简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

OANDA's Europe Announcements To Inform Investors About Closing Malta's Operation, Divert To Poland

Abstract:OANDA's New Announcements Regarding Operations In Europe Country To Inform Its Investors About Shutting Down Malta, Divert To Poland.

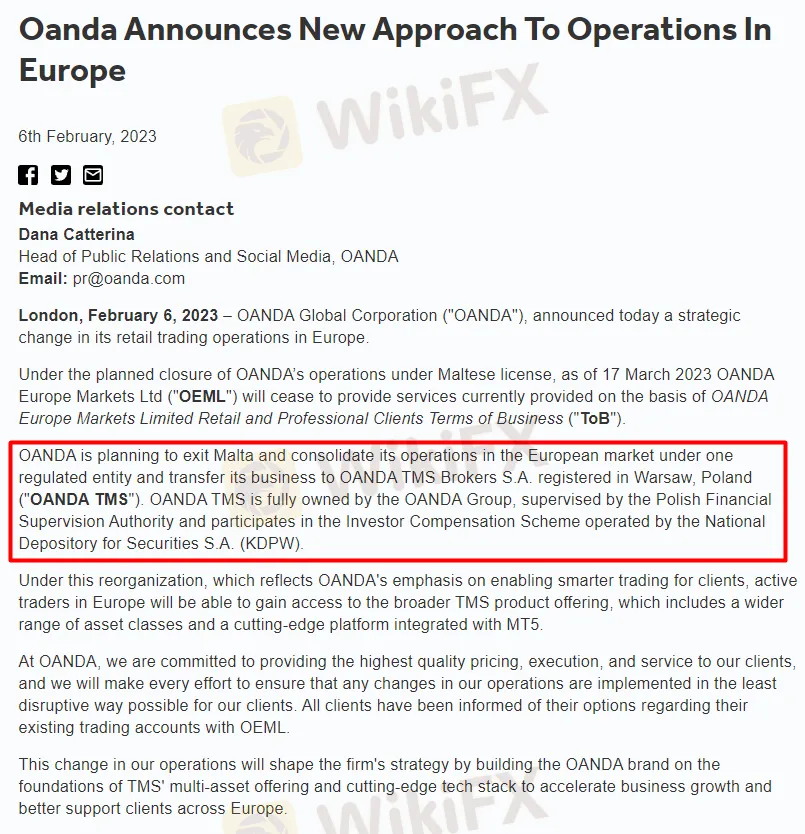

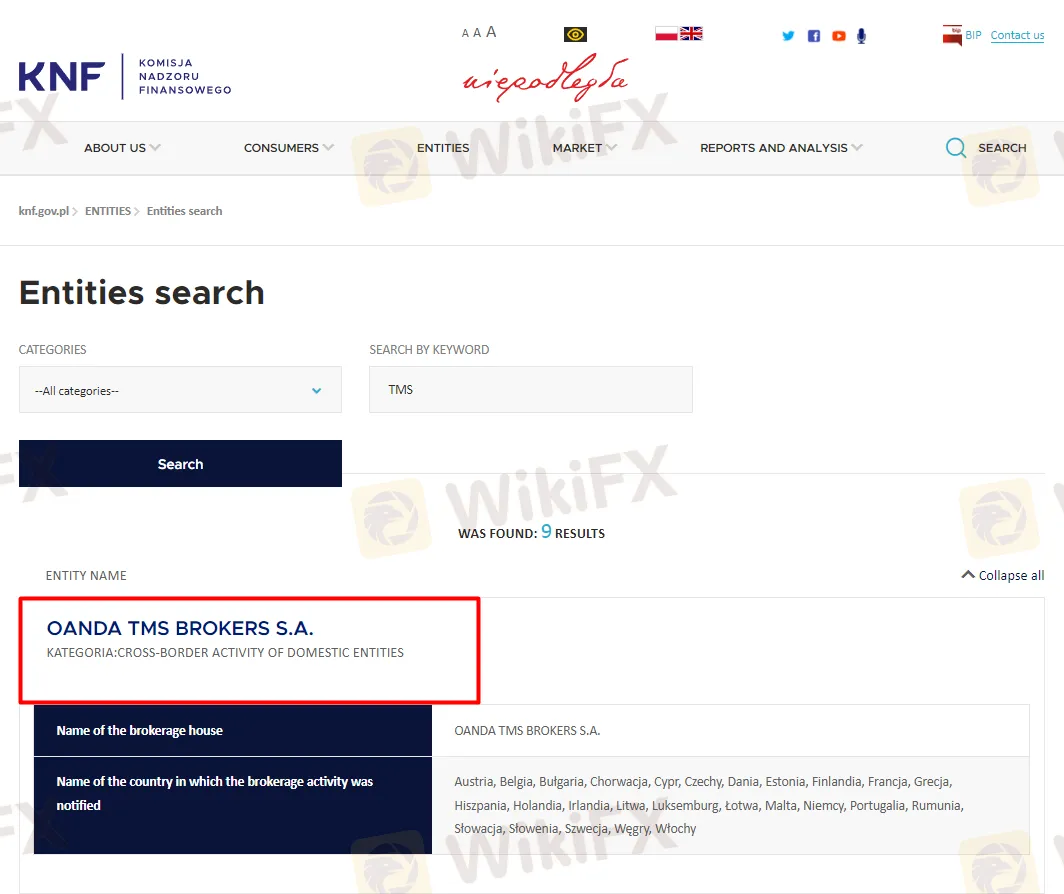

OANDA, a forex brokerage firm, intends to leave Malta and concentrate its activities in Europe under a single regulated entity, namely a company established in Warsaw, Poland.

The broker has set March 17, 2023, as the scheduled end date for its activities under the Maltese license, which operate under the brand name OANDA Europe Markets Ltd (“OEML”). Clients of OEML will be moved to OANDA TMS, which is regulated by the Polish Financial Supervision Authority.

OANDA purchased the Polish broker Dom Maklerski TMS Brokers SA, or TMS Brokers, in 2020 to expand into the Baltic nations. TMS was founded in 1997 and is the oldest and second-largest local Polish brokerage. It is regulated by the KNF and has access to markets in the European Union.

OANDA established itself in Malta three years ago as it ramped up its preparations for the United Kingdom's withdrawal from the European Union. The multi-regulated broker obtained regulatory authorization in Malta for its European subsidiary. At the time, OANDA offered customers of its UK subsidiary, OANDA Europe Limited (OEL), the choice of being transferred to its Maltese company or opting out and remaining with the FCA-regulated business.

“At OANDA, we are dedicated to offering the greatest quality pricing, execution, and service to our customers, and we will make every effort to ensure that any changes in our operations are done in the least disruptive manner possible for our clients. All customers have been advised of their choices with reference to their current OEML trading accounts. ”We will define the firm's strategy by establishing the OANDA brand on the pillars of TMS' multi-asset offering and cutting-edge tech stack to drive company development and better assist customers throughout Europe, the broker said.

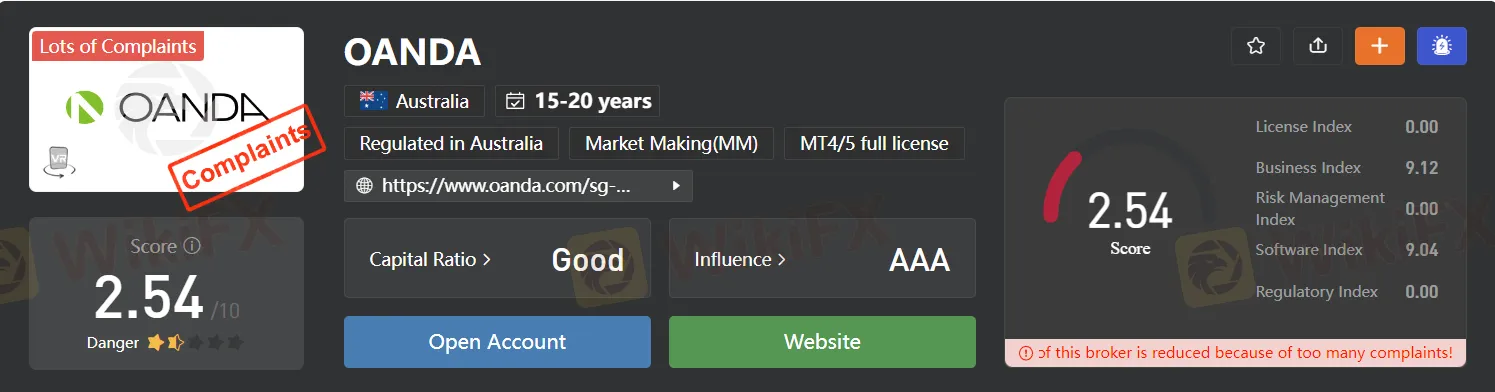

OANDA is a multi-regulated broker having locations in Toronto, Europe, and Asia Pacific. The firm has an FX trading platform that is used by both individual and institutional clients. Furthermore, it offers currency information to individuals, major organizations, and portfolio managers.

Under Bambury's leadership, the company has experienced a transformational shift in its operating architecture, broadening its product range and boosting marketing spending to support future development.

Install the WikiFX App on your smartphone to keep up to speed on current events.

Link to the download: https://www.wikifx.com/en/download.html?source=fma3

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Top Forex Brokers for Low-Cost Trading in 2025

Find the best Forex brokers for 2025 with low spreads, zero commissions, and no hidden fees. Simplify your trading journey with insights and the WikiFX app!

Participate Now in ForexCup Trading Championship

FXOpen announced the trading competition called ForexCup Trading Championship 2025 for traders. You can join, trade, and compete for exciting prizes. Here are the details

What the Movie Margin Call Taught Traders About Risk and Timing

The 2011 film Margin Call offers a gripping portrayal of the early hours of the 2008 financial crisis, set within a Wall Street investment firm. While the film is a fictionalised account, its lessons resonate strongly with traders and finance professionals. For one trader, watching the film had a lasting impact, shaping how they approached risk, decision-making, and the harsh realities of the financial world.

Why More Traders Are Turning to Proprietary Firms for Success

Over the past decade, one particular avenue has gained significant popularity: proprietary trading, or prop trading. As more traders seek to maximize their earning potential while managing risk, many are turning to proprietary firms for the resources, capital, and opportunities they offer. In this article, we’ll explore why an increasing number of traders are choosing proprietary trading firms as their preferred platform for success.

WikiFX Broker

Latest News

Fake ‘cyber fraud online complaint’ website Exposed!

Day Trading Guide: Key Considerations

NAGA Launches CryptoX: Zero Fees, 24/7 Crypto Trading

Scam Alert: 7 Brokers You Need to Avoid

AvaTrade Launches Advanced Automated Trading Tools AvaSocial and DupliTrade

What Determines Currency Prices?

Why More Traders Are Turning to Proprietary Firms for Success

MC Markets Review 2025

How to Use an Economic Calendar in Forex Trading

T4Trade Enhances Forex Trading with Advanced Tools for 2025

Currency Calculator