简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

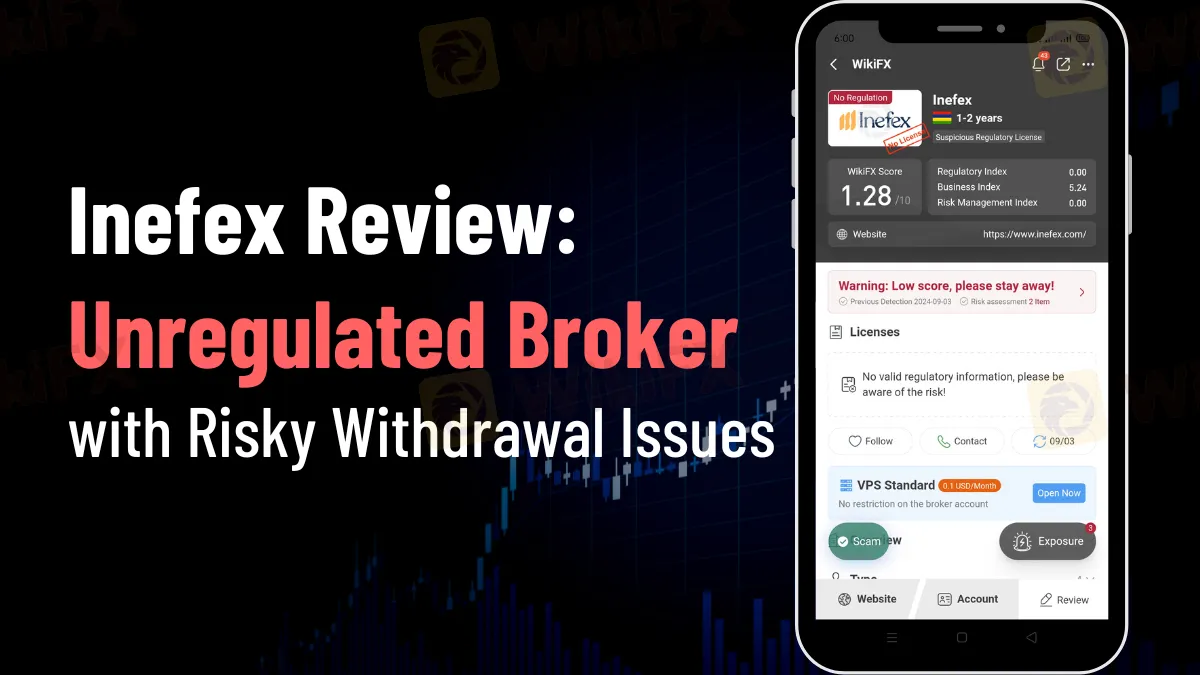

Inefex Review: Unregulated Broker with Risky Withdrawal Issues

Abstract:Inefex is an unregulated CFD broker with a poor reputation. Users report withdrawal issues, fraud, and scams. Avoid trading with this broker.

Inefex, a CFD online trading broker, claims to offer a wide range of trading instruments, including Forex, stocks, cryptocurrencies, commodities, and indices. However, despite its offerings, Inefex has garnered an overwhelmingly negative reputation among traders. The company is associated with Novir Markets LTD, which is purportedly registered and regulated under the Financial Services Commission of Mauritius (FSC) with license number GB21026833. However, this regulatory status could offer more comfort to potential traders.

The Financial Services Commission of Mauritius (FSC) is not held in the same regard as other major regulatory bodies like the UK's FCA, ASIC, or NFA. This lack of solid regulation raises significant concerns about the safety of your capital and the security of your deposits when trading with Inefex. The robustness of its regulation heavily influences a broker's trustworthiness, and in this case, Inefex falls short.

Inefex Reviews Reported to WikiFX

All the reports submitted to Inefex's WikiFX page are negative, with the most common complaints relating to an inability to withdraw funds. Many users have reported experiencing fraudulent activities and outright scams. The broker's rating on WikiFX is a dismal 1.28 out of 10, reflecting its user base's widespread dissatisfaction and distrust.

Given the serious issues associated with Inefex, traders must exercise caution. Utilizing tools like the WikiFX App can help you avoid the pitfalls of dealing with unregulated brokers like Inefex. Always ensure that the broker you choose is regulated by a reputable authority to safeguard your investments.

Conclusion

In conclusion, Inefex is an unregulated and high-risk broker with numerous reports of fraudulent activity and withdrawal issues. The lack of robust regulation makes it an unsafe choice for traders. To avoid falling victim to scams, it is advisable to research thoroughly and choose brokers regulated by well-respected authorities.

Stay informed and protect your investments. Visit Inefex's WikiFX page now to see detailed reviews and feedback from other traders. Don't let yourself fall victim to potential scams—make sure your broker is well-regulated and trustworthy.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

OctaFX Flagged by Malaysian Authorities

OctaFX has been officially listed on warning lists by both Bank Negara Malaysia (BNM) and the Securities Commission Malaysia (SC). These alerts raise serious concerns about the broker’s status and whether it is legally allowed to operate in Malaysia.

Errante Broker Review

Established in 2020, Errante has rapidly gained recognition in the forex and CFD trading industry. With a commitment to transparency, client protection, and a diverse range of trading services, Errante caters to both novice and experienced traders. This review provides an in-depth look at Errante's offerings, regulatory standing, trading conditions, and more.

IronFX Broker Review 2025: A Comprehensive Analysis of Trustworthiness and Performance

IronFX Review 2025: Explore the broker’s AAAA WikiFX rating, global regulations, and $500,000 trading prize. Is it trustworthy or a scam? Dive into our transparent analysis!

TradingPRO: A Closer Look at Its Licences

In an industry where safety and transparency are essential, the regulatory status of online brokers has never been more important. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about TradingPRO and its licenses.

WikiFX Broker

Latest News

How much money will you earn by investing in Vantage Broker?

IronFX vs Exness Review 2025: Comprehensive Broker Comparison

Fraudsters Are Targeting Interactive Brokers' Users with Lookalike Emails

Interactive Brokers: Global Office Visits and Licensing Details

Top Tips to Choose the Best Forex Broker in 2025

SEBI Notifies New F&O Rules for Investors - New Derivative Trading Limits & More Amendments

U.S. Jobs Data Released: A Potential Boost for Gold Prices

SkyLine Guide 2025 Malaysia: 100 Esteemed Judges Successfully Assembled

Everything you need to know about ADSS

Vantage Markets Review 2025: Trusted Forex and CFD Trading Since 2009

Currency Calculator