简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Vantage Markets has decided to extend its swap-free service to other digital assets in 2023.

Abstract:Vantage Markets' swap-free gold XAU USD trade has received an overwhelming response from clients, saving its traders nearly $1 million in overnight fees in three months of operation.

Vantage extended the swap-free Gold Traders' Day to expand the range of services offered. In response to the overwhelming response from clients, Vantage decided to extend the swap-free service through 2023 and extend it to other digital assets to allow more clients to benefit.

Customers do not pay an overnight fee when trading on all trading accounts, including on the Vantage App, regardless of the size of the transaction. In addition, customers can use the Vantage calculator to calculate their own transaction savings.

Marc Despallieres, Vantage's chief strategy, and trading officer, said: “We have received very positive feedback from our clients and are excited to extend this service to more clients. During extreme market volatility, swap-free trading eliminates the cost of overnight fees for our clients when they choose to use a long-term trading strategy. In addition, it gives clients greater trading flexibility by allowing them to terminate their trades at a point of their choosing, instead of manually terminating trades on a daily basis and focusing on hedging targets.”

What swap-free account is

With a standard account, you are charged or credited swaps or interest on any leveraged positions that you keep open at the end of each trading day. These costs are known as overnight fees or swap fees. The swap-free account is designed to meet the needs of clients who do not wish to be charged or credited this swap or interest.

About Vantage Markets

Founded in 2009, VANTAGE GLOBAL PRIME PTY LTD (short for “Vantage Markets”) is a brokerage firm registered in Australia, offering its clients access to a wide selection of trading instruments. Vantage Markets does not offer services to residents of certain regions such as North Korea, Japan, the United States. WikiFX has given this broker a decent score of 7.48/10.

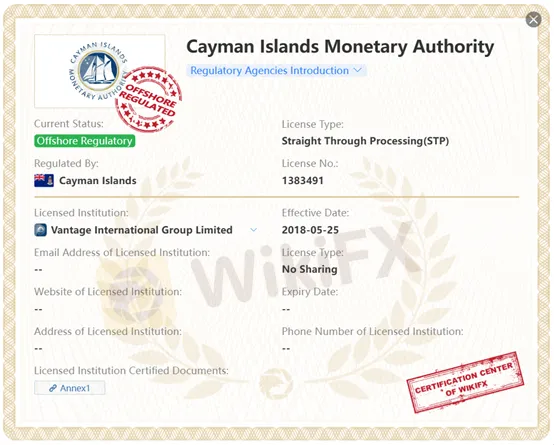

Vantage Markets is a regulated broker. It was authorized and regulated by the Cayman Islands Monetary Authority (CIMA), with Regulatory License Number: 1383491, the Australian Securities and Investments Commission (ASIC), AFSL No. 428901, the Financial Conduct Authority(FCA), with Regulatory License No. 590299.

Click on Vantage Markets' WikiFX page for details

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Nigeria’s Oil and Gas Sector Gains Momentum

Nigeria’s oil and gas industry is experiencing a surge in investment, fueled by policy reforms and international collaboration, paving the way for continued energy expansion.

The Global Tariff War Escalates: Who Suffers the Most?

The global trade war is intensifying as countries continue to raise tariffs, aiming to protect their own economies while creating greater market uncertainty. In this tit-for-tat game, who is truly bearing the brunt?

Immediate Edge Review 2025: Is it safe?

Launched in 2019, Immediate Edge claims to be an automated cryptocurrency trading platform using AI technology for crypto trading services. The platform requires a minimum deposit of $250 to begin trading, which is relatively expensive for many investors. During its short operation, Immediate Edge failed to establish a positive reputation. The platform has undergone frequent domain changes and has repositioned itself as an intermediary connecting users with investment firms—a move that appears designed to obscure its actual operations. Immediate Edge restricts services to investors from the United States; it remains accessible to users in other regions.

BSP Restricting Offshore Forex Trades to Control Peso Volatility

BSP tightens rules on offshore forex trades, including NDFs, to reduce systemic risks and peso volatility. Stakeholders’ feedback due by March 26.

WikiFX Broker

Latest News

Indian Watchdog Approves Coinbase Registration in India

SILEGX: Is This a New Scammer on the Block?

How Can Fintech Help You Make Money?

Good News for Nigeria's Stock Market: Big Gains for Investors!

IIFL Capital Faces SEBI's Regulatory Warning

Why Is OKX Crypto Exchange Under EU Probe After Bybit $1.5B Heist?

Gold Trading Insights: Prepare for Moves Above $2,900 Post-CPI

The ‘Boom-S’ Scam: How a Simple Click Led to RM46,534 in Losses

Royal Forex’s CySEC License Revoked: Can It Still Operate Legally?

Trump vs. Powell: The Showdown That Will Shape Global Markets

Currency Calculator