简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

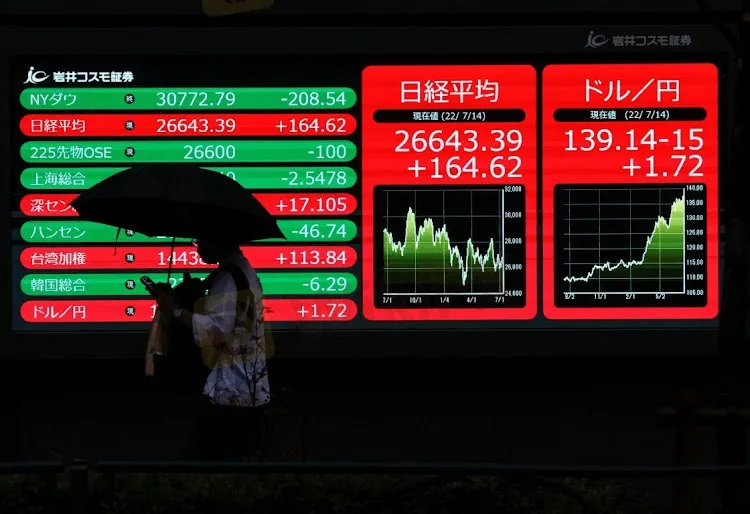

Bullish Bets On Asian Assets Skyrocket

Abstract:The restoration of China's economic activities is predicted to result in a total surplus of $836 billion. As other major central banks continue to tighten policy, fears of a worldwide recession may diminish. Skeptics, on the other hand, are concerned that a hawkish Federal Reserve will continue to control financial markets and the global economy.

Asian stocks and equities have plenty more space to go.

When China switched to pro-growth policies in late 2022, global markets got a sugar rush. Other Asian assets argue that it is never too late to participate in the rally.

Chinese stocks account for another 20% of the increase. Furthermore, if demand in the world's second-largest economy rebounds, the oil may rise beyond $100 per barrel and copper could reach $10,000 per pound. A flood of forecasts has been made by strategists and money managers. Emerging market shares and some Asian currencies are also expected to rise.

The restoration of China's economic activities is predicted to result in a total surplus of $836 billion. As other major central banks continue to tighten policy, fears of a worldwide recession may diminish. Skeptics, on the other hand, are concerned that a hawkish Federal Reserve will continue to control financial markets and the global economy.

Morgan Stanley and Goldman Sachs Group Inc. predict that the MSCI China Index would rise by 10%. Meanwhile, Citi Global Wealth Investments anticipates a 20% increase in 2023 when compared to its global rivals.

Others, on the other hand, feel that Asian stocks will continue to increase even after the bull market has begun. South Korean and Taiwanese exporters would profit, as will Southeast Asian nations that rely on Chinese tourism, such as Thailand.

Another currency increase is on the way.

Since China relaxed virus restrictions in November, the offshore yuan has increased by almost 6%. According to UBS Global Wealth Management, if economic growth exceeds the trend in the second half of this year, the yen might reach 6.50 per dollar.

A 60-day correlation measure between the yuan and emerging-market currencies has risen to 0.70, the highest level in five months. The Thai baht and the South Korean won, both of which benefit from Chinese tourists, may profit from the reopening. The Chilean peso is projected to climb in reaction to the rising Chinese demand for copper.

Alan Wilson of Eurizon SLJ Capital is a money manager. According to him, the Chinese economy, its underlying assets, and the larger emerging market universe are at a tipping point.

Download the link for the mobile app

https://www.wikifx.com/en/download.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex Hedging: Is It a Trader’s Safety Net or Just an Illusion?

In the volatile world of forex trading, risk is inevitable. One widely used strategy is forex hedging, which is a useful technique designed not to eliminate risk entirely, but to reduce its potential impact. As global economic uncertainty persists, understanding how hedging works could be an essential addition to a trader’s toolkit.

Thinking of Investing? Read Must-Know Facts About Funding pips!

When you check the internet for Funding Pips, you'd be surprised to know it's filled with praise for Funding Pips but often lacks the real facts that traders need. Everything that seems too good to be true should always be verified first. It could be Fraud . So, we conducted research and collected several facts you must know about Funding Pips.

OctaFX Back in News: ED Attaches Assets Worth INR 134 Cr in Forex Scam Case

The Enforcement Directorate (ED) in Mumbai has attached assets worth around INR 131.45 crore. This included a luxury yacht and residential properties in Spain. Read this interesting story.

Truth About Angel One – Here’s What You Need to Know

Thinking about investing in Angel One? Wait! Know the essential things about the broker before Invest. It could be SCAM. Read, think, and invest .

WikiFX Broker

Latest News

He Thought He Earned RM4 Million, But It Was All a Scam

CryptoCurrency Regulations in India 2025 – Key Things You Should Know

OctaFX Back in News: ED Attaches Assets Worth INR 134 Cr in Forex Scam Case

Trump inaugural impersonators scammed donors out of crypto, feds say

Ethereum is powering Wall Street's future. The crypto scene at Cannes shows how far it's come

Forex Hedging: Is It a Trader’s Safety Net or Just an Illusion?

US debt is now $37trn – should we be worried?

OPEC+ members agree larger-than-expected oil production hike in August

Dukascopy Ends EOS/USD Trading Amid Liquidity Issues

FIBO Group MT5 Cent Account with Ultra-Leverage up to 1:5000 for Beginners

Currency Calculator