简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

“You will never get your money back if you invest in a scam called VICTORIA CAPITAL," victims said.

Abstract: Recently one forex broker called VICTORIA CAPITAL caught our attention because traders told WikiFX that this broker does not allow them to withdraw and even put forward unreasonable demands. Protecting the legitimate rights and interests of forex traders are always the primary concern of WikiFX. In this article, we will expose this case to you in detail based on the evidence we gathered.

About WikiFX

WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. WikiFX can evaluate the safety and reliability of more than 40,000 global forex brokers. WikiFX gives you a huge advantage while seeking the best forex brokers.

About VICTORIA CAPITAL

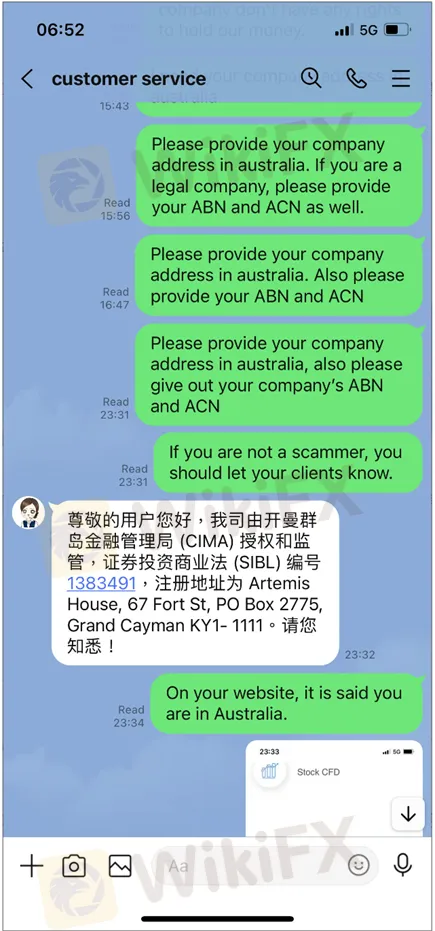

VICTORIA CAPITAL is an online forex broker registered in Australia. WikiFX has received a lot of complaints against this broker recently. In addition, we find this broker is not regulated and WikiFX has given this broker a low rating of 1.39/10. Please note that investing in an unregulated broker with a low WikiFX score is pretty dangerous for your fund safety.

According to our investigation, this brokers original name is Rui win, it changed Rui win to VICTORIA CAPITAL not long ago. We do not the reason why this broker changed its name, but we know that many scam brokers like to change their name in order to cover their disreputable behavior.

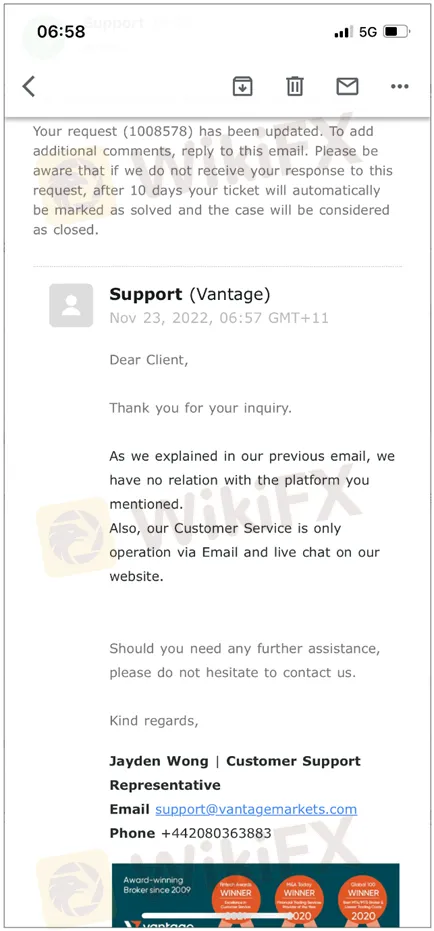

The victim requires the withdrawal, however, this broker asks extra tax fee for the withdrawal. he invested a lot of money with them, but the victim haven't yet received any returns. The victim can't get to the profits in his account unless he pays a commission and tax fee. “ I recently almost spent all of my cash with VICTORIA CAPITAL, which absolutely aided the recovery process. I never get a response they automatically stopped communicating with me when I request for withdrawal.” Even worse, this broker did not give any response to this trader.

Conclusion

We believe that VICTORIA CAPITAL is getting involved in a scam. This broker eventually took the victims money away fraudulently without giving any response to the victim. The reason why WikiFX exposed this case to the public is to remind all traders of the potential risks. All traders should be vigilant when investing in a broker.

WikiFX is actively reaching out to the victim and other traders hoping to find more evidence to help resolve the problem. Please stay tuned for more information.

WikiFX keeps track of developments, providing instant updates on individual traders and helping investors avoid unscrupulous brokers. If you want to know whether a broker is safe or not, be sure to open WikiFXs official website (https://www.WikiFX.com/en) or download the WikiFX APP through this link (https://www.wikifx.com/en/download.html) to evaluate the safety and reliability of this broker!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

JT Capital Markets Review

JT Capital Markets is a UK-registered foreign exchange broker with an operating history of approximately 5–10 years. It maintains a commercial website at www.jtcapitalmarkets.com, which, according to WikiFX’s Time Machine snapshots, was last captured in August 2020 before going offline under the guise of “maintenance”.

Gold Breaks $3,300 Barrier—Time to Celebrate or Caution?

Gold hits record high—rally or risk ahead?

FCA Proposes Simplifying Investment Cost Disclosure for Retail Investors

FCA plans to cut “imprecise” transaction cost disclosures for UK investment products, making cost info clearer and easier for retail investors.

WeTrade Secures CySEC License to Expand EU Trading Services

WeTrade secures a CySEC license, allowing EU-wide operations. The approval boosts services, partnerships, and trust across the global trading community.

WikiFX Broker

Latest News

eXch Exchange to Shut Down on May 1 Following Laundering Allegations

How a Viral TikTok Scam Cost a Retiree Over RM300,000

JT Capital Markets Review

FCA Proposes Simplifying Investment Cost Disclosure for Retail Investors

Fresh Look, Same Trust – INGOT Brokers Rebrands its Website

Beware of Gold Bar Investment Scams: Rising Threats

Finalto Teams Up with Alphaville for 2025 London Quiz

Elites Gather in Taipei to Forge a New Forex Ecosystem

Kraken Launches Forex Perpetual Futures on Kraken Pro Platform

WeTrade Secures CySEC License to Expand EU Trading Services

Currency Calculator