简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Federal Reserve: Kept to expectations

Abstract:Heading into the Federal Reserve meeting there was already a very high bar set for a hawkish policy meeting. In the event, the Fed kept to the script. It hiked by 50 bps, indicated further 50 bps rate hikes were to come, and also thought the neutral rate is going to be at around 2.40% by year-end. So, with rates currently at 0.875%, there is another 150 bps worth of rate hikes to come between now and the year-end.

The bar was set very high

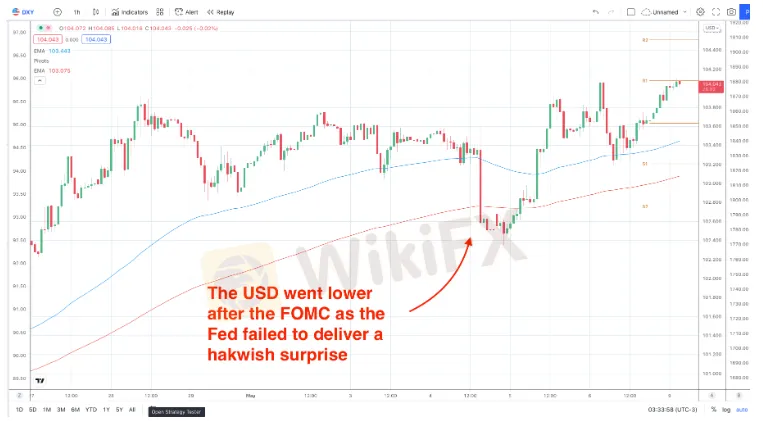

Heading into the meeting we were expecting a ‘buy the rumour, sell the fact response’ and this is what the initial reaction was. The start in QT was based on a phased approach with the Fed expected to take 3 months to bring the level up to $60 bln in treasures and $35 bln in Mortgage Backed Securities. On top of this dovish development Jerome Powell ruled out a 75 bps rate hike, so this all meant the Fed was unable to surprise markets with a more hawkish response, so there was an initial move lower in the USD. See the reaction here:

However, the USD weakness was not sustained post the FOMC. The strength in the USD is also partly due to the slowing global trade situation. As a global reserve currency, the USD tends to gain when global growth slows. So, the recent concerns over slowdowns in China‘s growth have also been a bullish pressure for the USD. This week we have some important inflation data out for the US. The US inflation rate is forecast to fall to 8.1% y/y down from the prior reading of 8.5%. Any signs of ’peak inflation take pressure off the Fed to hike rates and can result in some USD selling. This could boost the EURUSD this week as the ECB is increasingly making calls for a July rate hike. On the other hand, if inflation comes back in high then expect more USD strength.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Want to be Sure of a Forex Settlement Process? Read This IMPORTANT Guide!

Forex settlements are complex—and missteps can cost millions. This guide breaks down CLS, the global standard in FX settlement, so you can reduce risk and streamline cross-border transactions.

Valid Reasons to Avoid SevenStar FX

SevenStar FX is a low-rated broker. When you search online, you will find tons of overly positive reviews about this broker. Strangely, there is almost no negative feedback anywhere, which is unusual. It makes us wonder: how can a forex broker with no proper regulation have such a perfect reputation? In this article we exposed the red flags of this broker.

Top 5 Forex Risk Management Errors Companies Usually Commit

Think your company’s forex strategy is under control? Think again. Even large organizations fall prey to hidden currency risks that can quietly eat into their margins. From overlooked exposures to outdated strategies, here are the top five forex risk management errors businesses make—and how to avoid them.

How to Use a Free Forex Trading Bot for Big Profit

Learn how to maximize your profits with free forex trading bots, set them up easily, and avoid common mistakes that can cost you big in automated trading.

WikiFX Broker

Latest News

Global week ahead: Banking bellwethers and a tariffs waiting game

CNBC Daily Open: The silver lining of positive earnings could be too blinding

Brexit made businesses abandon the UK. Trump's hefty EU tariffs could bring them back

CNBC Daily Open: Solid earnings beats might mask tariff volatility these two weeks

Mastering Deriv Trading: Strategies and Insights for Successful Deriv Traders

Jeep-maker Stellantis expects first-half net loss of $2.7 billion as tariffs bite

U.S. doubles down on Aug. 1 tariffs deadline as EU battles for a deal

Buffett and Thorp’s Secret Options Strategies

Trading Market Profile: A Clear and Practical Guide

Sharing Trading Mistakes and Growth

Currency Calculator