简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

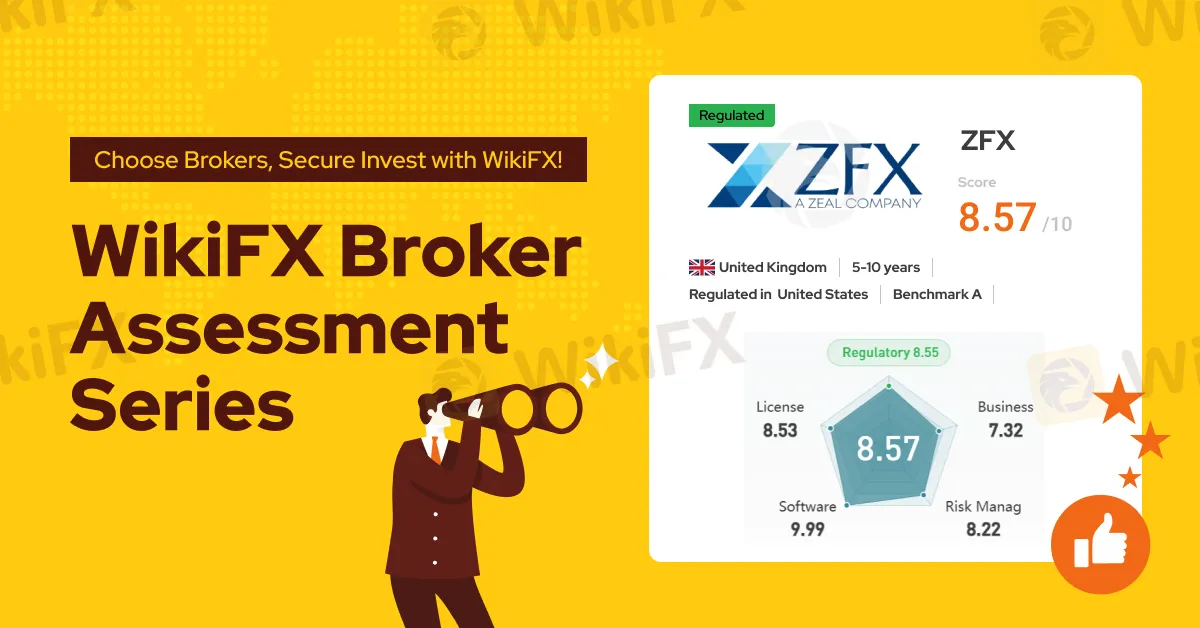

WikiFX Broker Assessment Series | Is ZFX Reliable?

Abstract: In this article, we will look in-depth at ZFX, examining its key features.

In this article, we will look in-depth at ZFX, examining its key features.

About ZFX

Name: ZFX

Registered Country: /Region: United Kingdom

Website: www.zealmarkets.com

Phone: +44(0)2071579968;

Address: No. 1 Royal Exchange, London, EC3V 3DG, United Kingdom; Office 1, Unit 3, 1st Floor, Dekk Complex, Plaisance, Mahe, Seychelles; Suite C, Orion Mall, Palm Street, Victoria, Mahe, Seychelles

Email: support@zfx.co.uk; cs@zfx.com

In an era of advancing technology and prevailing investment trends, many individuals have turned to using their smartphones for the stock market, futures, and forex trading. Consequently, they encounter a crucial question: “How to choose a broker?” As a result, they often seek advice from platforms like Forex Scam Alert. Given the recent influx of inquiries regarding ZFX Mountain and Sea Securities, today we will share insights on how to evaluate this platform.

A search on WikiFX reveals that ZFX, a forex broker established for 5-10 years, employs the main trading software MT4/MT5. It holds a direct license from the UK's Financial Conduct Authority (FCA) and is regulated by the Seychelles Financial Services Authority (FSA) offshore. Additionally, it offers a “100% official intervention for complaints” service. WikiFX gives this broker a favorable score of 8.57/10.

Currently, ZFX offers three types of accounts for investors to choose from ECN, standard STP, and micro. The micro account has a minimum deposit limit of $50, a maximum leverage of 1:2000, and a minimum spread of 1.5. Both ECN and standard STP accounts have a maximum leverage of 1:500, with minimum spreads of 0.2 and 1.3 respectively, and require minimum deposits of $1000 and $200. All accounts support EA services.

ZFX's trading environment has an overall rating of AA, ranking 39th out of 130 brokers. Trading speed and costs are rated as A, while overnight costs and software disconnection are rated as AA, with the average disconnection frequency being deemed perfect.

On-Field Survey

To help you fully understand the broker, WikiFX also investigates the brokers by sending surveyors to the brokers physical addresses.

On WikiFX, you can visually check the physical addresses of brokers by pressing the “Survey” button.

WikiFX did make an on-site survey on ZFX in May 2022 and successfully found their office.

Conclusion

Based on the above findings, ZFX, regulated by the UK's FCA, demonstrates a strong performance in its trading environment, making it a high-quality broker. Investors can decide whether to use it based on their circumstances. If you still want to learn about other brokers, consider using the “Broker Inquiry” feature on the WikiFX app to confirm relevant regulatory information, trading environments, and ratings, helping you find the ideal platform for your needs.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Why Trade Agreements Matter to Nations

In today’s interconnected world, trade agreements serve as the foundation for stable and predictable international commerce.

Trade Fights Are Heating Up—What Happens Next?

Global financial markets have become increasingly reactive to even minor developments in international trade talks.

Juno Markets Upgrades to FYNXT PAMM

Juno Markets has successfully upgraded its managed account infrastructure by integrating FYNXT’s Percent Allocation Management Module (PAMM) system.

Italy’s CONSOB Blocks Sites of ITradingFX and NEX TRADE in Latest Crackdown

Italy’s Companies and Exchange Commission (CONSOB) has ordered Internet service providers to block access to nine unauthorized investment websites, including “ITradingFX” and “NEX TRADE,” as part of its ongoing effort to curb abusive financial services Consob.

WikiFX Broker

Latest News

SkyLine Guide 2025 Thailand Officially Launched: Judging Panel Formation Underway

FSRA Sanctions Hayvn Group and CEO for Regulatory Breaches and Misleading Conduct

Why Are More Regulated Brokers Providing Free VPS Services?

"Rate & Reward: Broker Review Contest"

2024 AI Ad-Blocking Performance Revealed

Five UK Financial Firms Collapse, FSCS Offers Support for Affected Clients

Why Trade Agreements Matter to Nations

Non-Existent Online Scheme Took Away RM580,000

RM15 Million Gone in Fake Investment Scam

Think Scams Won’t Happen to You? That’s Exactly What Scammers Count On

Currency Calculator