简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

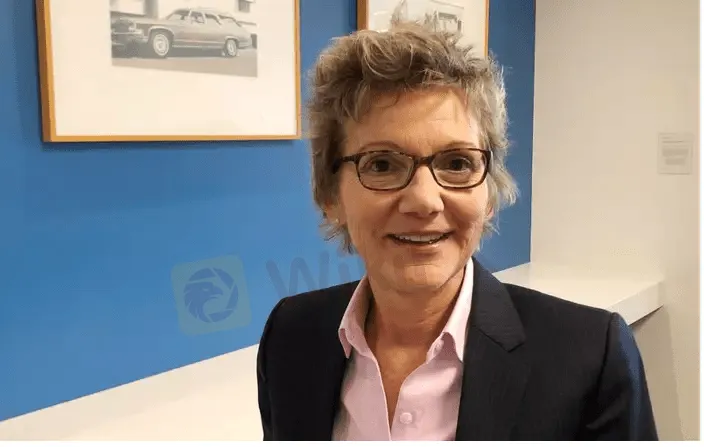

Fed’s Mary Daly says it’s too early to ‘declare victory’ over inflation

Abstract:San Francisco Fed President Mary Daly warned it is far too early for the U.S. central bank to “declare victory” in its fight against inflation after new data showed a reprieve in consumer price pressures, the Financial Times reported on Wednesday.

San Francisco Federal Reserve Bank President Mary Daly warned it is far too early for the U.S. central bank to “declare victory” in its fight against inflation, the Financial Times reported on Thursday.

Dalys remarks comes as U.S. consumer prices remained unchanged in July due to a sharp drop in the cost of gasoline, delivering the first notable sign of relief for weary Americans who have watched inflation climb over the past two years.

In an interview with the Financial Times, Daly did not rule out a third consecutive 0.75% point interest rate rise at the central banks next policy meeting in September, however, she said that a half-percentage point rate rise was her “baseline”. (https://on.ft.com/3SEkQ7E)

“Theres good news on the month-to-month data that consumers and business are getting some relief, but inflation remains far too high and not near our price stability goal,” the newspaper quoted Daly as saying during the interview conducted on Wednesday.

She also maintained that interest rates should rise to just under 3.5 per cent by the end of the year, according to the report. The fed funds rate, the rate that banks charge each other to borrow or lend excess reserves overnight, is currently in the 2.25%-2.5% range.

Slowing U.S. inflation may have opened the door for the Federal Reserve to temper the pace of coming interest rate hikes, but policymakers left no doubt they will continue to tighten monetary policy until price pressures are fully broken.

The Fed is “far, far away from declaring victory” on inflation, Minneapolis Federal Reserve Bank President Neel Kashkari said at the Aspen Ideas Conference, despite the “welcome” news in the CPI report.

Kashkari, the Fed‘s most hawkish member, said he hasn’t “seen anything that changes” the need to raise the Feds policy rate to 3.9% by year-end and to 4.4% by the end of 2023.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex Hedging: Is It a Trader’s Safety Net or Just an Illusion?

In the volatile world of forex trading, risk is inevitable. One widely used strategy is forex hedging, which is a useful technique designed not to eliminate risk entirely, but to reduce its potential impact. As global economic uncertainty persists, understanding how hedging works could be an essential addition to a trader’s toolkit.

Thinking of Investing? Read Must-Know Facts About Funding pips!

When you check the internet for Funding Pips, you'd be surprised to know it's filled with praise for Funding Pips but often lacks the real facts that traders need. Everything that seems too good to be true should always be verified first. It could be Fraud . So, we conducted research and collected several facts you must know about Funding Pips.

OctaFX Back in News: ED Attaches Assets Worth INR 134 Cr in Forex Scam Case

The Enforcement Directorate (ED) in Mumbai has attached assets worth around INR 131.45 crore. This included a luxury yacht and residential properties in Spain. Read this interesting story.

Oil Prices Stay Firm on Solid US Jobs Data

Oil prices stayed firm this week as the US labour department posted a better-than-expected payroll data in June 2025. Read this news in detail.

WikiFX Broker

Latest News

Forex Hedging: Is It a Trader’s Safety Net or Just an Illusion?

OPEC+ members agree larger-than-expected oil production hike in August

Top Wall Street analysts are pounding the table on these 3 stocks

Stock futures fall after Trump team says tariffs will go into effect on Aug. 1: Live updates

Asia-Pacific markets mixed after Trump shifts goalposts on tariffs again

FCA clarifies expectations on bullying, harassment and violence to deepen trust in financial service

Asia-Pacific markets set for mixed open after Trump shifts goalposts on tariffs again

CNBC Daily Open: Most people don't start a political party after separation

Asia-Pacific markets mostly lower after Trump shifts goalposts on tariffs again

Currency Calculator