简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

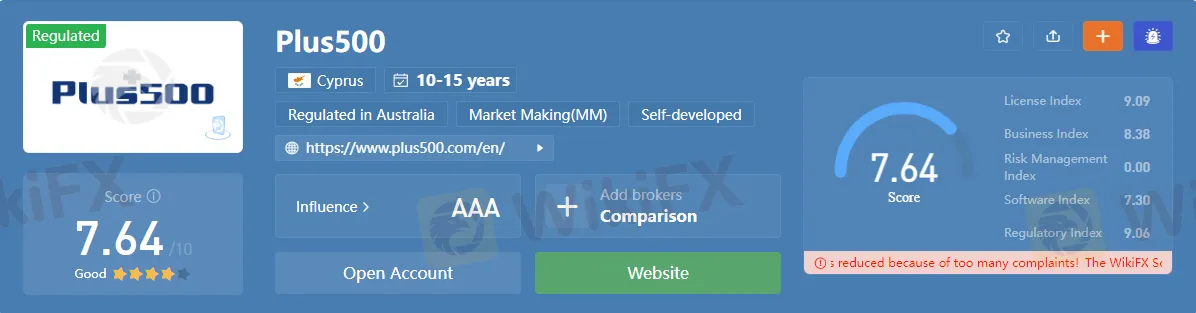

With The Addition Of A New DFSA License, Plus500 Expands Its MENA Presence

Abstract:Plus500 said on Monday that it has obtained a license from the Dubai Financial Services Authority (DFSA) to join the lucrative Middle Eastern markets.

Plus500 Receives DFSA License

The London-listed firm said that the new license will provide substantial development potential by enabling the broker to extend its capabilities to consumers in the UAE.

“We are delighted to have received license authorization from the DFSA in the UAE, and we are excited to bring our market-leading technology capabilities to customers in the region. This is the latest realization of our strategy to enter new markets, develop new products, and deepen engagement with our customers,” stated David Zruia, CEO of Plus500.

The DFSA license is extensively used by brokers who want to enter the Middle Eastern markets. In recent years, several brokers, such as Zenfinex, XTB, and MutiBank Group, have received DFSA accreditation.

Plus500's Global Expansion Goal

Plus500, headquartered in Israel, was launched in 2008 and provides forex trading services as well as CFDs on various asset classes such as stocks, indices, cryptocurrencies, ETFs, and options. It is one of the few retail FX/CFD brokers that is publicly traded.

Furthermore, it is one of the brokers that has substantially invested in technology and solely provides trading services via its own trading platform.

Plus500 has greatly tightened its regulatory standards over the years and currently possesses twelve licenses internationally. Over the last three years, the firm has secured licenses in the United States, Japan, Estonia, and Seychelles. It entered the US and Japan via the acquisition of two domestically controlled enterprises in those countries.

The broker received the new DFSA license after finishing the fiscal year 2022 with $832 million in revenue and $454 million in EBITDA. Both statistics were up from the previous year and met the company's expectations.

It is currently focusing on expansion in the United States, and in Q3 2022, it will develop a US-specific proprietary futures trading platform. It discontinued a seven-year partnership with the Spanish football club Atletico Madrid in October to establish a four-year sponsorship agreement with the Chicago Bulls, a professional basketball team headquartered in the United States.

Install the WikiFX App on your smartphone to keep up to speed on current events.

Link to the download: https://www.wikifx.com/en/download.html?source=fma3

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Lirunex Joins Financial Commission, Boosts Trader Protection

Lirunex joins the Financial Commission, offering traders €20,000 protection per claim. A multi-asset broker regulated by CySEC, LFSA, and MED.

Why Your Forex Trades Are Always Losing

There is no guaranteed way to win in forex trading, but why do so many people still fail?

Capital.com Review 2025: Trading Account & Withdrawal to Explore

Despite its relative youth, the Cyprus-registered online broker Capital.com has garnered respectable attention from a large number of retail and professional investors since its 2016 launch. Capital.com is a frontrunner among low-cost trading products; it allows individual and institutional investors to trade contracts for difference (CFDs) on three thousand markets, including Forex, Stocks, Commodities, Indices, Cryptocurrencies, and more. Impressively, Capital.com is on board with ESG investments as well. You can begin trading CFDs on the Capital.com platform with as little as $20. You can trade CFDs on this platform without paying any commissions; the only fees involved are the spreads. This broker offers a wide range of platforms, including mobile apps, a desktop trading app, an API from Capital.com, Tradingview, and MetaTrader 4. Among Capital.com's many distinguishing features is the wealth of educational content and high-quality research it offers its users. The platform's Marke

BaFin Unveils Report: The 6 Biggest Risks You Need to Know

BaFin’s latest annual risk report highlights multiple challenges for the financial sector in 2025. While the financial system remained stable in 2024, global economic fluctuations, geopolitical tensions, digitalization, and sustainability concerns demand stronger risk management. The report examines six core risks facing Germany’s financial system and three major trends shaping the industry’s future.

WikiFX Broker

Latest News

Robinhood Halts Super Bowl Betting Contracts After CFTC Request

3-Day Online Scam Trap: Victims Lose $200K—Don't Be Next!

Japan's January PMI has been released, investors need to pay attention to these points!

Investment Scam on Telegram: How a Woman Lost Over RM65,000

Judge halts Trump\s government worker buyout plan: US media

Spotting Red Flags: The Ultimate Guide to Dodging WhatsApp & Telegram Stock Scams

WikiFX Review: Why so many complaints against QUOTEX?

Trans X Markets: Licensed Broker or a Scam?

Carmaker Kia becomes latest global firm to face tax trouble in India

IMF Warns Japan of Spillover Risks from Global Market Volatility

Currency Calculator