简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Alert! Beware of the Scam Broker AstroFXC Trades

Abstract:This is proof that AstroFXC Trades is a scam broker and has been warned by the FCA, a major UK financial regulator.

Forex trading is one of the most convenient methods to make money from the comfort of your own home. Many scam brokers in the forex market operate without the approval of a financial body. One of the biggest, the UK watchdog FCA, has been disclosing banned corporations to raise public awareness.

A forex scam broker is an organization or person who may be running a fraudulent operation in the foreign exchange market. They may entice traders with false promises of large profits, manipulate transactions, attract advertisements, or steal money from traders' accounts. AstroFXC Trades is one example.

A Quick Overview of AstroFXC Trades

AstroFXC Trades is a fund management firm established in the United Kingdom (https://astrofxctrade.com/index.html). The broker promises to provide planned investing solutions with a greater rate of return in a variety of financial markets, including forex, stocks, and binary options. The business believes that consumers will choose an investment plan beginning with a $300 deposit and rising up to $50,000 and then wait a few weeks to get rewards. It diversifies customers' investment portfolios, according to the broker, to decrease risk exposure and boost return potential. It does not, however, discuss its regulatory status or if a financial compensation plan is in existence. If you want to join the broker, bitcoin is the sole accepted payment option. Customer service is available 24 hours a day, seven days a week by live chat, phone, and email.

Is the trading of AstroFXC regulated?

No! AstroFXC Trades is not a regulated entity. The firm is situated in the United Kingdom, according to the broker's website. Because all brokerage businesses must be registered with the Financial Conduct Authority (FCA) in order to operate, we investigated the British regulator's database for a match and found none.

Thus, the UK watchog FCA released a warning statement againts AstroFXC Trades.

What Made AstroFXC Trades a Scam Broker?

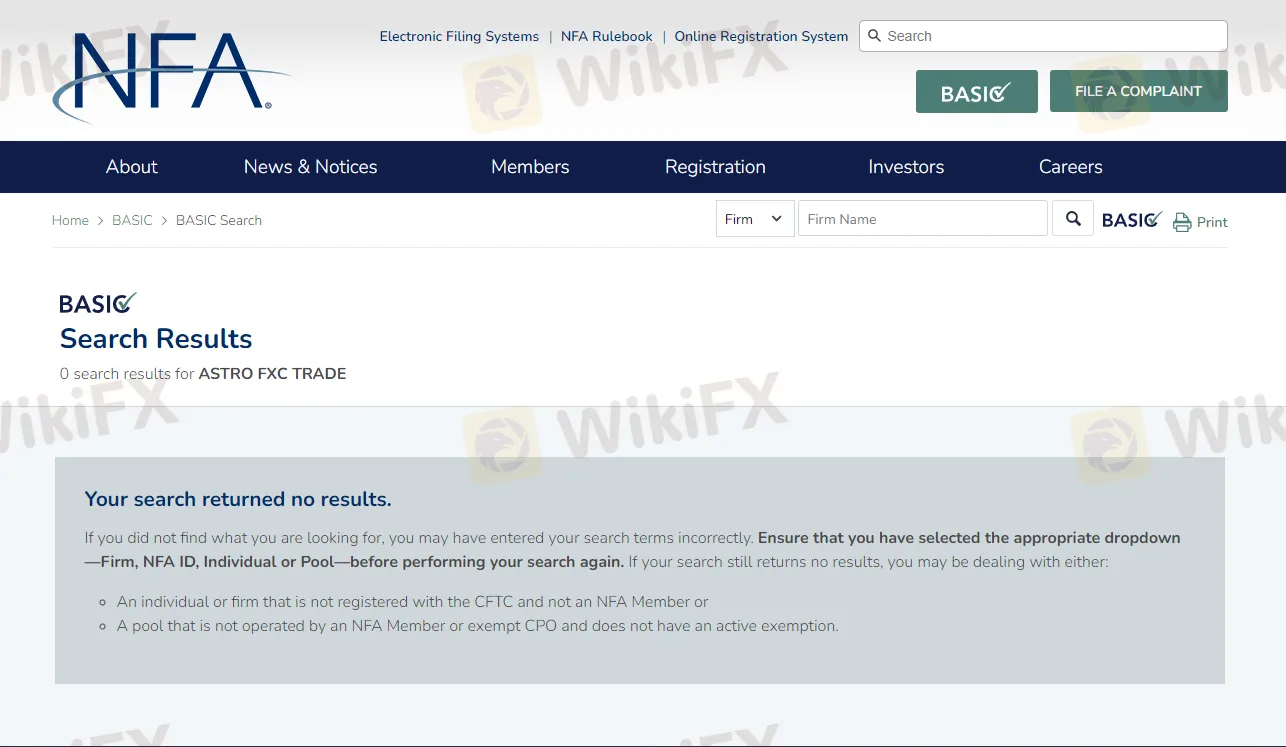

They are registered in the United States, according to their official website. The NFA, a significant financial body in the United States, does not have an account with AstroFXC Trades. In addition to the US SEC.gov

US SEC Gov

On the other hand,

WikiFX App as a medium platform of major financial authorities across the globe. Investigated and found that this broker hasn't registered even on a certain financial authority.

Aside from the firm's regulatory standing, they are confident on their official website to offer the client a set return based on the amount deposited. That is a complete fabrication. Losses are a component of the investment markets, and no investment firm can remain profitable indefinitely.

Final words

Before investing with any broker, do comprehensive research and due diligence on them, and be careful of red flags such as a lack of regulation, claims of assured returns, and unsolicited offers. If you feel a broker is a swindler, report them to the proper regulatory authorities and stop doing business with them.

Keep an eye out for more Forex scam news.

Install the WikiFX App on your smartphone to keep up to speed on current events.

Link to download: https://www.wikifx.com/en/download.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Dark Side of AETOS: They Don’t Want You to Know

AETOS is an Australia-based broker. All over the internet, you will find positive reviews about this broker, but no one is talking about the risks involved with AETOS. However, we have exposed the hidden risks associated with AETOS

Contemplating Investments in Quotex? Abandon Your Plan Before You Lose All Your Funds

Have you received calls from Quotex executives claiming to offer you returns of over 50% per month? Do you face both deposit and withdrawal issues at this company? Or have you faced a complete scam trading with this forex broker? You're not alone. Here is the exposure story.

15 Brokers FCA Says "Are Operating Illegally" Beware!

If a reputable regulator issues a warning about unlicensed brokers, it's important to take it seriously — whether you're a trader or an investor. Here is a list you can check out- be cautious and avoid getting involved with these scam brokers.

Scam Alert: Revealing Top Four Forex Scam Tactics Employed to Dupe Investors

Gaining and losing on forex trades is normal, but not scams that siphon out millions in no time! In this article, we will reveal forex scam tactics. Read on!

WikiFX Broker

Latest News

Lead Prices Remain in the Doldrums Despite Seasonal Expectations

Myanmar Tin Ore Shipments from Wa Region Set to Resume

Major U.S. Banks Plan Stablecoin Launch Amid Crypto Regulations

SHFE Tin Prices Stabilise in the Night Session After Initial Decline

Treasury yields rise as Trump denies plans to fire Fed Chair Powell

Forex Trading Simulator vs Demo Account: Key Differences

Different Forex Market Regulators But One Common Goal - Investor Safety

Do You Really Understand Your Trading Costs?

5 Reasons Why Some Traders Choose XChief

Harsh Truths About ATC Brokers Every Trader Must Know

Currency Calculator