简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Rupee Outlook & Market Drivers

Abstract:1. Muted Reaction, Range‑Bound TradeThe rupee has largely stayed within a narrow band of ₹85.50–₹86.00 per USD despite the tariff headlines. Volatility is low—ten‑day realized volatility is down to ar

1. Muted Reaction, Range‑Bound Trade

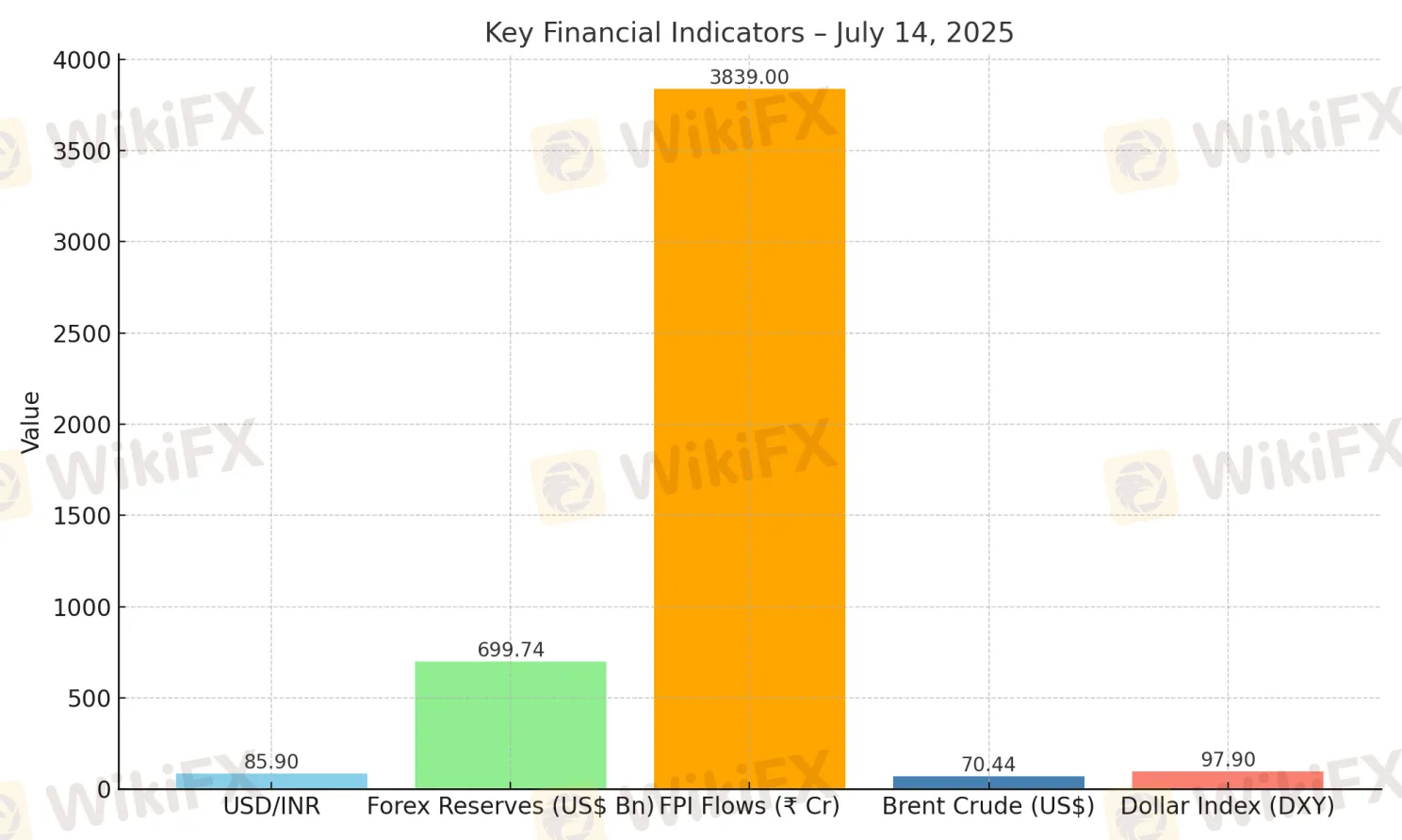

The rupee has largely stayed within a narrow band of ₹85.50–₹86.00 per USD despite the tariff headlines. Volatility is low—ten‑day realized volatility is down to around 4–4.3%—indicating calm trading conditions and active corporate and interbank participants using volatility options Reuters+15Reuters+15Reuters+15.

Its 30‑day correlation with the Nifty 50 has risen to ~0.66—its strongest since mid‑May—suggesting it‘s increasingly tracking domestic equities Reuters.

2. Short‑Term Pressure from Tariff Jitters & Dollar Strength

U.S. tariff threats (30% on EU/Mexico; 35% Canada; proposed BRICS tariffs) and a firmer dollar index (98–99) have nudged the rupee toward the weaker end of its range (₹85.9–86.2) X (formerly Twitter)+2CBS News+2YouTube+2.

Meanwhile, rising U.S. inflation and reduced odds of Fed rate cuts (now ~50% or lower for 2025) further boost the dollar Mitrade+3Reuters+3Reuters+3.

3. Fundamentals Provide Resilience

Strong RBI intervention and dollar-selling by state-run banks are actively capping sharp rupee depreciation Reuters+1Reuters+1.

India’s forex reserves (~$700 billion) give the RBI scope to manage volatility (even though exact current figures werent in these stories) Wikipedia.

FPI flows are modestly supportive, with equity inflows and mixed bond flows cushioning turbulence bis.org+1Wikipedia+1.

🔭 What to Watch Next

EventImplicationU.S. inflation dataMay keep Fed on hold longer → continued dollar strength → pressure on INR The Times of India+10Reuters+10Reuters+10U.S.–India trade dynamicsClarity on deals or reciprocal tariffs (beginning August 1) could shift sentiment ReutersReutersMitradeRBI actionFurther dollar interventions could stabilize or even strengthen the rupee 🔍Oil prices & global risk moodHigher crude or global risk-off could hurt INR; easing could alleviate pressure

The rupee remains resilient—staying within a tight ₹85.5–86 band—but recent U.S. tariff threats, stronger dollar, and U.S. inflation data are setting a softer tone in the short term. Ongoing RBI interventions and healthy forex reserves continue to back the currency. Key catalysts in the coming days: U.S. inflation prints, Fed policy updates, developments in U.S.–India trade, and crude price movements

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Exness Halts New India Accounts Amid Regulatory Change

eToro and BridgeWise Launch AI Smart Portfolio for US Mid-Cap Stocks

Contemplating Investments in Quotex? Abandon Your Plan Before You Lose All Your Funds

How family offices can protect the bottom line when putting family members on payroll

Meta says it won't sign Europe AI agreement, calling it an overreach that will stunt growth

Ether and trading stocks take the crypto spotlight as Congress passes historic stablecoin bill

Inflation outlook tumbles to pre-tariff levels in latest University of Michigan survey

Peter Thiel-backed cryptocurrency exchange Bullish files to go public on NYSE

What a Trump, Powell faceoff means for your money

Ether takes crypto spotlight as Congress passes historic stablecoin bill

Currency Calculator