简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

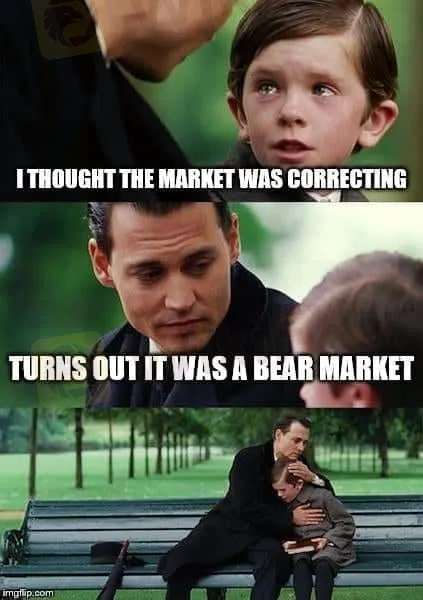

More Approach to Not Fail During Bear Market Pt.2

Abstract:Previously in part one, the article suggested two approaches to survive during bear markets. Those were dollar cost averaging and calibrated risk. This article continues the second and the third part of the tricks to deal during the bear market. The third is diversifying but without disengaging. Here is the reason why.

During bear markets, the growth of stocks is extremely high than the stocks value. As a result, the lower-risk stocks generate long-term returns which are the same to those riskier ones. Some diversification into value or when portfolios fall in speculative stocks due to the bear market still is still able to pay dividends. Plus, it could act longer after the bear markets cool off. In a diversified portfolio cash has a significant role. Although it does not create more yield, the cash reserves buying power that could help create opportunities during bear markets.

However, it is not suggested to place more of your retirement account into cash during bear markets. This is because you will encounter difficult uncertainties like when and where you should redeploy it. Finally, you could also face diminished long-term returns. Planning market timing is indeed hard. Meanwhile, trying your luck in the market seems to put you in a poor condition.

Finally, the last trick is you should hedge and speculate with options. Based on the data only a few traders could finally make money. Meanwhile, the vast majority of retail investors face a lot that economists believe that they just do it for gambling. In this case, you could put options. In other words, it could be putting spreads. This is for those buying after the bear market. The function of it could lead to the use of a hedge long position.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

XTB Hack 2025: Major Security Breach Exposes Client Accounts

XTB suffers a major hack in 2025, with hackers draining client accounts and sparking urgent security upgrades. Learn how the breach unfolded and what’s next.

XTB Hack 2025: Major Security Breach Exposes Client Accounts

XTB suffers a major hack in 2025, with hackers draining client accounts and sparking urgent security upgrades. Learn how the breach unfolded and what’s next.

Want to Succeed in Forex? Start with the Right Trading System

If you want to trade currencies and make money in the long run, you need a good forex trading system. Many new traders enter the market without a clear plan. Some rely on luck or tips from others. But trading without a system often leads to losses.

Mumbai Police Nabs Black Paper Dollar Conversion Forex Scam Perpetrators: Check Out the Details

The crime branch of the Mumbai Police has nabbed a racket involved in duping people by claiming to convert black paper into dollars. Check this unique 24.7-lakh scam story.

WikiFX Broker

Latest News

Manual vs. Automated Forex Trading: Which One Should You Choose?

Scammed by a Click: He Lost RM300,000 in a Month

Revealing Factors That Help Determine the Gold Price in India

Why Regulatory Compliance Is the Secret Ingredient to Trustworthy Forex Brokers

How Are Trade Policies Affecting the Aluminum Market?

US Government Interest Grows in Victory Metals’ Rare Earths Supply

RM71,000 Lost in a Share Scheme That Never Existed

Pentagon to become largest shareholder in rare earth miner MP Materials; shares surge 40%

Delta shares jump 13% after airline reinstates 2025 profit outlook as CEO says bookings stabilized

Delta shares jump 12% after airline reinstates 2025 profit outlook as CEO says bookings stabilized

Currency Calculator