简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Broker Assessment Series | Bokefx: Is It Trustworthy?

Abstract:In this article, we will conduct a comprehensive examination of Bokefx. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

In this article, we will conduct a comprehensive examination of Bokefx. Our aim is to equip readers with essential information needed to make informed decisions about utilizing this platform.

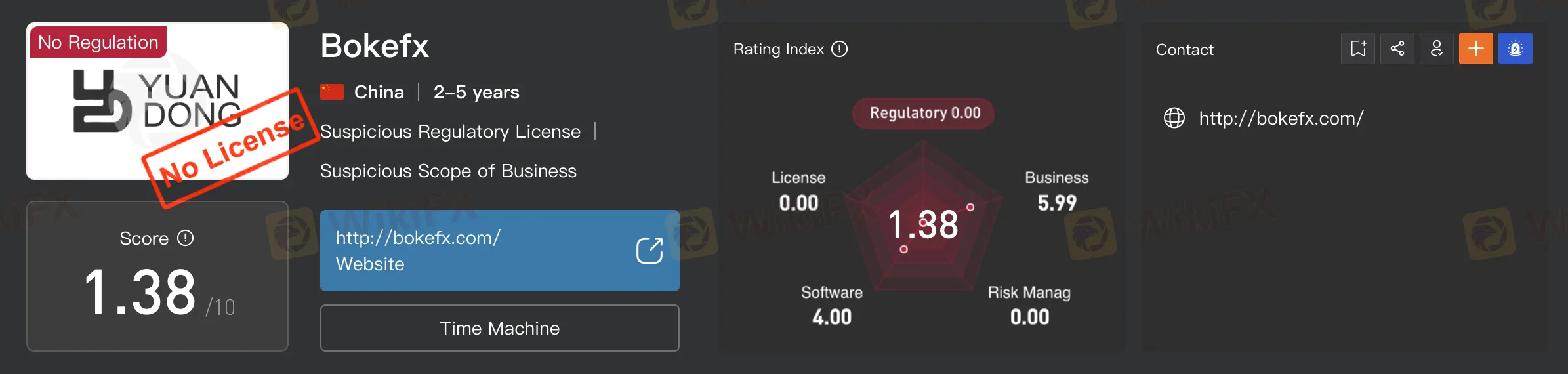

In the realm of online forex trading, identifying potential concerns is vital, and Bokefx has raised some notable issues. Marketed as an online forex broker, Bokefx lacks a crucial element – regulatory authorization. This sets Bokefx apart from reputable competitors, as it operates without the oversight necessary for a trustworthy online trading option.

The absence of regulatory authorization poses a significant problem. Regulatory bodies play a pivotal role in ensuring fair practices, setting standards, and facilitating issue resolution. Without this oversight, traders face potential risks of unethical practices with no proper recourse.

When assessing the legitimacy of a forex broker, the accessibility and reliability of its official website are paramount. Bokefx, however, adds to existing concerns by having its official website, bokefx.com, conspicuously unavailable. A reputable forex broker typically maintains a professional and easily accessible website, providing clients with a centralized platform for crucial information about services, policies, and regulatory compliance. The unavailability of Bokefx's website not only hinders potential traders from accessing vital details but also raises significant questions about the transparency of the broker's operations and the safety of clients' funds.

The sudden unavailability of Bokefx's website raises red flags, deviating from industry norms. Clients rely on brokers to deliver a secure and informative online environment, and the absence of Bokefx's website disrupts this essential aspect of the client-broker relationship. This unforeseen development heightens concerns about the broker's legitimacy, leaving clients uncertain about the safety and whereabouts of their funds. In the competitive forex trading landscape, where trust and transparency are paramount, Bokefx's missing official website cast doubt on its commitment to maintaining open communication and providing a secure trading environment for its clients.

Bokefx's status as an unlicensed and non-regulated online forex broker, coupled with the sudden unavailability of its website, serves as a clear warning to traders. Caution and thorough research are advised before selecting an online trading platform. In an industry where trust and transparency are of utmost importance, Bokefx's current circumstances underscore the significance of choosing brokers with a solid regulatory foundation and a commitment to clear communication and robust customer support.

Hence, WikiFX recommends that users exercise caution and consider exploring alternative brokers with a verified regulatory status from WikiFX's comprehensive database. Download your free WikiFX mobile app now!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Top Forex Brokers for Low-Cost Trading in 2025

Find the best Forex brokers for 2025 with low spreads, zero commissions, and no hidden fees. Simplify your trading journey with insights and the WikiFX app!

Participate Now in ForexCup Trading Championship

FXOpen announced the trading competition called ForexCup Trading Championship 2025 for traders. You can join, trade, and compete for exciting prizes. Here are the details

What the Movie Margin Call Taught Traders About Risk and Timing

The 2011 film Margin Call offers a gripping portrayal of the early hours of the 2008 financial crisis, set within a Wall Street investment firm. While the film is a fictionalised account, its lessons resonate strongly with traders and finance professionals. For one trader, watching the film had a lasting impact, shaping how they approached risk, decision-making, and the harsh realities of the financial world.

Why More Traders Are Turning to Proprietary Firms for Success

Over the past decade, one particular avenue has gained significant popularity: proprietary trading, or prop trading. As more traders seek to maximize their earning potential while managing risk, many are turning to proprietary firms for the resources, capital, and opportunities they offer. In this article, we’ll explore why an increasing number of traders are choosing proprietary trading firms as their preferred platform for success.

WikiFX Broker

Latest News

Fake ‘cyber fraud online complaint’ website Exposed!

Day Trading Guide: Key Considerations

NAGA Launches CryptoX: Zero Fees, 24/7 Crypto Trading

Scam Alert: 7 Brokers You Need to Avoid

AvaTrade Launches Advanced Automated Trading Tools AvaSocial and DupliTrade

What Determines Currency Prices?

Why More Traders Are Turning to Proprietary Firms for Success

MC Markets Review 2025

How to Use an Economic Calendar in Forex Trading

T4Trade Enhances Forex Trading with Advanced Tools for 2025

Currency Calculator