberships

Crypto Craze Fizzling Out? Here is Why

10-year Treasury yield ticks higher as investors eye jobs report

Public companies bought more bitcoin than ETFs did for the third quarter in a row

Tokenized Stocks: Innovation or Just Another Wrapper?

Currency Calculator