简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Scam Alert! Beware of the Unlicensed FX Broker Finex Stock

Abstract:Finex Stock is the trade name of Broker Capitals Limited, a badly disguised scam. It does not take much effort to expose the truth because everything it claims is nonsence.

Finex Stock claims to be an experienced and regulated broker, offering bonuses and cashback to attract you to invest. However, the truth is not as beautiful as it describes. It is not worth taking the risk to lose your money by trading with it.

An “Experienced” Broker from 2000

For convincing traders that Finex Stock is an experienced forex broker, this broker tells a lie that is as fragile as a bubble.

This broker claims it has “20 years of experience from 2000”. And it has been “regulated in the UK for 15 years since 2005”. How could a broker in the financial business make such a simple addition wrong?

By checking this broker's domain (https://finexstock.com/), we found a funny fact that this “20-year-experienced broker” created its website on 6 Feb 2022, less than half a year ago. So how could it start a business in 2000? Those are red flags.

Fake UK-regulated Broker

Finex Stock also tries to convince people that it is regulated by the United Kingdom Financial Conduct Authority (UK FCA).

This is how we verify Finex Stock's regulation in the UK - we searched both the trade name “Finex Stock” and the company name “Broker Capitals Limited” through the FCA. But no results matched for Finex Stock and Broker Capitals Limited (Finex Stock's company name) in the FCA's Register. In other word, FinexStock is not regulated by UK FCA.

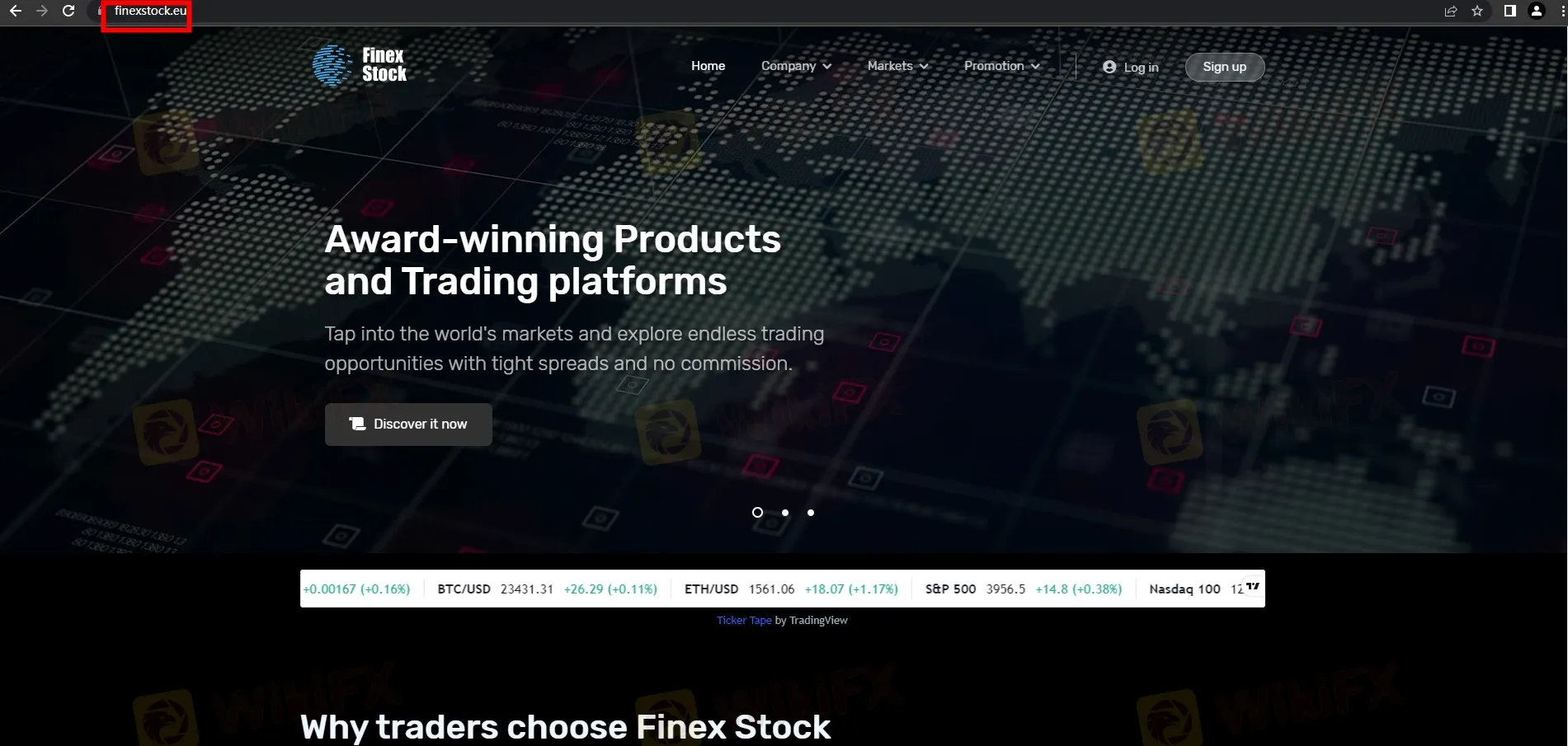

Two Operating Websites & Two Warnings

Finex Stock has two operating websites - “https://finexstock.eu/” and “https://finexstock.com/”. Both websites have the same design and similar domain names. It is not rare to see a forex scammer has two or even more operating websites. When a scam website is exposed, it can continue to deceive through the other website.

Moreover, the two websites are warned by the Italian Companies and Exchange Commission (CONSOB). Finex Stock is not authorized to provide financial services in Italy. Checking the blacklists of regulators can help us avoid many scams.

Bad Reviews

Some of the victims shared their unpleasing experiences when trading with Forex Stock. This broker keeps asking clients to deposit without giving any cent back to them.

These proof make it clear: Finex Stock is not regulated by any regulators. We would recommend traders stay away from unregulated brokers like Finex Stock and trade with licensed brokers.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Bank Negara Malaysia Flags 12 New Companies for Unauthorised Activity

Bank Negara Malaysia (BNM) has updated its Financial Consumer Alert List (FCA List) by adding 12 more entities, reinforcing its efforts to warn the public against unregulated financial schemes. Check if your broker made the list!

TradingView Brings Live Market Charts to Telegram Users with New Mini App

TradingView has launched a mini app on Telegram, making it easier for users to track market trends, check price movements, and share charts.

March Oil Production Declines: How Is the Market Reacting?

Oil production cuts in March are reshaping the market. Traders are closely watching OPEC+ decisions and supply disruptions, which could impact prices and future production strategies.

How to Calculate Leverage and Margin in the Forex Market

Leverage amplifies both potential profits and risks. Understanding how to calculate leverage and margin helps traders manage risks and avoid forced liquidation.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

U.S. March ISM Manufacturing PMI Released

Should You Beware of Forex Trading Gurus?

Exposed by SC: The Latest Investment Scams Targeting Malaysian Investors

Currency Calculator