简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Nigeria’s Senate summons central bank chief over ‘free fall of the naira’

Abstract:Nigeria’s Senate passed a motion on Wednesday to summon Central Bank Governor Godwin Emefiele over the “free fall of the naira” and called on the central bank to urgently intervene.

The naira has fallen to successive record lows on the parallel market due to dollar scarcity since July last year after the central bank stopped forex sales to retail currency traders to ease pressure on reserves and support the official market.

The move funnelled demand to the unofficial market, where the currency is freely traded. Lawmakers on Wednesday said the policy had “contributed to the excessive scarcity of forex in Nigeria,” the Senate president said in a statement.

The currency has been trading within a range on the official market.

No date was set for the summon to be conducted by the senates committee on banking. The central bank did not respond to a request for comment.

The naira hit a record low of 695 naira per dollar on the black market on Wednesday, traders said, citing scarcity of foreign currency.

Nigeria‘s currency woes worsened after foreign investors fled as oil prices collapsed in the wake of the COVID-19 pandemic, widening the country’s funding requirement. Oil prices have since recovered but investors are yet to return.

One lawmaker faulted the central banks decision to halt dollar sales to bureau de change operators and said the move had contributed to dollar scarcity.

Lawmakers feared the currency could hit “1,000 naira by end of the year based on the current rate of depreciation”, citing a lack of foreign investment on insecurity plaguing Nigeria, which is also battling with double-digit inflation and low growth.

The Senate plans to question Emefiele on the impact of cheap loans granted by the central bank to certain sectors of the economy to boost local production in a bid to cut imports.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

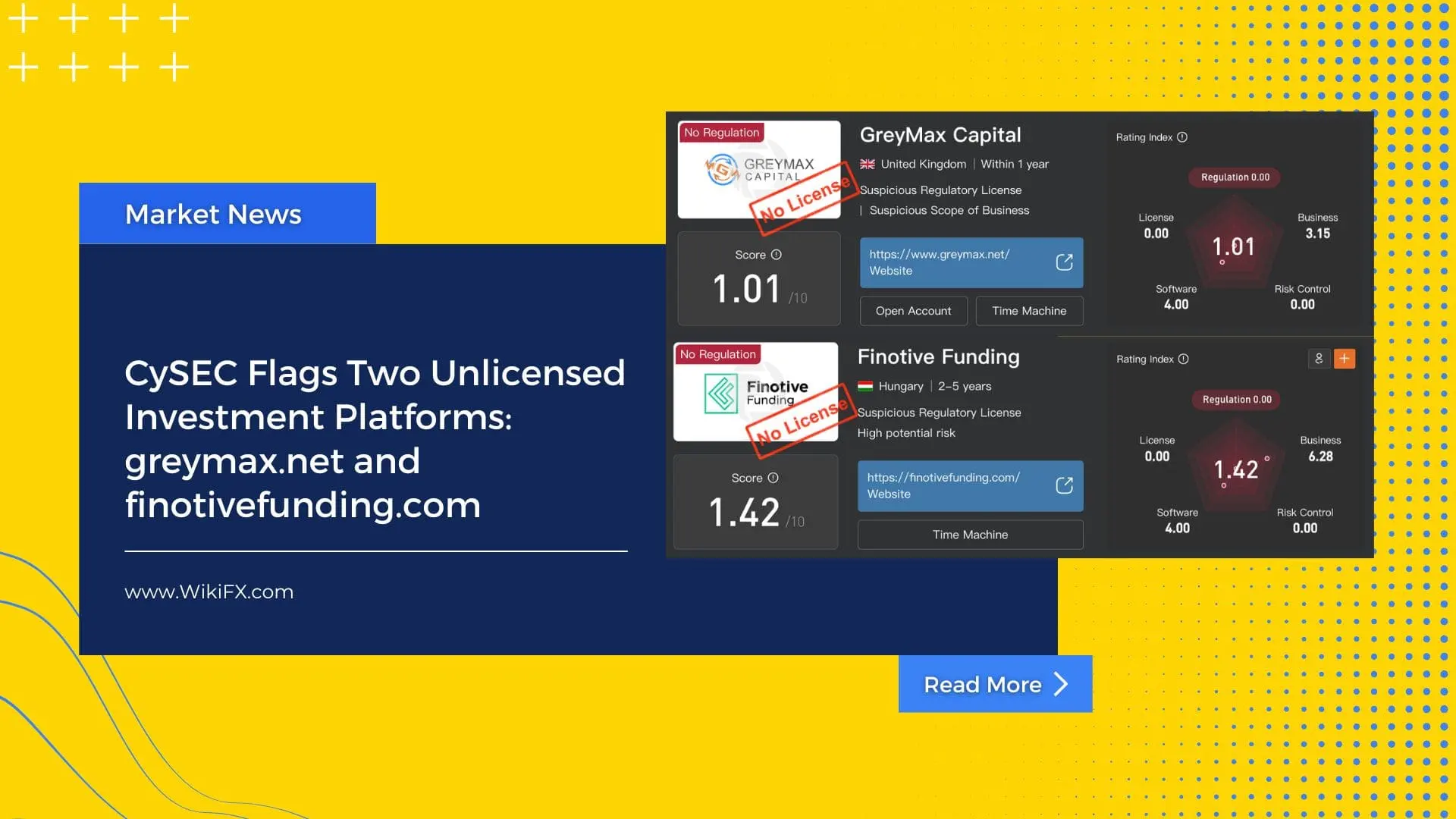

CySEC Flags Two Unlicensed Investment Platforms: greymax.net and finotivefunding.com

CySEC warns investors about greymax.net and finotivefunding.com—two unauthorized platforms offering investment services without a license. Learn how to protect your funds.

Top 6 Shocking Truths Behind Pocket Option – Avoid this Trap

Before You Invest, Read This Important Article About Pocket Option. Protect Your Money from Scam! This article exposes 6 hidden truths about the broker that you need to know before making any investment.

Investors Call Growline a FRAUD Broker - Check Out Their Comments

Dreamt of massive returns on your forex investments through Growline but didn’t receive profit withdrawals? You are not alone! In this article, you will get to know about the problems faced by its investors. Read out their comments and share your reviews on our platform. We will highlight your issue.

The Easiest Way to Learn Forex Trading for Complete Beginners

Unlock the secrets of forex trading as a complete beginner. Explore essential tools, proven strategies, major mistakes to avoid, and more in this comprehensive guide.

WikiFX Broker

Latest News

Brexit made businesses abandon the UK. Trump's hefty EU tariffs could bring them back

Mastering Deriv Trading: Strategies and Insights for Successful Deriv Traders

U.S. doubles down on Aug. 1 tariffs deadline as EU battles for a deal

Buffett and Thorp’s Secret Options Strategies

Trading Market Profile: A Clear and Practical Guide

CNBC Daily Open: Investors dismiss Trump administration's beef with the Fed — S&P hits new high

Sharing Trading Mistakes and Growth

Eyeing Significant Returns from Forex Investments? Be Updated with These Charts

Want to be Sure of a Forex Settlement Process? Read This IMPORTANT Guide!

Can We Just Skip To Next Week

Currency Calculator