简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

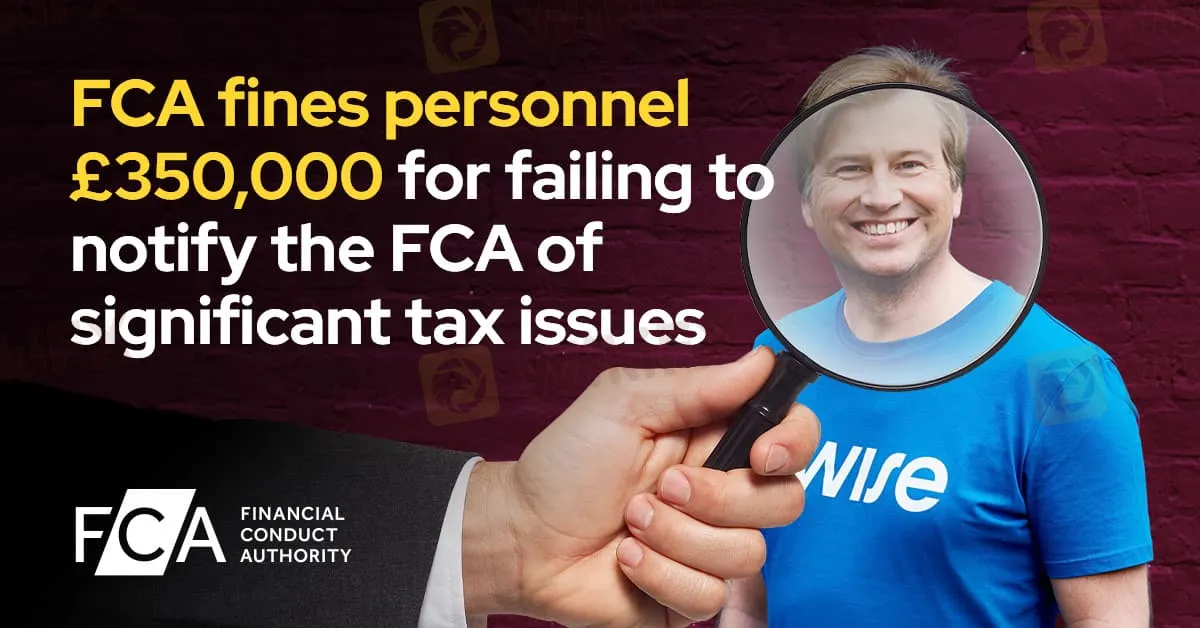

FCA fines personnel £350,000 for failing to notify the FCA of significant tax issues

Abstract:This fine, a result of Mr. Käärmann's breach of a senior manager conduct rule, underlines the regulatory expectation that leaders within financial services uphold high ethical standards and transparency in their dealings.

In a recent move emphasizing regulatory transparency and accountability, the Financial Conduct Authority (FCA) imposed a £350,000 fine on Kristo Käärmann, CEO of Wise plc and senior manager at Wise Assets UK Ltd. This fine, a result of Mr. Käärmann's breach of a senior manager conduct rule, underlines the regulatory expectation that leaders within financial services uphold high ethical standards and transparency in their dealings.

The penalty originates from tax-related issues dating back to 2017, when Mr. Käärmann sold shares worth £10 million, incurring a capital gains tax liability. However, he failed to notify HM Revenue & Customs (HMRC) of this liability, a move deemed “deliberate” by HMRC. In February 2021, Mr. Käärmann paid a substantial fine of £365,651 to HMRC, and in September 2021, he was added to HMRC's public tax defaulters list.

According to the FCA, the period between February and September 2021 was critical in its assessment of Mr. Käärmann's “fitness and propriety” as a senior manager. The FCA determined that he failed to appropriately assess the significance of these tax issues and did not inform the FCA, despite his knowledge of the matter for over seven months. Such a lapse, the FCA stated, highlights a failure to maintain the level of accountability expected of senior executives in financial institutions.

Therese Chambers, Joint Executive Director of Enforcement and Oversight at the FCA, underscored this sentiment, stating, “We, and the public, expect high standards from leaders of financial firms, including being frank and open. It should have been obvious to Mr. Käärmann that he needed to tell us about these issues which were highly relevant to our assessment of his fitness and propriety.”

At the time, Mr. Käärmann held significant roles across Wise entities regulated by the FCA, including his position as CEO of Wise plc and as both Chief Executive (SMF1) and Executive Director (SMF3) of Wise Assets UK Ltd. The FCA noted that the original fine was set at £500,000, yet Mr. Käärmanns willingness to resolve the matter early qualified him for a 30% reduction, resulting in the final fine of £350,000.

This penalty underscores the FCAs commitment to ensuring that senior figures within regulated financial firms adhere to rigorous standards of conduct, especially concerning transparency with both tax obligations and regulatory oversight.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Risk Involved with Cabana Capital – Every Trader Should Know

Cabana Capital has changed its name and logo, basically everything about its identity. This seems a bit suspicious, and it's something you should definitely be concerned about. In this article, you’ll learn about the red flags that every trader needs to watch out for.

CME International Records a Massive Jump in Forex Volumes

CME International recorded a record surge in its foreign exchange trading volumes during the second quarter. Check out its performance across products and markets.

Scam Brokers Exposed! FCA Warns Traders to Stay Safe

If you are into forex trading, you need to protect your money from investment scams. Many scam brokers are active in the market now. The FCA, a reputed financial regulator, has issued a list of unlicensed brokers you need to stay away from.

New to Forex Trading in India? Here's How You Can Start and Maximize

Want to begin your forex trading journey in India? Here's a guide that will help you open and close trading positions effectively, resulting in enhanced returns and minimized risks.

WikiFX Broker

Latest News

Manual vs. Automated Forex Trading: Which One Should You Choose?

Scammed by a Click: He Lost RM300,000 in a Month

Revealing Factors That Help Determine the Gold Price in India

Why Regulatory Compliance Is the Secret Ingredient to Trustworthy Forex Brokers

How Are Trade Policies Affecting the Aluminum Market?

US Government Interest Grows in Victory Metals’ Rare Earths Supply

RM71,000 Lost in a Share Scheme That Never Existed

Pentagon to become largest shareholder in rare earth miner MP Materials; shares surge 40%

Delta shares jump 13% after airline reinstates 2025 profit outlook as CEO says bookings stabilized

Delta shares jump 12% after airline reinstates 2025 profit outlook as CEO says bookings stabilized

Currency Calculator