简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

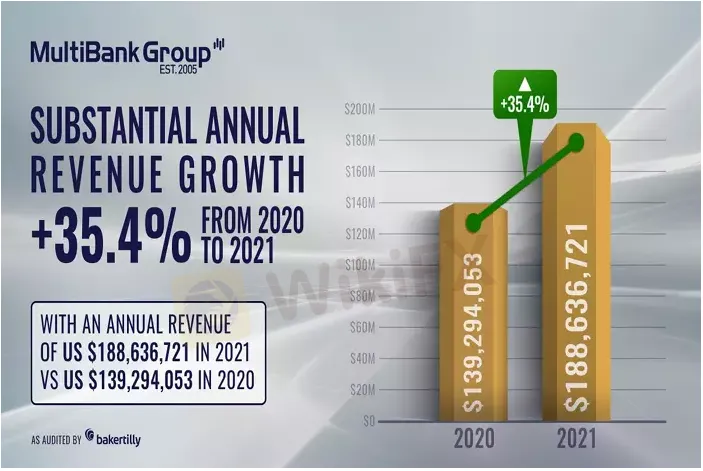

MultiBank Group Announces Record-Breaking Financial Figures for 2021

Abstract:With a Daily Turnover of over US$ 12.1 Billion and annual revenue of US$ 189 million.

The award-winning financial services group announced a record turnover of over US$ 12.1 Billion per day, with a record annual revenue of approximately USD $ 189 million in FY 2021. This was an impressive 35.4% increase from 2020s results, marking a record-breaking year for the global giant.

MultiBank Group, established in 2005, has an unparalleled and unblemished regulatory record, with over 11 financial regulators and over 25 branches worldwide.

The Group is strategically focused on developing and investing in advanced trading technologies. Currently, MultiBank Group is in the latest stages of launching a digital assets exchange fully regulated in Australia, which aims to be the worlds first cross-asset ecosystem to bridge the gap between traditional and alternative finance.

Multibank Founder and Chairman Naser Taher, who in 2022 was awarded as one of the 50 Most Influential Financial Figures in Global Financial Markets, further stated:

2021 was a monumental year for MultiBank Group, and I am proud of these record-breaking financial figures. Moreover, I am proud to announce that the number of users on our platforms has surpassed over 1 million by the end of the second quarter of 2022. These results are a testament to our commitment to providing our valued customers with advanced, reliable platforms and first-class customer service provided by our over 600 staff globally.

These achievements give us continued motivation to increase our investment in our technology and regulatory infrastructure for the benefit of traders worldwide in general and our valued clients in particular. We have high hopes for the second half of 2022 and plan to launch further projects which will fortify our position as a global leader in the market.

About MultiBank Group:

MultiBank Group was established in California, USA, in 2005. It boasts a daily trading volume of over US $12.1 billion and services an extensive client base of over 1,000,000 customers across 100 countries. Since its launch, MultiBank Group has evolved into one of the largest online financial derivatives providers worldwide, offering brokerage services and asset management.

The group offers its valued customers award-winning trading platforms, with up to a 500:1 leverage on products including Shares, Commodities, Indices, Digital Assets, Metals, and Foreign Exchange.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

BlackBull: A Closer Look at Its Licenses

When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about BlackBull and its licenses.

Dark Side of AETOS: They Don’t Want You to Know

AETOS is an Australia-based broker. All over the internet, you will find positive reviews about this broker, but no one is talking about the risks involved with AETOS. However, we have exposed the hidden risks associated with AETOS

Contemplating Investments in Quotex? Abandon Your Plan Before You Lose All Your Funds

Have you received calls from Quotex executives claiming to offer you returns of over 50% per month? Do you face both deposit and withdrawal issues at this company? Or have you faced a complete scam trading with this forex broker? You're not alone. Here is the exposure story.

15 Brokers FCA Says "Are Operating Illegally" Beware!

If a reputable regulator issues a warning about unlicensed brokers, it's important to take it seriously — whether you're a trader or an investor. Here is a list you can check out- be cautious and avoid getting involved with these scam brokers.

WikiFX Broker

Latest News

Scam Alert: Revealing Top Four Forex Scam Tactics Employed to Dupe Investors

Meta says it won't sign Europe AI agreement, calling it an overreach that will stunt growth

Ether and trading stocks take the crypto spotlight as Congress passes historic stablecoin bill

Inflation outlook tumbles to pre-tariff levels in latest University of Michigan survey

Peter Thiel-backed cryptocurrency exchange Bullish files to go public on NYSE

What a Trump, Powell faceoff means for your money

Ether takes crypto spotlight as Congress passes historic stablecoin bill

Exness Halts New India Accounts Amid Regulatory Change

eToro and BridgeWise Launch AI Smart Portfolio for US Mid-Cap Stocks

Forex.com vs OANDA: A No-Nonsense Comparison That Actually Helps You Decide

Currency Calculator