简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Scam Alert: CNMV Warns Against Allfinagroup!!!

Abstract:The Spanish regulatory body CNMV issued an official warning against Allfinagroup on September 19th!!!

Investors who are still trading forex at Allfinagroup had better quit trading ASAP!!! Investors who have been deceived by this broker please contact WikiFX to help you recover your funds!!!

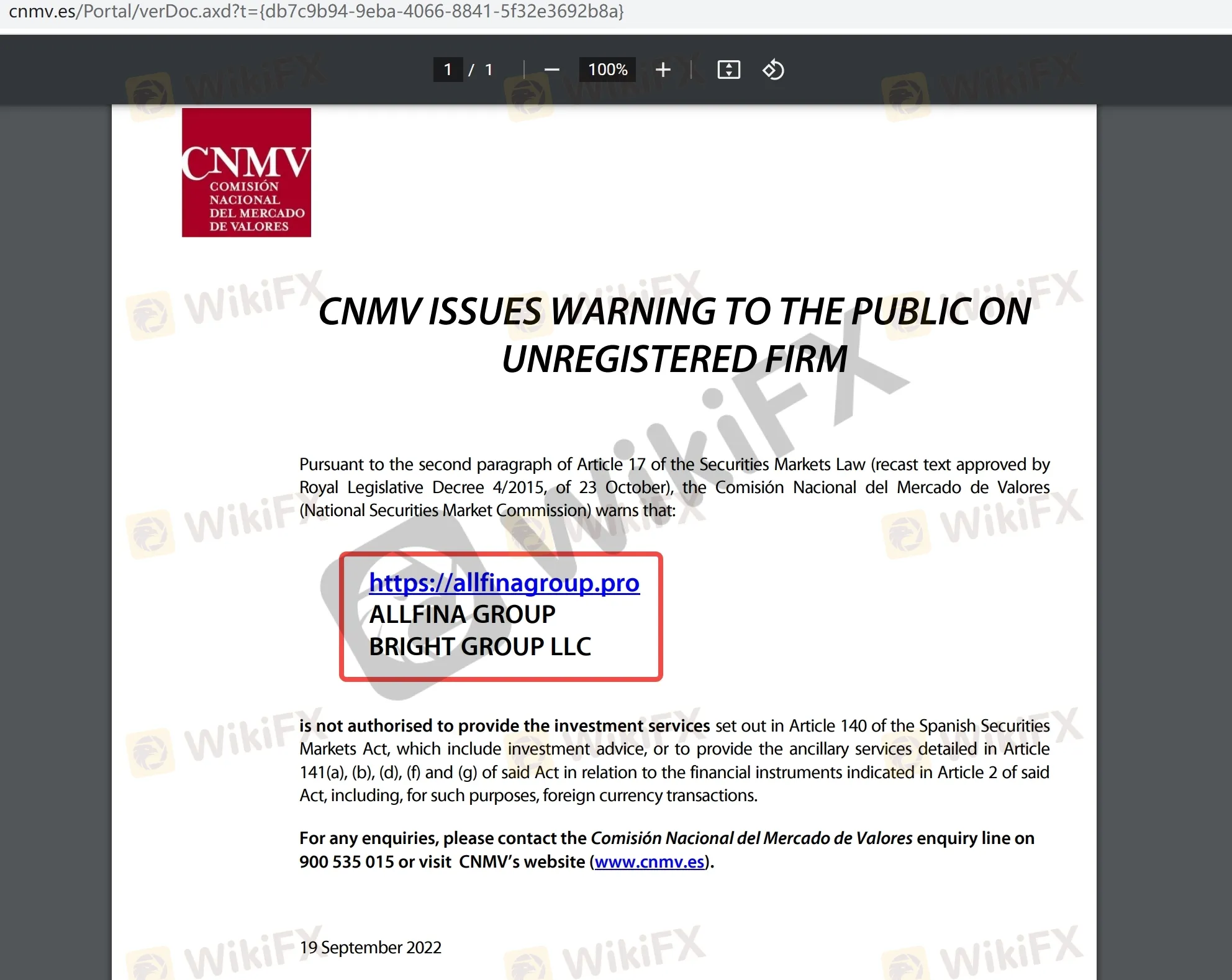

First let us start with the most important –Allfinagroup (allfinagroup.pro) is recently blacklisted as a scam by CNMV – the financial regulator in Spain. It proves with almost complete certainty that investing with this broker will only result in you getting scammed. You may check the recent warning on the screenshot below.

It states the company has been offering its services without authorization from the Spanish regulatory body CNMV. The Spanish regulator warned investors that this broker is most probably running a dangerous scam scheme. Take such warnings seriously – financial authorities usually have very specific reasons for blacklisting brokers.

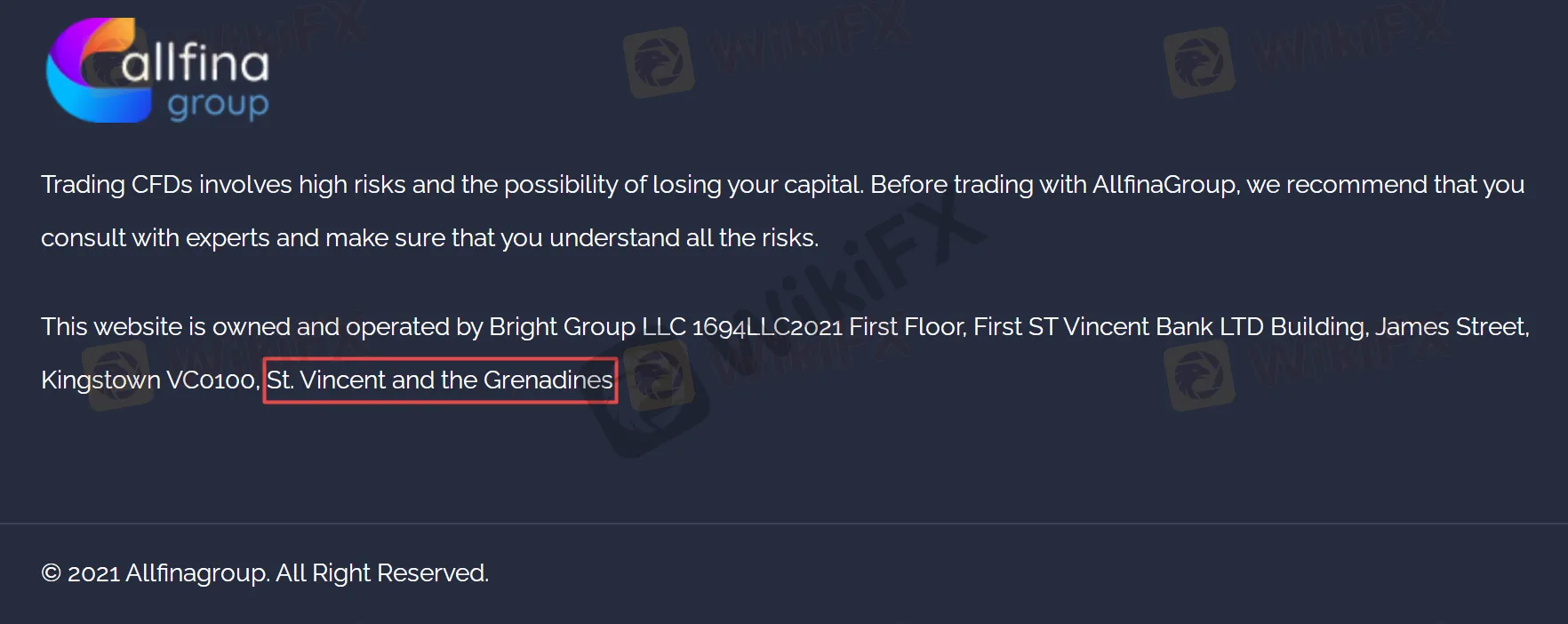

WikiFX also paid a visit to the brokers official website to learn more. Allfinagroup is based in St. Vincent and the Grenadines which makes them an offshore broker. And while not all such brokers are scammers, you should probably refrain from doing business with such companies unless you are sure that you are dealing with a branch of a reputable international brokerage. St. Vincent and the Grenadines does have a financial regulator – but that regulator has warned investors on multiple occasions that it does not supervise the activities of forex brokers and does not impose any laws in the sphere of forex trading. That is why so many scammers have set up companies in this specific country.

Allfinagroup offers access to the web-based trading platform you can see below. Such trading platforms are actually decent enough – they are easy to use which makes them a good fit for beginner traders but still provide some useful indicators and additional trading tools. However, since the number of those tools is quite limited, you will find that you would not be able to get the most satisfactory trading experience out of such a platform – compared to its competitors, MetaTrader 4 and MetaTrader 5 – this software seems quite rudimentary.

Besides, Allfinagroup does not seem to offer the most favorable trading conditions. The spread WikiFX got on the brokers platform was all but great – 3 pips on EURUSD. This means that you would have to pay $30 for every lot you trade with this broker which is not exactly great. Such a spread will quickly eat away all of your potential profits!

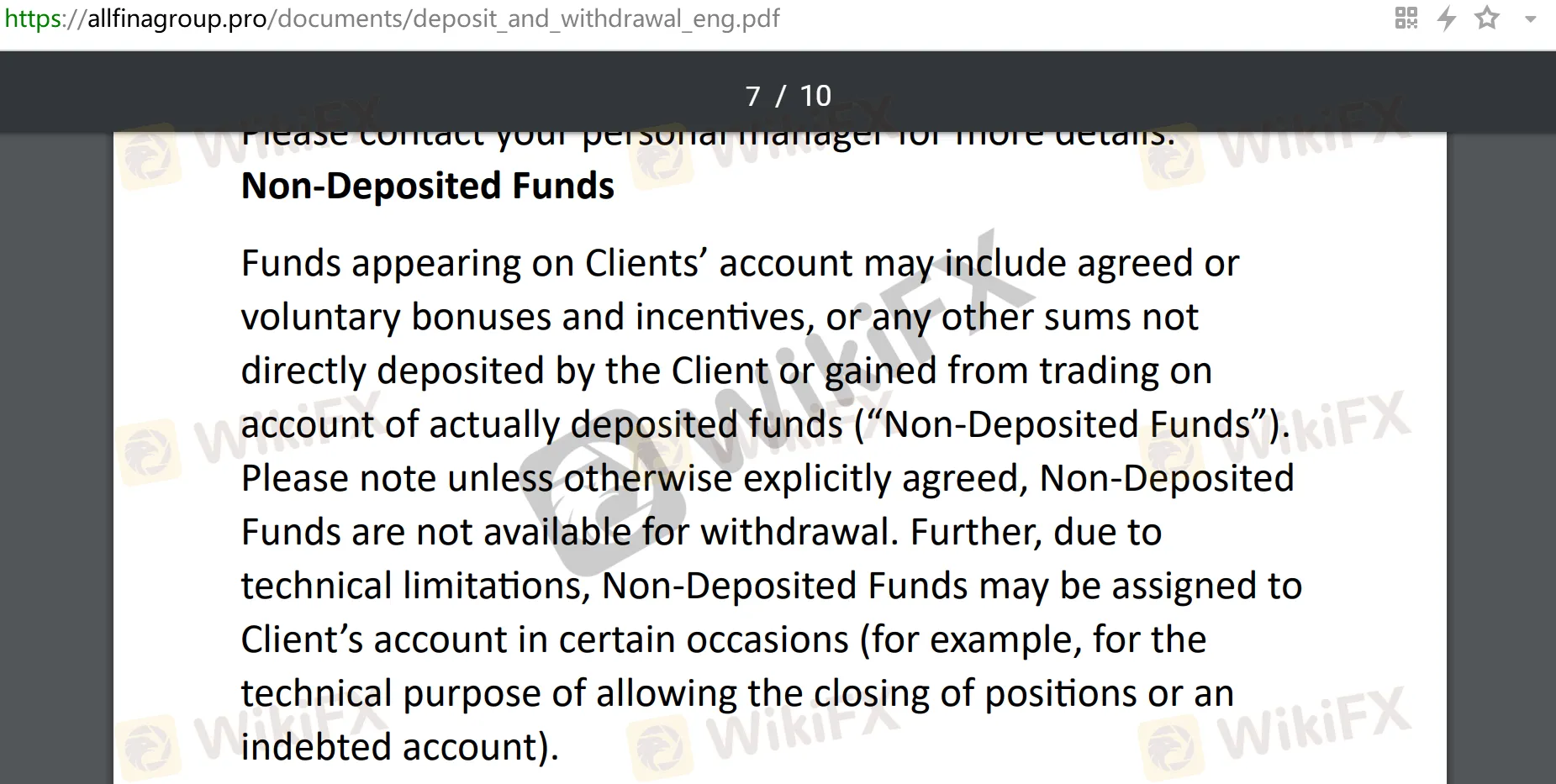

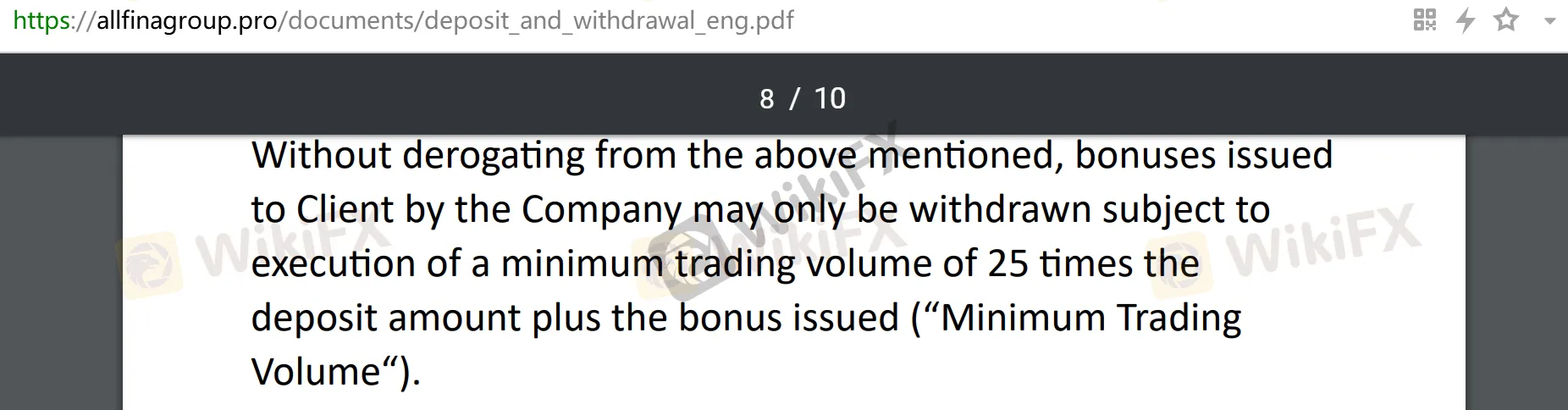

It is also worth pointing out that Allfinagroup offers bonuses – but as with all scam brokers, those come with strings attached. The moment your account has been credited with a bonus, all profits that were not been generated on account of your deposits will be considered non-deposited funds.

Those funds cannot be withdrawn unless you have reached a quite huge trading volume – 25 times your deposits plus the bonus. The problem with this is simple – nobody would be able to tell if certain profits were the result of your deposits or of the bonus. This is a simple trick scam brokers often use in order to prevent you from withdrawing your money too soon – so that they could have more time to convince you to deposit bigger amounts and then simply disappear with all of your money.

Now let's search “Allfinagroup” on WikiFX APP to find out more about this broker. WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. WikiFX can evaluate the safety and reliability of more than 36,000 global forex brokers. WikiFX gives you a huge advantage while seeking the best forex brokers.

As you can see, based on information given on WikiFX (https://www.wikifx.com/en/dealer/1047899502.html), Allfinagroup currently has no valid regulatory license and the score is rather negative - only 0.99/10! WikiFX gives brokers a score from 0 to 10. The higher the score is, the more reliable the broker is.

Investors are advised to search relevant information on WikiFX APP about the broker you are inclined to trade with before finally deciding whether to make investment or not. Compared with official financial regulators which might lag behind, WikiFX is better at monitoring risks related to certain brokers - the WikiFX compliance and audit team gives a quantitative assessment of the level of broker regulatory through regulatory grading standards, regulatory actual values, regulatory utility models, and regulatory abnormality prediction models. If investors use WikiFX APP before investing in any broker, you will be more likely to avoid unnecessary trouble and thus be prevented from losing money! The importance of being cautious and prudent can never be stressed enough.

In a nutshell, it's not wise to invest in Allfinagroup. WikiFX reminds you that forex scam is everywhere, you'd better check the broker's information and user reviews on WikiFX before investing.

You can also expose forex scams on WikiFX. WikiFX will do everything in its power to help you and expose scams, warn others not to be scammed. In addition, scam victims are advised to seek help directly from the local police or a lawyer.

WikiFX keeps track of developments, providing instant updates on individual traders and helping investors avoid unscrupulous brokers. If you want to know whether a broker is safe or not, be sure to open WikiFXs official website (https://www.WikiFX.com/en) or download the WikiFX APP through this link (https://www.wikifx.com/en/download.html) to evaluate the safety and reliability of this broker!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Understanding the New York Forex Trading Session Time in the Philippines

The forex market operates 24 hours a day, 5 days a week, with different trading sessions that overlap and offer various trading opportunities. One of the most active trading sessions is the New York session, which plays a crucial role in the global forex market. If you're in the Philippines, understanding when the New York session overlaps with local time is essential for maximizing your trading potential.

Lirunex Joins Financial Commission, Boosts Trader Protection

Lirunex joins the Financial Commission, offering traders €20,000 protection per claim. A multi-asset broker regulated by CySEC, LFSA, and MED.

Capital.com Review 2025: Trading Account & Withdrawal to Explore

Despite its relative youth, the Cyprus-registered online broker Capital.com has garnered respectable attention from a large number of retail and professional investors since its 2016 launch. Capital.com is a frontrunner among low-cost trading products; it allows individual and institutional investors to trade contracts for difference (CFDs) on three thousand markets, including Forex, Stocks, Commodities, Indices, Cryptocurrencies, and more. Impressively, Capital.com is on board with ESG investments as well. You can begin trading CFDs on the Capital.com platform with as little as $20. You can trade CFDs on this platform without paying any commissions; the only fees involved are the spreads. This broker offers a wide range of platforms, including mobile apps, a desktop trading app, an API from Capital.com, Tradingview, and MetaTrader 4. Among Capital.com's many distinguishing features is the wealth of educational content and high-quality research it offers its users. The platform's Marke

WikiFX Review: Is Fortune Prime Global Reliable?

Founded in 2011, Fortune Prime Global (FPG) is an Australia-registered broker that offers a wide range of investment products (Forex pairs, Commodities, Stocks, Cryptocurrencies, Indices, and so on). Today’s article will show you what it looks like in 2025.

WikiFX Broker

Latest News

IMF Warns Japan of Spillover Risks from Global Market Volatility

Beware of Comments from the Fed's Number Two Official

BaFin Unveils Report: The 6 Biggest Risks You Need to Know

Nomura Holdings Ex-Employee Arrested in Fraud Scandal

RBI: India\s central bank slashes rates after five years

Judge halts Trump\s government worker buyout plan: US media

Spotting Red Flags: The Ultimate Guide to Dodging WhatsApp & Telegram Stock Scams

WikiFX Review: Why so many complaints against QUOTEX?

Trans X Markets: Licensed Broker or a Scam?

Pepperstone Partners with Aston Martin Aramco F1 Team for 2025

Currency Calculator