简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

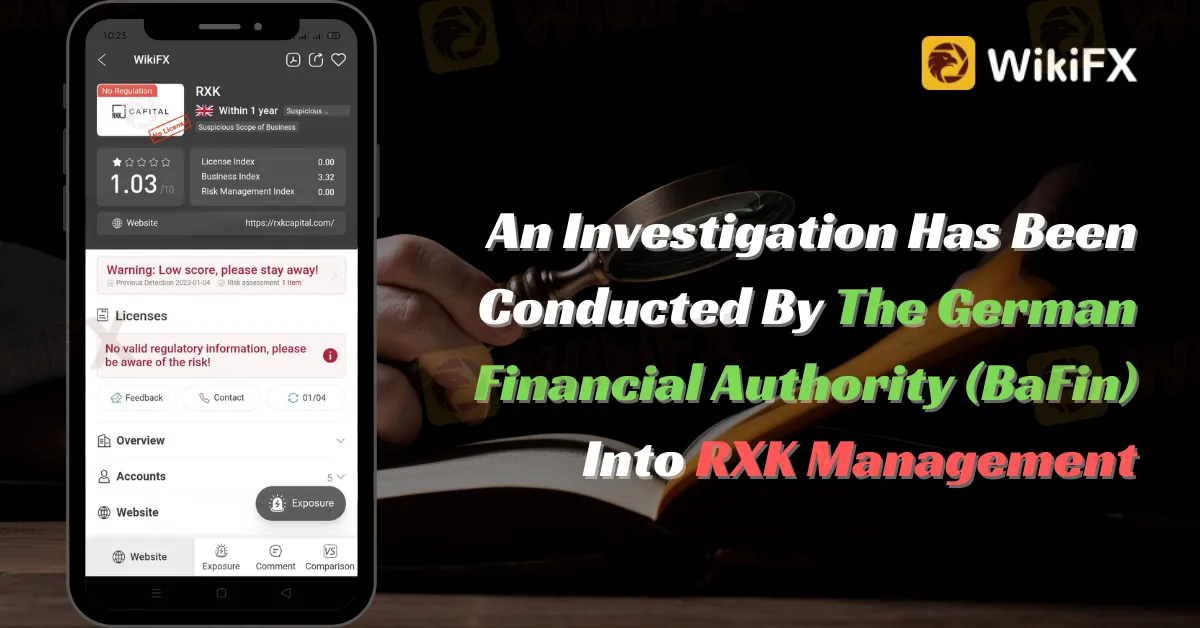

An Investigation Has Been Conducted By The German Financial Authority (BaFin) Into RXK Management

Abstract:The German Federal Financial Supervisory Authority (BaFin) is looking into RXK Management Ltd., a firm that offers online trading in a variety of products, including Forex and cryptocurrency.

The German Federal Financial Supervisory Authority (BaFin) is looking into RXK Management Ltd., a firm that offers online trading in a variety of products, including Forex and cryptocurrency.

According to Section 37(4) of the German Banking Act (Kreditwesengesetz, - KWG), BaFin cautions that RXK Management Ltd. is not authorized to conduct banking activity or offer financial services under the KWG. BaFin does not oversee the firm.

The material on the company's website, rxkcapital.com, suggests that RXK Management Ltd. is doing banking activity and offering financial services in Germany without the necessary permission.

According to WikiFX data, RXK has not been authorized by any financial authorities, which essentially implies that the company has no permission to do financial business or any other kind of financial investment activity.

WikiFX attempted to search RXK Capital on two major financial regulators, BaFin and FCA but found no results.

Companies that do banking activity or provide financial services in Germany must be licensed under the KWG. However, some businesses operate without the proper permits. BaFin's business database contains information on whether a certain firm has been given authorization.

BaFin, the German Federal Criminal Police Office (Bundeskriminalamt - BKA), and the German state criminal police offices (Landeskriminalämter) advise consumers seeking to invest money online to exercise extreme caution and conduct extensive research ahead of time in order to detect fraud attempts early on.

About BaFin

The Federal Financial Supervisory Body, or Bafin, is Germany's financial regulatory authority. It is in charge of overseeing the country's financial markets and financial service providers, which include banks, insurance companies, financial consultants, and investment businesses. Bafin also seeks to ensure that these businesses comply with consumer protection laws and regulations, and it has the right to take enforcement action against those that do not. Bafin is an autonomous organization in Germany that answers to the Federal Ministry of Finance.

Stay tuned for more Forex Broker news.

Download and install the WikiFX App from the download link below to stay updated on the latest news, even on the go.

Download link: https://www.wikifx.com/en/download.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Investing in Coinexx? Think Again Before Your Account Balance Hits ZERO

Coinexx has emerged as a nightmare for traders who once saw potential and profit in its platform. The problems lie in its lack of transparency, which has left many investors with a ZERO balance. Scamming investors by employing fraudulent tactics and introducing bogus trading rules is increasingly becoming its status symbol. The endless negative reviews of this scam broker are trending on various platforms. To expose the troubling investor experiences, we’ve compiled sharp complaints from verified users of Coinexx. Read on!

UnityFXLive: How This Broker Scammed Over $350,000 ? Know the Red Flags

On August 4, 2025 Indian police arrested two men for running a fake forex trading scam under the name UnityFXLive.com. The suspects were caught operating from a rented office in Goregaon, Mumbai. During questioning, they revealed the name of a third person who is believed to be the mastermind behind the scam. He is currently on the run. The scammers promised people high returns on forex investments, but instead of doing real trading, they stole the money using fake online platforms.

FXPRIMUS Exposed: Withdrawal Denials, Account Blocks & Other Alarming Issues

Have your fund withdrawal applications been constantly denied by FXPRIMUS? Does the forex broker inappropriately block your trading account? Are your deposits disappearing without reaching your trading account? There’s something seriously wrong with this forex broker, whose track record keeps getting worse by the day. Many traders have expressed their anguish on several broker review platforms. While reading those reviews, we could not resist exposing this broker. Check out how traders have criticized FXPRIMUS for its illicit acts.

FXPRIMUS Exposed: Withdrawal Denials, Account Blocks & Other Alarming Issues

Have your fund withdrawal applications been constantly denied by FXPRIMUS? Does the forex broker inappropriately block your trading account? Are your deposits disappearing without reaching your trading account? There’s something seriously wrong with this forex broker, whose track record keeps getting worse by the day. Many traders have expressed their anguish on several broker review platforms. While reading those reviews, we could not resist exposing this broker. Check out how traders have criticized FXPRIMUS for its illicit acts.

WikiFX Broker

Latest News

Forex Swaps Explained in 5 Minutes – Everything You Need to Know

Telegram vs WhatsApp vs Discord: Which Platform Is Best for Forex Signals?

Investment Scam Alert: FCA Identifies 15 Scam Brokers

BaFin Issues Consumer Alerts Against Unauthorised Platforms

Retired Man Loses Life Savings to ‘Sister Duo’ in Forex Scam

Exploring Laxmii Forex: Kharadi's Financial Hub

TradexMarkets: 5 Troubling Signs You Shouldn’t Ignore

A Guide to Buy Stop vs Buy Limit in Forex Trading

SEC Implements New Rules for Crypto-Asset Service Providers

Binance Users Convert Crypto and Withdraw Instantly to Mastercard

Currency Calculator