简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

【MACRO Insight】 US Treasury volatility, Fed policy game and global central bank gold hoarding: dual

Abstract:The US economic “stagflation” dilemma and the dilemma of policy authoritiesIn the first half of 2025, the US economy is deeply trapped in the shadow of stagflation of low growth and high inflation. Th

The US economic “stagflation” dilemma and the dilemma of policy authorities

In the first half of 2025, the US economy is deeply trapped in the shadow of stagflation of "low growth and high inflation". The International Monetary Fund (IMF) lowered its GDP growth rate from 2.8% in 2024 to 1.8%, and the OECD further dropped to 1.6%. Consumer data deteriorated across the board: the consumer confidence index fell to 50.8 in May (the lowest since June 2022), and the average annual loss of household disposable income due to tariffs was US$1,700-8,100, with low-income groups suffering 4%; at the same time, the core PCE inflation rate is expected to exceed 3.2% by the end of the year, far exceeding the Fed's 2% target, and the price of imported goods such as leather and electronic products has increased by more than 15%, with an average annual additional expenditure of US$3,800 for a single household.

U.S. Treasury market volatility and the Treasury Department's aggressive support

Against the backdrop of deteriorating economic fundamentals, the U.S. bond market has become the core battlefield of policy games. After "Trump Liberation Day" in April 2025, the 30-year U.S. bond yield approached the dangerous level of 5%. Market panic stems from two aspects: one is that foreign institutions sold U.S. bonds to stabilize the exchange rate of their own currencies, and the other is the liquidity chain reaction caused by the liquidation of $2 trillion basis trading. U.S. Treasury Secretary Bensont sent a strong signal on April 14, suggesting that "expanding U.S. bond repurchases" would be the core means; six weeks later, the Treasury Department set a record of $10 billion in Treasury bond repurchases, and the scope of operations expanded from short-term bonds to 10-20 year long-term bonds, doubling the scale of similar operations in May.

Faced with such a severe situation, U.S. Treasury Secretary Benson decisively released a strong signal on April 14, suggesting that "expanding U.S. bond repurchases" would be the core means of stabilizing the market. This news was like a bombshell, causing a thousand waves in the financial market. Six weeks later, the U.S. Treasury Department fulfilled its promise with practical actions and set a record for Treasury bond repurchases with a repurchase scale of US$10 billion. It is worth noting that the scope of this repurchase operation is no longer limited to the previous short-term bonds, but has been further expanded to long-term bonds with a term of 10 to 20 years, and the scale has doubled compared with similar operations in May.

Global trust crisis and the rise of gold under Trumps tariff policy

The Trump administration's erratic tariff policy has become a catalyst for economic stagflation and has shaken the world's trust in the dollar reserve system. Although the "reciprocal tariff" was suspended in June 2025, the 10% "base tariff" and the high tariff of 125% on China are still retained, leading to an intensified fragmentation of the global industrial chain. Atlanta Fed President Bostic warned that the price increase caused by tariffs will be apparent in the coming weeks, and if it continues, it may lead to the "solidification" of inflation expectations; Chicago Fed President Goolsbee bluntly stated that the central bank lacks a response script under the risk of "stagflation".

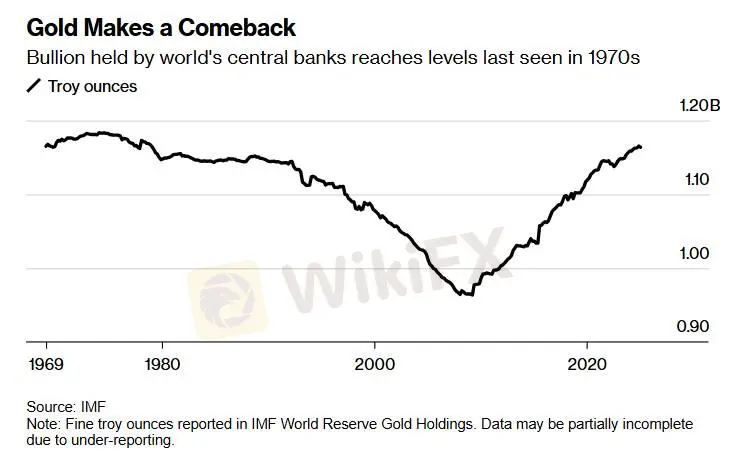

This policy uncertainty directly drives global central banks to accelerate their gold reserve layout. According to Goldman Sachs data, global central banks hoard about 80 tons of gold (worth $8.5 billion) per month, and most purchases are kept secret. The World Gold Council shows that central banks and sovereign wealth funds purchase 1,000 tons of gold each year, accounting for a quarter of the global mining volume; among the 72 central banks surveyed by HSBC, more than one-third plan to increase their gold holdings by 2025, and none intend to sell.

Deep cracks in the US dollar system and policy linkage effects

In the short term, the Fed's interest rate meeting on June 17 and the Treasury's repurchase scale will become a key window for policy shifts; but in the long term, the stagflationary pressure of the US economy and the global wave of de-dollarization have resonated. When the US bond market relies on fiscal support and the Fed is caught in a policy dilemma, the strategic value of gold as a "de-risking" asset is reshaping the global financial landscape - this is both a response to the disorder of US policies and an inevitable choice for the diversification of the international monetary system.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ASIC Urges Financial Licensees to Fix Register Errors Before 2026 Deadline

eToro Review 2025: Top Trading Opportunities or Hidden Risks?

How much money will you earn by investing in Vantage Broker?

IronFX vs Exness Review 2025: Comprehensive Broker Comparison

Fraudsters Are Targeting Interactive Brokers' Users with Lookalike Emails

Top Tips to Choose the Best Forex Broker in 2025

SEBI Notifies New F&O Rules for Investors - New Derivative Trading Limits & More Amendments

Interactive Brokers: Global Office Visits and Licensing Details

U.S. Jobs Data Released: A Potential Boost for Gold Prices

Everything you need to know about ADSS

Currency Calculator