简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

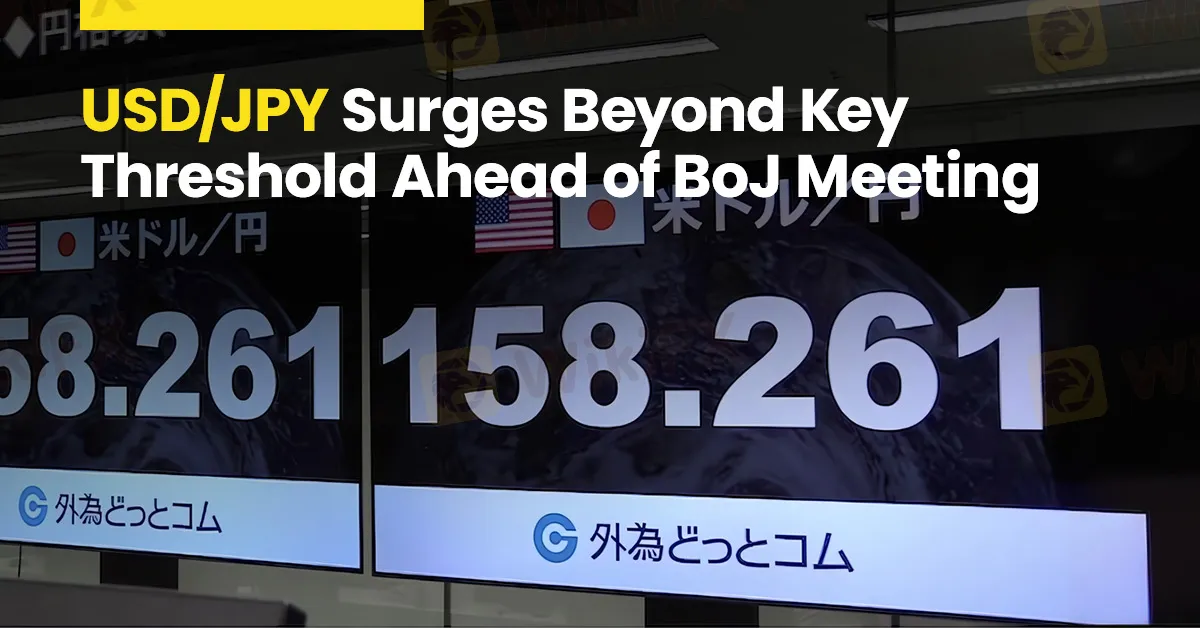

USD/JPY Surges Beyond Key Threshold Ahead of BoJ Meeting

Abstract:Japanese Yen (USD/JPY) Analysis: The yen ventures into critical territory as the BoJ meeting approaches. USD/JPY surpasses a significant threshold.

Japanese Yen (USD/JPY) Analysis:

The yen ventures into critical territory as the BoJ meeting approaches.

USD/JPY surpasses a significant threshold.

Will the BoJ's updated forecast bring the inflation objective within reach, given Governor Ueda's concerns about trend inflation?

Enhance your trading acumen and stay ahead of the curve. Access the Japanese yen Q2 outlook today for exclusive insights into pivotal market drivers every trader should be monitoring:

USD/JPY Breaks Through Critical Barrier Ahead of BoJ Meeting:

Yesterday, USD/JPY breached the 155.00 level, a threshold highlighted by former Deputy Finance Minister Michio Watanabe as one likely to trigger a response from Japanese authorities. As Thursday unfolds, the pair maintains its ascent beyond 155.00, poised before two potential dollar catalysts: US GDP (today) and PCE data (tomorrow).

Should US growth outperform expectations and PCE data reveal further setbacks to disinflationary trends, USD/JPY could see accelerated gains. The Atlanta Fed presently forecasts Q1 GDP at 2.7%, while economists anticipate a 2.5% growth rate for the first quarter.

The Bank of Japan (BoJ) aims to avoid replicating the dovish messaging preceding the 2022 FX intervention efforts that sent the yen plummeting. While BoJ Governor Kazuo Ueda has hinted at the possibility of raising interest rates if underlying inflation trends upward, he underscored on Tuesday that trend inflation remains slightly below 2%, shifting attention to the medium-term inflation projection accompanying the BoJ statement as the two-day central bank meeting nears its conclusion tomorrow.

In recent days, the yen has weakened against several major currencies, amplifying pressure on Japanese authorities to address the persistent devaluations of the domestic currency. While a weaker yen benefits Japanese exports, escalating input costs like fuel pose economic challenges, particularly amidst rising oil prices.

USD/JPY's breach of 155.00, anticipated for weeks, appears to have little impact on currency markets, even preceding the release of high-impact US data. The upper boundary of the longer-term ascending channel emerges as the next resistance level ahead of the 160.00 threshold.

With the BoJ likely maintaining rates unchanged, Kazuo Ueda's options are limited to tapering asset purchases (or signaling reduced bond acquisitions) or adopting a staunchly hawkish stance in his overall assessment. In the absence of BoJ or finance officials' action, momentum seems poised for further USD/JPY gains.

Conversely, swift developments may unfold if the Ministry of Finance intervenes. Previous interventions have witnessed USD/JPY plummeting by approximately 500 pips, highlighting the pair's volatility.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

New to Forex Trading in India? Here's How You Can Start and Maximize

Want to begin your forex trading journey in India? Here's a guide that will help you open and close trading positions effectively, resulting in enhanced returns and minimized risks.

How a TikTok Crypto Scam Cost One Investor RM84,000

A Malaysian woman has lost RM84,000 after falling prey to a cryptocurrency investment scam promoted through the social media platform TikTok. The 52-year-old victim was lured into the scheme by a fraudster posing as an investment advisor, according to police reports filed earlier this week.

Manual vs. Automated Forex Trading: Which One Should You Choose?

Both manual and automated forex trading have their strengths and weaknesses. Should you trade manually or use automated systems? Today’s article may give you some clues.

IFC Markets: The Broker With No License!!

When evaluating a forex broker, regulatory status is one of the most important indicators of credibility and investor protection. In the case of IFC Markets, WikiFX’s findings raise several red flags that potential traders should carefully consider before engaging with this platform.

WikiFX Broker

Latest News

What is a Pip in Forex?

xChief: A Closer Look at Its Licenses

FXTRADING.com: A Closer Look at Its Licenses

New to Forex Trading in India? Here's How You Can Start and Maximize

Intel spins out AI robotics company RealSense with $50 million raise

Tom Lee's Granny Shots ETF is crushing the market and raking in cash

Risk Involved with Cabana Capital – Every Trader Should Know

XTB Hack 2025: Major Security Breach Exposes Client Accounts

Nvidia's Jensen Huang sells more than $36 million in stock, catching up with Warren Buffett in net worth

These are America's 10 weakest state economies most at risk in a recession

Currency Calculator