简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

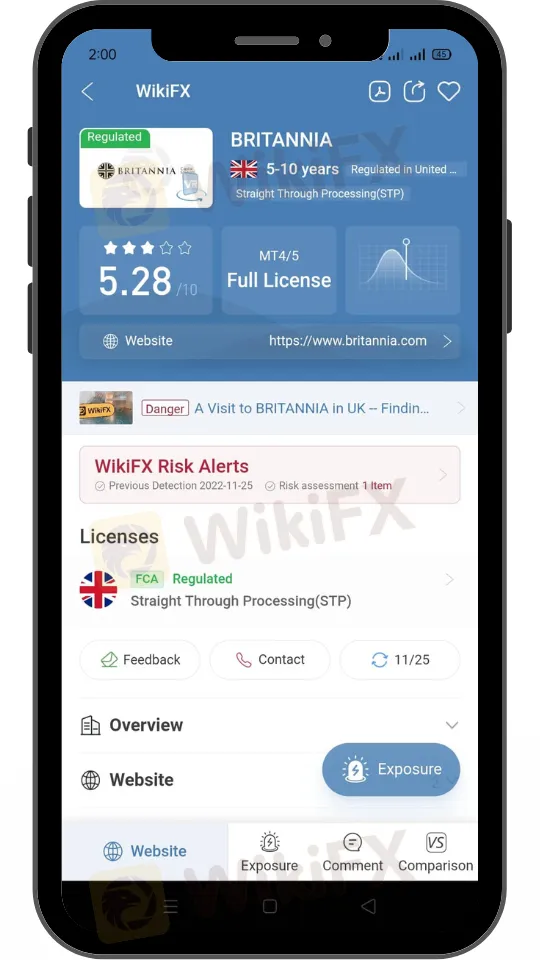

Britannia Financial Expands Its Prime Brokerage Offering with FX, Index, and Commodity CFDs

Abstract:Britannia Financial Group has announced that the Prime Brokerage product of Britannia Global Markets Limited has been expanded to include trading of FX, Index, and Commodity CFDs.

Britannia Financial Group has announced that Britannia Global Markets Limited's Prime Brokerage product has been expanded to cover the trading of FX, Index, and Commodity CFDs.

The new service will be backed up by cutting-edge technology platforms such as Lucera, PrimeXM, MetaQuotes, and MaxxTrader.

Britannia's collaborations with award-winning financial services technology vendors will enable the Group to deliver cutting-edge aggregation software, ultra-low-latency connection, institutional-grade hosting solutions, and high-end MT4/MT5 Bridging and White Labels to its customers.

Britannia will also join the XCore community, confirming its dedication to the FX and CFD industries.

“We are thrilled to extend our Prime Brokerage offering to include CFDs and further enhance our technology infrastructure, which will enable us to successfully serve our customers' growing demand,” said Samuel Gunter, Head of Foreign Exchange Trading.

Britannia is dedicated to providing best-in-class service to our expanding professional and institutional customers by offering a diverse variety of trading and investing options. This new product and investment reflect the underlying goal of Britannia, which is to use technology to develop the Group's hallmark boutique, individualized services.

About Britannia Global Markets Inc.

Britannia Global Markets is a multi-asset brokerage that provides institutions, businesses, and UHNWs with execution, give-ins and give-ups, custody, and clearing services for a wide variety of financial instruments. Stock indices, interest rates, precious and base metals, agriculture, energies, financials, spot and forward foreign exchange, and equities are among the key global derivative markets accessible via the firm. Britannia is a stock exchange member in London as well as the Dubai Gold and Commodities Exchange. Britannia Global Markets is a subsidiary of the Britannia Financial Group, which is headed by Venezuelan/Italian banker Julio Herrera Velutini.

You can check out more of Britannia Capital Markets here: https://www.wikifx.com/en/dealer/8521258365.html

Stay tuned for more Forex Broker news.

Download the WikiFX App from the App Store or Google Play Store to stay updated on the latest news.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Best Binary Options Indicators: Enhance Your Trading Strategy

Binary options trading involves predicting whether an asset's price will rise or fall within a specific timeframe. Unlike traditional investing, more specifically, binary options demand rapid decisions due to fixed expiry times (e.g., 60 seconds to 1 hour). For instance, speculating if EUR/USD will be above 1.0800 in the next five minutes. Success yields a fixed payout, while failure results in the loss of invested capital. Binary indicators distill complex market data—price action, volume, volatility—into actionable signals tailored for short-term trades. Indicators act as a compass, guiding traders to trends, reversals, and optimal entry points, thus enabling traders to detect market shifts for higher-probability decisions.

Baazex Review: Is it safe to invest in it?

Baazex is a relatively new broker registered in the United Arab Emirates, with an operating history of between 2 to 5 years. Despite its claims of offering over 1500 trading instruments—from foreign exchange pairs like EUR/USD, GBP/USD, and AUD/JPY, to major stocks including Apple, Meta, Disney, LVMH, and Tesla; as well as commodities (oil, gold, silver, coffee), indices, cryptocurrencies, and futures—investors should be aware of some critical risks.

Forex BackTesting: Pros and Cons | Best Free Backtesting Software to Explore

Imagine you're driving from New York City to Philadelphia and want to know if your route is optimal, then you take two steps: Firstly, you gather the traffic records in the past five years, including traffic patterns, historic weather conditions, and holiday congestion records. Second, you run simulations of your proposed road to see if it is most efficient and fuel-saving before an actual trip.

Shocking! Trump to Double Tariffs on Canada!

Trump announced a tariff hike on Canadian steel and aluminum to 50%, shaking the markets. The Canadian stock market took a hit, the Canadian dollar plummeted, and U.S. steel and aluminum stocks surged, triggering strong reactions from all sides.

WikiFX Broker

Latest News

Plunging Oil Prices Spark Market Fears

Celebrate Ramadan 2025 with WelTrade & YAMarkets

WikiFX App Version 3.6.4 Release Announcement

Indian Watchdog Approves Coinbase Registration in India

SILEGX: Is This a New Scammer on the Block?

IIFL Capital Faces SEBI's Regulatory Warning

How Can Fintech Help You Make Money?

Why Is OKX Crypto Exchange Under EU Probe After Bybit $1.5B Heist?

Gold Trading Insights: Prepare for Moves Above $2,900 Post-CPI

Good News for Nigeria's Stock Market: Big Gains for Investors!

Currency Calculator