简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Industry Powerhouse Alliance: XTB and BlackRock Announce Partnership

Abstract:Embarking on a strategic collaboration with BlackRock, XTB, a prominent financial entity, endeavors to revolutionize retail investing by promoting exchange-traded funds (ETFs) in Spain, aiming to transform saving habits and offer diversified, low-cost investment opportunities to European consumers.

XTB, a key player in the financial sector, is expanding its investment offerings towards passive strategies by partnering with BlackRock, the world's largest asset management firm. The collaboration aims to encourage savings and capital growth through the utilization of exchange-traded funds (ETFs) among retail investors. Initial deployment will occur in Spain, where the savings rate, according to Euromonitor, was 5.8% in 2023, prompting XTB to address this market.

Javier Urones, Head of Sales for XTB Spain, highlighted the partnership's core objective: fostering a culture of saving, effective capital management, and promoting investment plans centered around ETFs. Urones foresees an increased interest in ETFs resulting from this collaboration. Notably, almost 25% of XTB's Spanish clients are already engaged in regular ETF investments.

Globally, ETFs have gained popularity among investors seeking cost-effective and transparent diversification. Silvia Senra, Digital Distribution Director at BlackRock's Spanish branch, noted ETFs' appeal to millions of Europeans pursuing investment for a brighter financial future, citing their transparency, low cost, and comprehensibility.

XTB and BlackRock see significant potential in jointly educating and equipping more European consumers with tools for improved investing and savings habits. XTB's introduction of “Investment Plans” based on ETFs in September aligns with the growing global demand for passive index products. The increase in XTB platform users purchasing ETF index funds in Poland, from 8% in 2020 to 24% in 2023, reflects the escalating interest in these investment strategies.

In response to the demand for passive investments and cryptocurrencies, XTB expanded its offerings beyond traditional avenues. The company introduced interest on idle deposits to compete with traditional banking institutions, offering new customers an attractive interest rate of up to 5%. Additionally, catering to the surge in interest in cryptocurrencies, XTB enhanced its offerings by introducing BTC ETN as an alternative to bitcoin ETFs listed in the United States. This expansion marks a shift from offering cryptocurrencies solely as CFDs to now encompassing three cryptocurrency exchange-traded instruments listed in Europe.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

LiteFinance Launches Powerful New Mobile Trading App

LiteFinance launches its revamped mobile trading app in 2025, introducing real-time analytics, a sleek UI, and a $1M trading contest for users.

WikiEXPO 2025 Cyprus Coming Soon! Join Us to Discuss Trading Safety and Seize Business Opportunities

On September 24, WikiEXPO 2025 Cyprus will grandly open in Limassol. Under the theme of “Sparking Opportunity, Trading Safety,” the expo will bring together over 8,000 industry pioneers and more than 100 top-tier enterprises and institutions to explore regulatory transformations and business opportunities in forex, cryptocurrency, Fintech, and other fields from a forward-looking perspective.

ZachXBT Exposes Crypto Beast’s $11M $ALT Token Dump Scheme

ZachXBT uncovers Crypto Beast’s $11 million pump and dump scheme, causing $ALT token’s crash and wiping out retail investors. Read the full investigation.

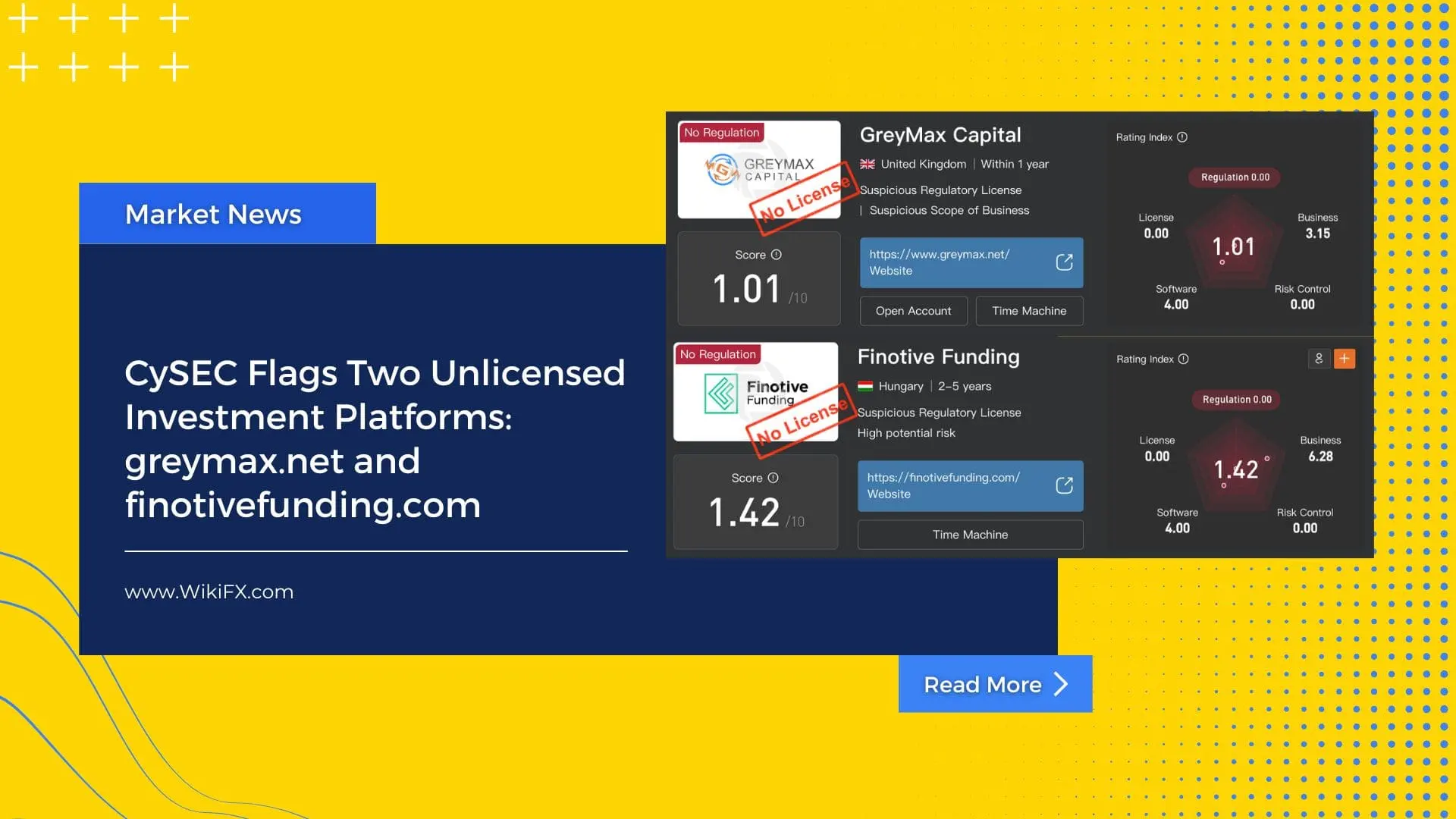

CySEC Flags Two Unlicensed Investment Platforms: greymax.net and finotivefunding.com

CySEC warns investors about greymax.net and finotivefunding.com—two unauthorized platforms offering investment services without a license. Learn how to protect your funds.

WikiFX Broker

Latest News

Brexit made businesses abandon the UK. Trump's hefty EU tariffs could bring them back

Mastering Deriv Trading: Strategies and Insights for Successful Deriv Traders

U.S. doubles down on Aug. 1 tariffs deadline as EU battles for a deal

Buffett and Thorp’s Secret Options Strategies

Trading Market Profile: A Clear and Practical Guide

CNBC Daily Open: Investors dismiss Trump administration's beef with the Fed — S&P hits new high

Sharing Trading Mistakes and Growth

Eyeing Significant Returns from Forex Investments? Be Updated with These Charts

Want to be Sure of a Forex Settlement Process? Read This IMPORTANT Guide!

Can We Just Skip To Next Week

Currency Calculator