简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

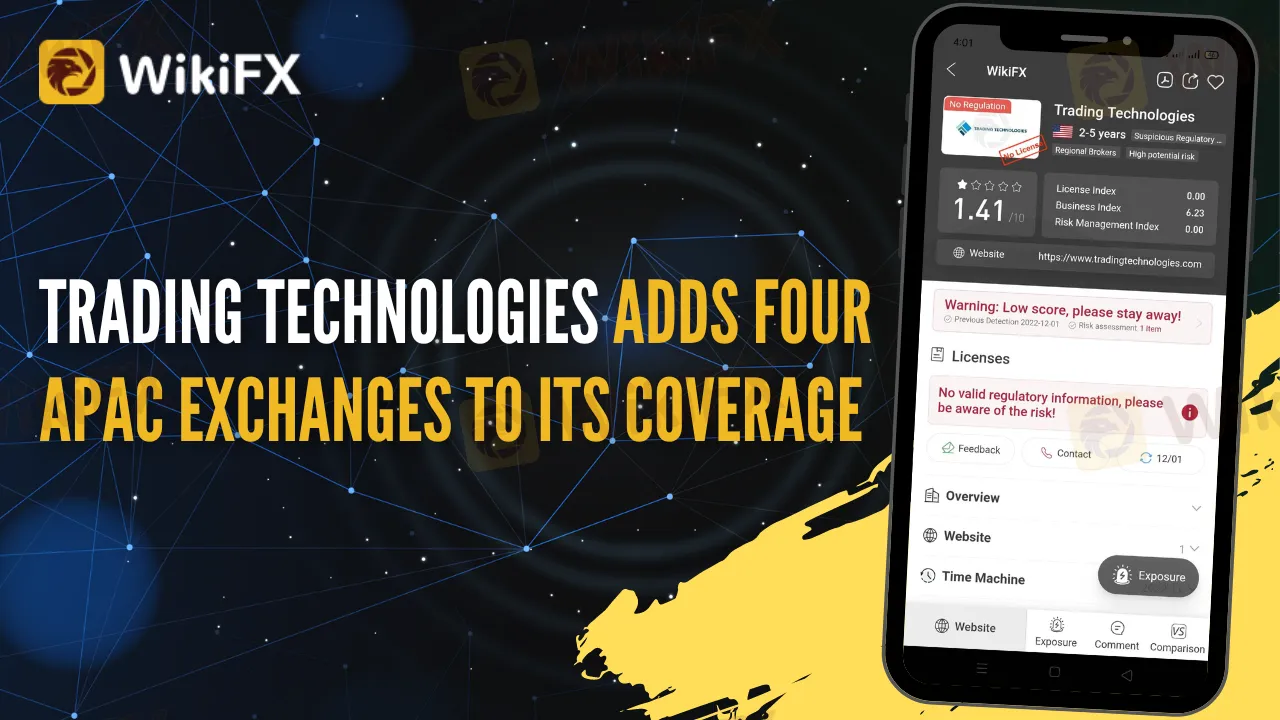

Trading Technologies Adds Four APAC Exchanges To Its Coverage

Abstract:Trading Technologies (TT), a supplier of professional trading software, stated on Wednesday that it is expanding its market coverage by adding four prominent Asian exchanges.

According to the press announcement, TT Premium Order Types, the company's new algorithmic execution methods tool coupled with the TT platform, ensures access to Singapore Exchange instruments (SGX Group). Before the end of the year, products from Japan Exchange Group (JPX), Hong Kong Exchanges and Clearing Limited (HKEX), and the Australian Securities Exchange (ASX) will be accessible.

TT is concentrating on increasing its low-latency offerings. With the inclusion of four more markets, the total number now stands at eleven. TT Premium Order Type had formerly supported the Cboe Futures Exchange, Intercontinental Exchange, CME Group, Eurex, Euronext, London Metal Exchange (LME), and Montréal Exchange. Depending on investor demand, other markets are projected to follow.

“We're excited to add these important APAC exchanges to our offering of best-of-breed synthetic order types driven by quantitative modeling, available directly through the TT platform,” said Guy Scott, EVP, and Chief Revenue Officer at Trading Technologies. “Asset managers, hedge funds, trading groups, commodity firms, and others can use these value-added tools to round out their macro portfolios, improve their hedging capabilities, and explore new trading and arbitrage opportunities.”

The product suite is the outcome of TT's purchase of RCM-X, a technology supplier of algorithmic execution methodologies and quantitative trading technologies, in March.

The TT Premium Order Types library, designed for a wide variety of execution use cases, includes:

TT Brisk: targeting arrival price and enhancing physical basis trades

TT Close: for executing intelligently into the settlement or market close

TT POV: in line with market activity to target a rate or in illiquid markets

TT Prowler: for iceberg-style execution with additional anti-gaming and liquidity capture features

TT Scale POV: to execute within a target range dependent on market conditions

TT TWAP+: for time-weighted average price execution evenly across time with intelligent sizing and distribution

TT VWAP+: for volume-weighted average price execution with expected liquidity, such as during settlement windows to mimic Trading at Settlement (TAS)

About Trading Technologies

Trading Technologies (www.tradingtechnologies.com) develops professional trading software, infrastructure, and data solutions for a diverse range of clients, including proprietary traders, brokers, money managers, Commodity Trading Advisors (CTAs), hedge funds, commercial hedgers, and risk managers. TT provides domain-specific technology for cryptocurrency trading as well as machine-learning capabilities for transaction monitoring via its TT® trading platform, in addition to access to the world's leading international exchanges and liquidity venues.

You can find more about Trading Technologies here: https://www.wikifx.com/en/dealer/6421434535.html

Stay tuned for more Forex Broker News.

Download the WikiFX App from the App Store or Google Play Store to stay updated on the latest news.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex Hedging: Is It a Trader’s Safety Net or Just an Illusion?

In the volatile world of forex trading, risk is inevitable. One widely used strategy is forex hedging, which is a useful technique designed not to eliminate risk entirely, but to reduce its potential impact. As global economic uncertainty persists, understanding how hedging works could be an essential addition to a trader’s toolkit.

Thinking of Investing? Read Must-Know Facts About Funding pips!

When you check the internet for Funding Pips, you'd be surprised to know it's filled with praise for Funding Pips but often lacks the real facts that traders need. Everything that seems too good to be true should always be verified first. It could be Fraud . So, we conducted research and collected several facts you must know about Funding Pips.

OctaFX Back in News: ED Attaches Assets Worth INR 134 Cr in Forex Scam Case

The Enforcement Directorate (ED) in Mumbai has attached assets worth around INR 131.45 crore. This included a luxury yacht and residential properties in Spain. Read this interesting story.

Truth About Angel One – Here’s What You Need to Know

Thinking about investing in Angel One? Wait! Know the essential things about the broker before Invest. It could be SCAM. Read, think, and invest .

WikiFX Broker

Latest News

Global Brokers Vs. Indian Rules: Why They Struggle in India

Services Surveys Signal 'Expansion' In June, Inflation Fears Remain High

ASIC cancels AFS licences of Ipraxis and Downunder Insurance Services

CFD Brokers Face Dual Compliance Pressures Ahead of 2026: Australia and EU Tighten Rules

FxPro to Launch Crypto Trading Desk, Deepening Digital Asset Push

CFI Financial Group Becomes Official Online Trading Partner of Etihad Arena

Discover 5 Benefits of Trading with Trive FX Broker

Major Risks Associated with AuxiliumFX: You Need to Know

IPO market gets boost from Circle's 500% surge, sparking optimism that drought may be ending

Asia-Pacific markets trade mixed ahead of Trump's deadline for higher tariffs

Currency Calculator