简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

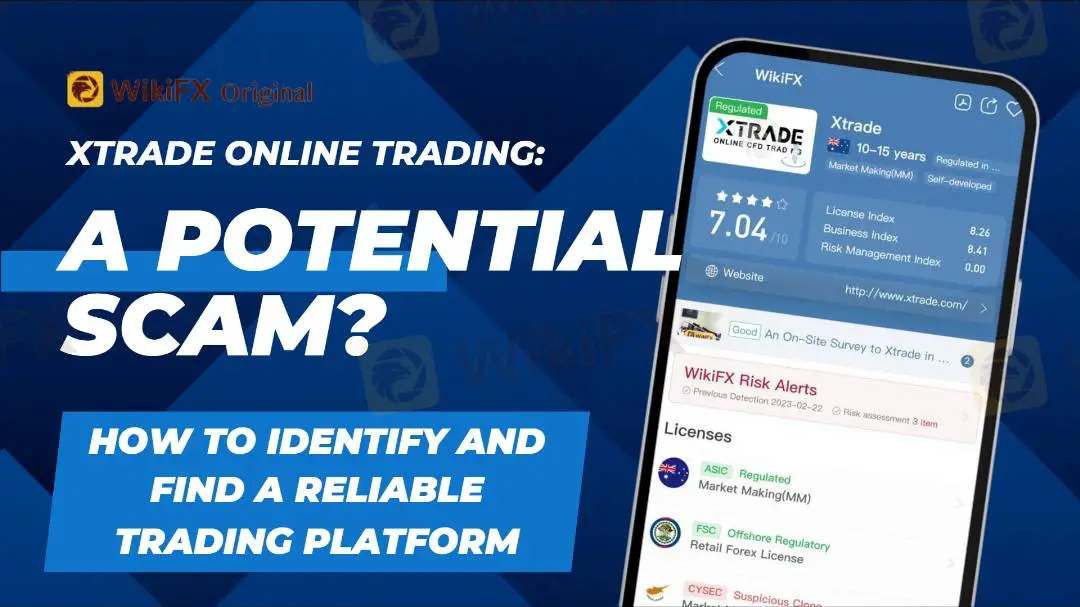

XTrade Online Trading: A Potential Scam? How to Identify and Find a Reliable Trading Platform

Abstract:The article warns readers about the potential risks associated with the XTrade online trading platform, citing numerous complaints and exposés of the company. The platform has been accused of engaging in malicious liquidation, inducing risky operations, and withholding funds from investors. The article provides screenshots of victim testimonials and offers tips on how to identify and avoid dangerous trading platforms.

XTRADE, an online trading platform, has recently been under scrutiny due to numerous complaints about their services. Many investors have reported issues such as malicious liquidation, slippage problems, induced operations, withdrawal issues, and being unable to withdraw funds. These complaints have sparked concerns that XTRADE may be a fraudulent platform, and investigations have revealed that the platform has multiple operating identities under one umbrella. This indicates that the platform is very dangerous and may not be trustworthy. Without further ado, take a look at the following infographic to learn more.

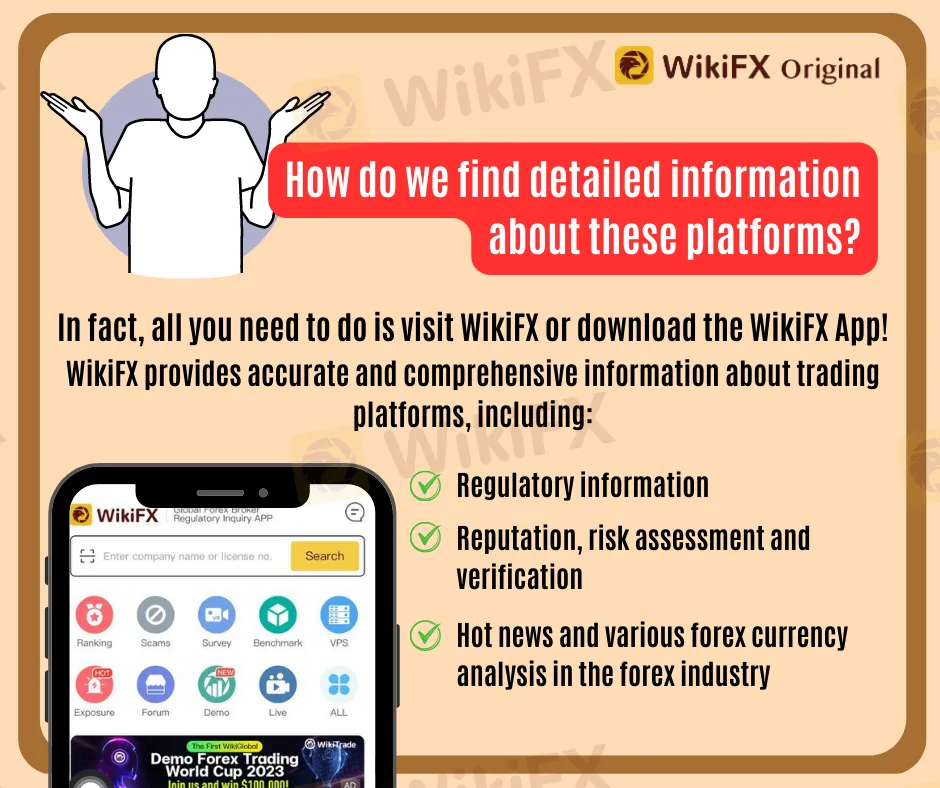

If you're an investor looking for a reliable trading platform, download WikiFX App to make things easier for you!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Think Scams Won’t Happen to You? That’s Exactly What Scammers Count On

We live in a world where information is everywhere. People are more digitally literate than ever before. Financial education is just a few clicks away. And yet, investment scams are not going away but they’re getting worse. It’s tempting to think that only the gullible fall for these tricks. But that’s far from the truth. Why? Because investment scams don’t target your knowledge. They target your emotions.

Why Trade Agreements Matter to Nations

In today’s interconnected world, trade agreements serve as the foundation for stable and predictable international commerce.

Trade Fights Are Heating Up—What Happens Next?

Global financial markets have become increasingly reactive to even minor developments in international trade talks.

Juno Markets Upgrades to FYNXT PAMM

Juno Markets has successfully upgraded its managed account infrastructure by integrating FYNXT’s Percent Allocation Management Module (PAMM) system.

WikiFX Broker

Latest News

Think Scams Won’t Happen to You? That’s Exactly What Scammers Count On

Currency Calculator