简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Teen Among 7 Busted in Shocking Online Investment Scam

Abstract:A 17-year-old boy and six others face charges for allegedly running a fraudulent investment scheme in Taman Ekoflora. While the six adults pleaded guilty, the teen denied the charges. The group could face penalties under Section 120B(2) of the Penal Code. The court will reconvene on March 6 to decide on sentencing.

A 17-year-old boy is among seven individuals charged in the Magistrate's Court in connection with a fraudulent online investment scheme.

The six adult accused—Choo Weng Seng (39), Tan Chun Leong (41), Sky Chang (20), Yap Wai Xien (20), Ryan Wong (24), and Wess Lee (19)—pleaded guilty before Magistrate Hidayatul Syuhada Shamsudin. The teenager, however, pleaded not guilty to the charges.

According to court documents, the accused allegedly conspired to lure victims into investing in a fraudulent scheme. The offence reportedly occurred on January 13 at Jalan Ekoflora 5/21, Taman Ekoflora, around 3:00 PM.

The charges fall under Section 120B(2) of the Penal Code for criminal conspiracy, read with Section 34, which carries a maximum penalty of six months' imprisonment, a fine, or both. The court may impose alternative sentences for the teenager, such as a good behavior bond, community service, or placement at an approved institution, including the Henry Gurney School, if found guilty.

Deputy Public Prosecutor Nik Noratini Nik Azman led the prosecution, while all the accused were represented by lawyer Dahlia Tan. The court scheduled the next hearing for March 6 to allow for document submission, including a Social Welfare Department report and sentencing considerations.

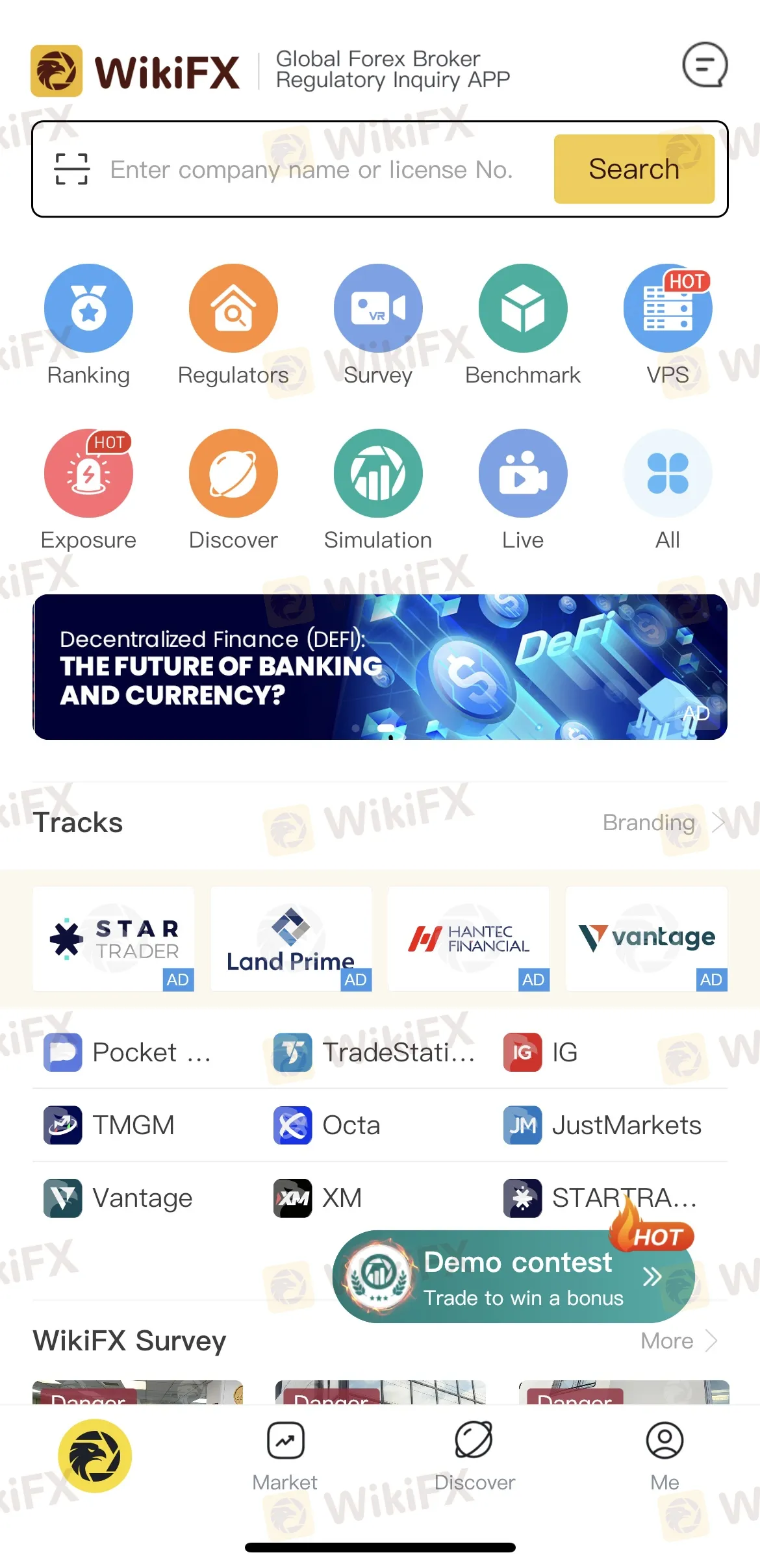

In light of such incidents, safeguarding your financial investments is more critical than ever. WikiFX provides a trusted platform to help users verify the legitimacy of brokers and financial institutions.

- Comprehensive Broker Database: Access detailed profiles, regulatory statuses, and user reviews of brokers worldwide.

- Risk Alerts: Stay informed about unlicensed or suspicious entities with real-time updates and risk ratings.

- Informed Decisions: Make smarter investments by checking a broker's background before committing your hard-earned money.

WikiFX is your reliable partner in navigating the financial landscape safely. Dont take risks—verify brokers and stay protected.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Think Scams Won’t Happen to You? That’s Exactly What Scammers Count On

We live in a world where information is everywhere. People are more digitally literate than ever before. Financial education is just a few clicks away. And yet, investment scams are not going away but they’re getting worse. It’s tempting to think that only the gullible fall for these tricks. But that’s far from the truth. Why? Because investment scams don’t target your knowledge. They target your emotions.

RM15 Million Gone in Fake Investment Scam

A 77-year-old Malaysian retiree has suffered financial losses totalling RM15.1 million after falling victim to an elaborate share investment scam orchestrated by an individual she knew personally.

Non-Existent Online Scheme Took Away RM580,000

A Malaysian assistant human resources manager has lost nearly RM580,000 to a fraudulent online investment scheme based in Taiwan.

Why Trade Agreements Matter to Nations

In today’s interconnected world, trade agreements serve as the foundation for stable and predictable international commerce.

WikiFX Broker

Latest News

Think Scams Won’t Happen to You? That’s Exactly What Scammers Count On

Currency Calculator