简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

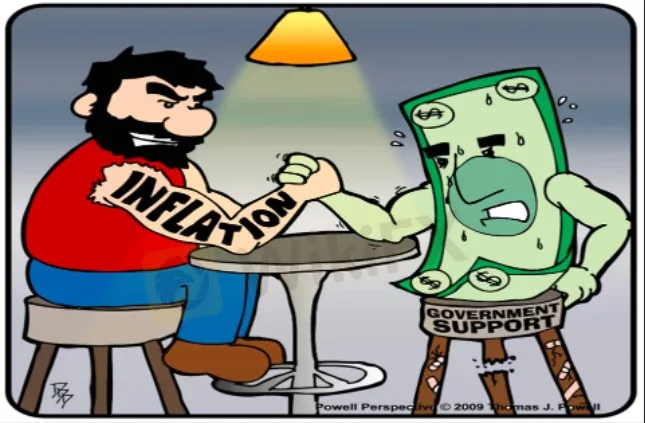

Despite skyrocketing inflation, the strong dollar supports gold prices.

Abstract:Because of the strength of the dollar, gold's traditionally positive performance in an inflationary and rising interest rate environment is hampered.

Click Here: After you read it, Daily Routine with WikiFx

Gold Gets Into The Action

The global commodities shock is increasing, and the 2/10 treasury yield curve – the differential between 2-year and 10-year treasury yields – became negative in early April. These have historically signaled a declining economy or recession. Early April saw gold and the dollar rise as traditional safe havens. On April 18, gold tested $2,000 an ounce with an intraday high of $1,998. On April 21, US Federal Reserve Chair Jerome Powell gave a strong message at an International Monetary Fund (IMF) session, indicating that more aggressive interest rate hikes are needed, presumably to battle inflation. On April 25, news of China's increasing COVID outbreak threatened to reduce demand for basic materials, causing gold to fall. Selling gold was misguided, as gold's drivers are distinct from other commodities. The volatility and falls in the Chinese stock and real estate markets have fueled investment demand for gold.

Dollar-Down

History texts teach us about inflation, the Cold War, and WWII. Ours was a world that would never allow such worldwide chaos or wickedness to occur again. Venezuela, Syria, and Myanmar could never happen in the West. Now we see that civilization isn't as evolved as we thought. The worst of human cycles is currently repeating, with war and nuclear threats. Gold is once again serving as a financial safe haven and wealth repository. Given the recent events, many gold supporters ask why the gold price isn't higher.

A secular bull market began in December 2015, when gold hit a low of roughly $1,050 an ounce. Gold's recent performance hasn't matched the 1970s and 2000s secular bull markets. In the present bull market, the pandemic has exacerbated some macroeconomic and geopolitical risks. One notable distinction may explain gold's poor performance thus far in this bull market. It was in a secular bear market from 1970 to 2000. From 1971 to 1978, the DXY plummeted 46%, and from 2002 to 2008, it fell 41%. The DXY has risen 5.2 percent since December 2015, and is currently testing a twenty-year high. While gold and the dollar often rise together in times of financial duress, their regular trend is downward. We think the strong dollar has slowed gold's current bull market ascent.

China and Europe seem to be leading the world into recession, while the Fed is raising rates. This is good news for the dollar for now. Gold has a lot of fans. The strong dollar is causing financial stress abroad, inflation appears to be out of control, and geopolitical and economic worries should keep driving gold. We expect gold prices will rise, but not to the levels seen in previous secular bull cycles.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

XTB Hack 2025: Major Security Breach Exposes Client Accounts

XTB suffers a major hack in 2025, with hackers draining client accounts and sparking urgent security upgrades. Learn how the breach unfolded and what’s next.

XTB Hack 2025: Major Security Breach Exposes Client Accounts

XTB suffers a major hack in 2025, with hackers draining client accounts and sparking urgent security upgrades. Learn how the breach unfolded and what’s next.

Want to Succeed in Forex? Start with the Right Trading System

If you want to trade currencies and make money in the long run, you need a good forex trading system. Many new traders enter the market without a clear plan. Some rely on luck or tips from others. But trading without a system often leads to losses.

Mumbai Police Nabs Black Paper Dollar Conversion Forex Scam Perpetrators: Check Out the Details

The crime branch of the Mumbai Police has nabbed a racket involved in duping people by claiming to convert black paper into dollars. Check this unique 24.7-lakh scam story.

WikiFX Broker

Latest News

US Government Interest Grows in Victory Metals’ Rare Earths Supply

How Are Trade Policies Affecting the Aluminum Market?

RM71,000 Lost in a Share Scheme That Never Existed

Scammed by a Click: He Lost RM300,000 in a Month

Manual vs. Automated Forex Trading: Which One Should You Choose?

Revealing Factors That Help Determine the Gold Price in India

Why Regulatory Compliance Is the Secret Ingredient to Trustworthy Forex Brokers

Pentagon to become largest shareholder in rare earth miner MP Materials; shares surge 40%

Delta shares jump 12% after airline reinstates 2025 profit outlook as CEO says bookings stabilized

Delta shares jump 13% after airline reinstates 2025 profit outlook as CEO says bookings stabilized

Currency Calculator