简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

What are the Best Brokers for US Traders?

Abstract:Regarding Forex trading in the United States, selecting the right broker is crucial for success. US traders need brokers that are reliable, regulated, and provide favorable trading conditions. In 2024, the following brokers stand out as the best options for US traders based on their ratings, trading conditions, and market reputation.

Regarding Forex trading in the United States, selecting the right broker is crucial for success. US traders need brokers that are reliable, regulated, and provide favorable trading conditions. In 2024, the following brokers stand out as the best options for US traders based on their ratings, trading conditions, and market reputation.

Best Forex Brokers for US Traders in 2024:

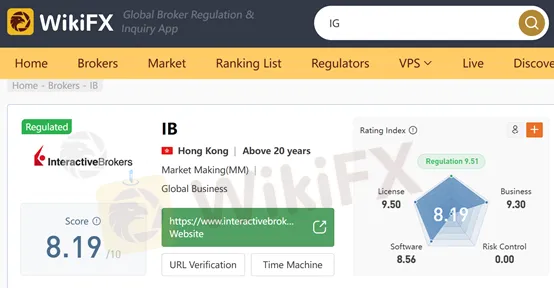

Interactive Brokers

WikiFX Rating: 8.19/10

Minimum Spread: 0.1 pip

Maximum Leverage: 1:40

Minimum Deposit: $2,000

Interactive Brokers is renowned for its comprehensive trading platform and a wide range of trading instruments. The broker offers competitive spreads starting from 0.1 pips and a leverage of up to 1:40. Although the minimum deposit of $2,000 is relatively high, the advanced tools and extensive market access make it a preferred choice for serious traders.

OANDA

WikiFX Rating: 8.36/10

Minimum Spread: 0.1 pip

Maximum Leverage: 1:200

Minimum Deposit: $0

OANDA is highly rated for its user-friendly platform and no minimum deposit requirement, making it accessible for traders of all levels. The broker offers competitive spreads and a maximum leverage of 1:200, providing flexibility for various trading strategies. OANDA's strong regulatory status and comprehensive market analysis tools further enhance its appeal.

FOREX.com

WikiFX Rating: 8.46/10

Minimum Spread: 0.1 pip

Maximum Leverage: 1:400

Minimum Deposit: $500

FOREX.com is a well-established broker with a high WikiFX rating, reflecting its reliability and excellent trading conditions. Traders benefit from low spreads, starting at 0.1 pips, and high leverage of up to 1:400. The minimum deposit of $500 is reasonable, making it a solid choice for both novice and experienced traders. FOREX.com also offers a wide range of educational resources and market insights.

IG

WikiFX Rating: 8.49/10

Minimum Spread: 1 pip

Maximum Leverage: 200:1

Minimum Deposit: $0

IG is a top-rated broker known for its robust trading platform and extensive market coverage. With a WikiFX rating of 8.49, IG provides reliable services with spreads starting from 1 pip and leverage up to 200:1. The absence of a minimum deposit requirement allows traders to start with any amount they are comfortable with. IG's advanced charting tools and comprehensive research materials are particularly beneficial for informed trading decisions.

Conclusion

These sophisticated brokers have years of experience and are well-established in the US market. They offer a range of services tailored to meet the needs of different traders. Whether you are a beginner or an experienced trader, you can choose the broker that best suits your trading style and financial goals.

By considering factors such as spreads, leverage, minimum deposits, and overall ratings, you can make an informed decision to enhance your trading experience in 2024.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Top Reasons Why FXCM is Your Go-to-Broker for Forex Trading

A revered broker name is what you want to associate with being a forex trader. Fortunately, you have plenty of such names on WikiFx where the best forex brokers and regulators are listed to ensure your transaction is genuine. One such name is FXCM, a regulated forex broker in the United Kingdom (UK). Let’s check out more details about FXCM through this article.

Scammers Use AI to Fake Lim Guan Eng’s Support for Investment Scheme

A fake video showing former Penang Chief Minister Lim Guan Eng promoting an investment scheme has started spreading online. Lim has come forward to say the video is not real and was made using artificial intelligence (AI).

IronFX: A Closer Look at Its Licences

In an industry where safety and transparency are essential, the regulatory status of online brokers has never been more important. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about IronFX and its licenses.

IronFX vs Tickmill: A Detailed Comparison for 2025

Discover an in-depth comparison between IronFX and Tickmill, covering regulations, account types, features, and recent cases to guide your trading choices.

WikiFX Broker

Latest News

IronFX Broker Review 2025: A Comprehensive Analysis of Trustworthiness and Performance

OctaFX Flagged by Malaysian Authorities

OctaFX and XM Trading Platforms to Be Blocked in Singapore

ATFX Opens New Office in Cape Town's Portside Tower to Expand in Africa

Tighter Scrutiny: Finfluencers Face Global Crackdown Amid Rising Risks

IronFX: A Closer Look at Its Licences

2025 Broker Real - World Reviews: Share Your Insights & Grab Thousands in Rewards!

Nonfarm Data Lifts Market Sentiment, U.S. Stocks Rebound Strongly

Interactive Brokers Enhances PortfolioAnalyst with New Features

Eid ul Adha Celebration Continues – Grab the STARTRADER Offer Now!

Currency Calculator