简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Crude Oil Prices Sink as White House Weighs Plan to Release a Million Barrels Daily

Abstract:CRUDE OIL, WTI, WHITE HOUSE, STRATEGIC RESERVES, INFLATION - TALKING POINTS:

Crude oil prices sink as White House weighs releasing more strategic reserves

This plan outlines one million barrels of oil per day to help alleviate inflation

WTI continues to trade within a Symmetrical Triangle, watch for a breakout

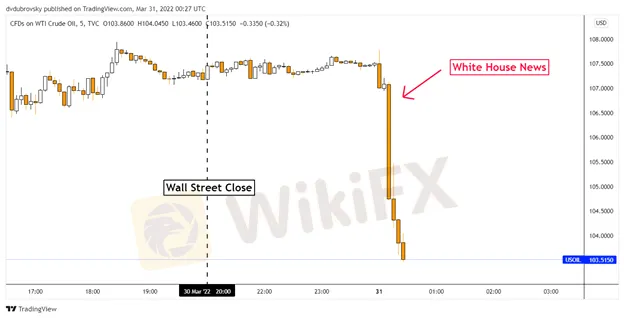

WTI crude oil prices sank as much as 5 percent during early Thursday Asia-Pacific trade after reports crossed the wires that the White House is weighing another plan to help alleviate rising prices at the pump. According to Bloomberg, the Biden administration is looking into releasing one million barrels of oil daily from strategic reserves for several months.

This follows strong gains in the commodity since November, which picked up pace as Russia attacked Ukraine. During this period, the price of WTI climbed from a low of USD 62.46 to a high of 129.42 in early March. Since then, fading European geopolitical escalation concerns have seen the commodity fall about 20% from the latest high.

Still, this has not been enough to bring down prices at United States gas stations materially. According to data from the US Energy Information Administration (EIA), the average price of regular gasoline, which is in dollars per gallon, clocked in at 4.23 for the week ending March 28th. This is up from 3.53 before the Russian attack, which represents a 19.8% increase.

Prices have fallen from the week ending March 14th, which was 4.32, but this only represents a 2% decrease. According to the report, the total amount could come up to 180 million barrels. For comparison, the Biden administration has released about 80m over the past 6 months from similar efforts. All eyes now turn to a potential announcement over the coming 24 hours.

WTI MARKET REACTION – 5MIN CHART

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

7 Common Mistakes Made by Indian Forex Traders

Forex trading has become very popular among Indian traders in recent years. Every month, thousands of new traders join this market. But sadly, majority of them lose their hard-earned money because of their common mistakes. Which are these mistakes? Read below.

What Does PrimeXBT's Offshore Regulatory Status Really Mean?

Understanding PrimeXBT's offshore regulatory status, its implications, and what it means for traders looking for transparency and reliability in their investments.

iFourX: So Many Red Flags You Can’t Ignore

Forex trading has become difficult nowadays due to the frequent frauds occurring every day. You can’t blindly trust any broker . They may appear genuine and authorized but end up being scams. That’s why it’s more important to stay aware. To stay alert and informed, you need to know about a particular FX broker called iFourX and recognize its red flags.

Five Unauthorised Brokers Warned by the FCA

UK’s watchdog, the Financial Conduct Authority (FCA), recently issued a fraud alert against brokers who are operating without a license but still offering financial services. The FCA has identified these scam brokers and is warning the public not to engage with them. Check out the names of those brokers below.

WikiFX Broker

Latest News

Thailand-Cambodia War Pressures Thai Baht in Forex Market

Treasury yields tick lower as investors look ahead to Fed's interest rate decision

Does XS.com Hold Leading Forex Regulatory Licenses?

Chile Bumps Up Copper Price Forecast and Flags Lagging Collahuasi Output

A breakthrough and a burden? What the U.S.-EU trade deal means for the auto sector

Investors Accuse Duttfx Markets of Scam: What You Should Know

Treasury yields flat as investors look ahead to Fed's interest rate decision

Bitget Lists Caldera for Spot Trading | What Should You Know?

China's latest AI model claims to be even cheaper to use than DeepSeek

European stocks head for higher open with earnings and U.S. trade deals in focus

Currency Calculator