简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Old trick for escape? Omega Pro allegedly transfers its members to another company.

Abstract:According to reports, OmegaPro, always with the excuse of the alleged "hacking" announces that it will transfer its members to another already established "company".

According to reports, OmegaPro, always with the excuse of the alleged “hacking,” announces that it will transfer its members to another already established “company.” We still need more information to confirm this issue, and we do not know what this “company” is yet. Thus, WikiFX welcomes investors to offer relevant evidence so that we can together air OmegaPro's dirty laundry in public.

About Omega Pro

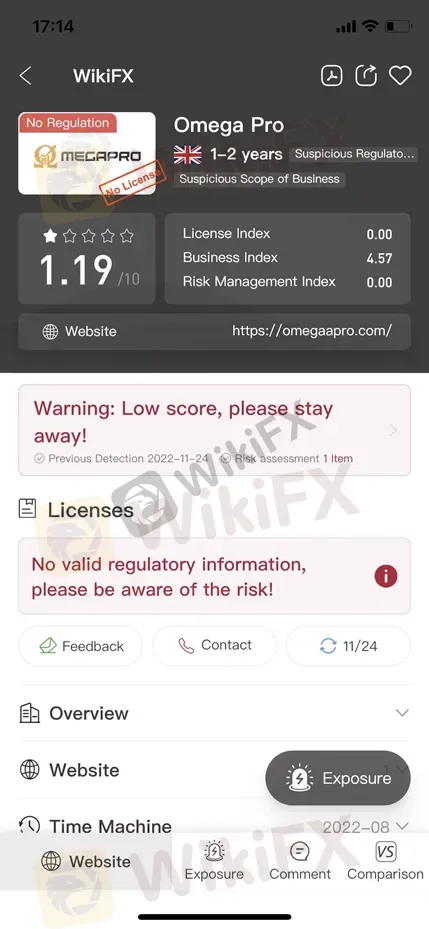

Omega Pro is a forex broker whose main target market is rooted in Africa. This broker has a special strong existence in the Spanish-speaking world. However, according to much feedback, this broker is getting involved in a Ponzi Scheme. And it is not trustworthy as you may think it is. It is not regulated and WikiFX has given it a fairly low score of 1.19/10. Please be aware of the risks.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

EUR/USD at a Critical Juncture: Can the 1.13 Level Hold?

EUR/USD is caught in a tug-of-war, with 1.13 acting as a pivotal level that may determine the next major move.

Warren Buffett’s 5 Golden Rules that Every Trader Must Know

Warren Buffett is one of the most successful investors in the world. He built his wealth through smart, patient decisions and a strong understanding of how markets work. Today, his advice is followed by investors and traders everywhere. Here are five simple but powerful lessons from Buffett that can help anyone grow their money wisely.

Futu Securities Launches Crypto Deposit Service for Investors

Futu Securities launches a crypto deposit service for Bitcoin, Ethereum, and Tether on its trading platform, bridging traditional and decentralized finance.

ASIC Releases New Regulatory Guidance to Support Buy Now, Pay Later Industry Reforms

The Australian Securities and Investments Commission (ASIC) has published a new regulatory guide aimed at assisting buy now, pay later (BNPL) providers in navigating their obligations ahead of new laws coming into effect on June 10, 2025. The guidance, titled Regulatory Guide 281: Low-cost credit contracts, provides critical information to help low-cost credit contract providers comply with their key responsibilities, including new, modified responsible lending obligations.

WikiFX Broker

Latest News

Promax Trading Exposed with Account Disabling and Scam Allegations

Who Are the Cybercriminals Behind the Darcula Phishing Network?

XNT Group Broker Review

XM Marks 15 Years in Trading with New Product Launches and Events

Warren Buffett’s 5 Golden Rules that Every Trader Must Know

Mastering Trading Psychology: Four Pillars of Mental Strength for Market Participants

Futu Securities Launches Crypto Deposit Service for Investors

EUR/USD at a Critical Juncture: Can the 1.13 Level Hold?

Meta Cracks Down on Scam Networks Targeting Brazil and India

Clicking on a Facebook Ad Cost Him His Life Savings of RM186,800

Currency Calculator