简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

From Charts to Profits: Unleashing the Power of Forex Trading Tools

Abstract:Want in-depth insights into the forex trading market so that you can make an informed investment call? Start unleashing the power of forex trading tools. These tools, comprising both fundamental analysis and technical charts, lay the foundation for successful forex outcomes.

Want in-depth insights into the forex trading market so that you can make an informed investment call? Start unleashing the power of forex trading tools. These tools, comprising both fundamental analysis and technical charts, lay the foundation for successful forex outcomes. If stats are to be believed, the forex market remains the most liquid financial instrument available globally, with a daily trading volume touching nearly £4.92 trillion. Some credit goes to forex trading tools that provide investors with increased visibility of the market dynamics. In this article, we will explore these tools and the positive difference they make to your trading journey.

Exploring Insightful Fundamental Analysis Forex Trading Tools

Fundamental analysis helps determine how forex trading impacts the countrys economy and currency. As a trader, you can make informed trading calls by analyzing fundamental aspects.

Economic Calendar

An economic calendar containing the exact dates of key economic data influences the currency pairs upon their release. This data includes inflation and employment numbers, Gross Domestic Product (GDP), and central bank meeting dates.

News Feeds

With news feeds, you receive all the required information associated with political events, economic developments, and other factors that can impact currency values. The latest news on forex further hints at the market sentiment, allowing you to decide effectively.

Notifications Issued by Central Banks

Central banks hold regular meetings on interest rates and economic policies. The decision made by them greatly impacts the economy. Currency prices can fluctuate upon announcements made by the central bank. Monitoring these announcements can help equip traders with the necessary insights into the potential movement of a currency.

Technical Analysis Forex Trading Tools

Technical analysis tools involve evaluating price trends, patterns, and historical market data to estimate future price movements. With these tools, traders gain actionable insights into the market behavior. Here are some technical forex trading tools to study and act upon.

Candlestick Charts

Candlestick charts are human emotions represented through visually impressive graphs. They depict human behavior both during the bullish and bearish phases of the market. These charts are easy to interpret and help traders understand prevailing market sentiment. As a result, they can either open or close forex positions.

Trend Indicators

Trend indicators form part of a crucial technical analysis that allows traders to spot trends. Moving Averages and the Ichimoku Cloud are some key examples. While moving averages help smooth price changes to demonstrate the overall trend, the Ichimoku Cloud allows traders to gain a broader overview of support and resistance levels besides potential changes in trends. Crucial trend indicators, including forex trading software, allow you to apply these seamlessly to your forex trading strategy.

Oscillators

They demonstrate the existing buying condition of the currency pair, allowing traders to accurately predict potential price reversals. Some popular oscillators are the Relative Strength Index (RSI) and the Stochastic Oscillator. With these tools, you can compare price movements of late with historical data, offering you further insights into potential market shifts.

Support and Resistance Tools

As the price goes up and then retreats, the highest point reached during this journey is called resistance. Resistance levels demonstrate surplus sellers, resulting in selling pressure that inhibits upward movement in prices. As the prices continue to move upward, the lowest point attained before it moves back is called support. Support levels indicate surplus buyers in the market, causing buying pressure to support the price.

Trading Platforms

Trading platform software applications allow traders to execute trades, gain market access, and manage their accounts. Selecting the appropriate trading platform helps transform your trading experience with an enhanced success rate. Below are some popular tools for forex trading.

MetaTrader 4

MT4, a user-friendly interface integrated with classy features, helps traders access advanced charting tools, customizable templates, and technical indicators. Expert advisors, which facilitate automated trading based on pre-set strategies, are some of its standout features.

MetaTrader 5

MT5 provides additional technical indicators, timeframes, and an extended array of instruments. It also helps traders seeking to access other markets, such as commodities and stocks, all within a single platform.

Conclusion

Achieving success in a dynamic and fast-paced market requires insight, precision, and the right set of tools. From fundamental analysis tools like economic calendars and central bank updates to technical instruments such as candlestick charts, oscillators, and trading platforms like MT4 and MT5, each helps traders create a solid forex trading strategy.

By understanding and integrating these tools into your trading routine, you explore hidden opportunities while managing risk and optimizing entry and exit points. Whether you're a novice or a seasoned trader, leveraging forex trading tools can transform your overall trading journey.

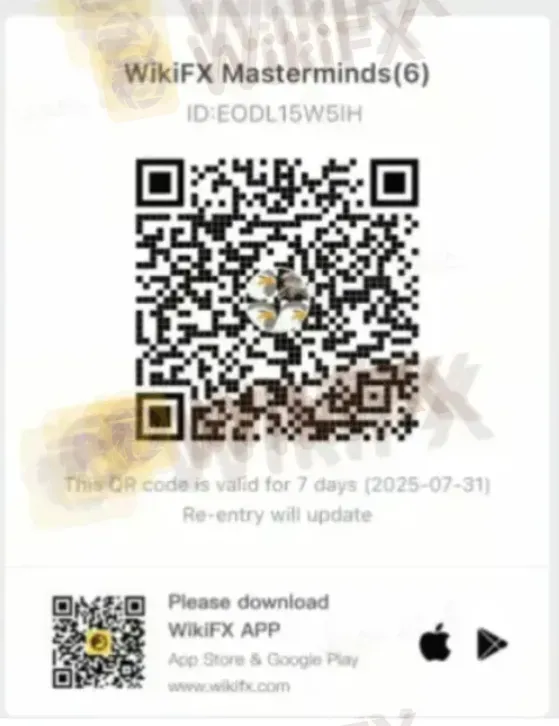

We are Celebrating WikiFX Masterminds - A Platform That Connects the Best Forex Minds.

A few steps, and you would make it to this community.

Here are those steps -

1. Scan the QR code placed right at the bottom.

2. Install the WikiFX Pro app.

3. Afterward, tap the ‘Scan’ icon placed at the top right corner

4. Scan the code again.

5. Congratulations, you have joined the community.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Before You Trade with Quest: 6 Warning Signs to Know

The Forex market is a jungle full of complex trades, high risks, and unpredictable moves. Without the right knowledge, you’re an easy target. In this environment, information is your only weapon. Many scam brokers are out there, ready to take advantage of uninformed traders. In this article, you will learn about another unlicensed broker: Quest.

FundedNext Exposed: Poor Service, Unfair Rules & Trader Complaints

FundedNext has been facing investor ire on forex broker review platforms for the numerous instances of foul play it has been part of. Investors face constant withdrawal issues, unfair and fake rules on trading, and several other issues. All these contribute to scams.

FCA Publishes New Warning List! Check It Now to Stay Safe

FRAUD ALERT! – All investors and traders should be careful. The UK’s financial regulator, the Financial Conduct Authority (FCA), has warned people about fake brokers that are working without a license. These scam brokers take people’s money and disappear. The FCA shares a list of these fake brokers every day to help people stay safe. Checkout the List below to Stay Safe.

New to Forex Trading? Check Out These 6 Key Features of Taurex

If you're just stepping into the forex market and feeling confused about which broker to choose, you might consider giving a chance to a regulated forex broker like Taurex. You may wonder why we are specifically mentioning this broker. It is because of several strong reasons outlined in the article below.

WikiFX Broker

Latest News

Forex Hedging Strategies - Calming You Amid Market Chaos

Key Events This Week: ISM, Trade Balance And More Earnings

What Is Forex Currency Trading? Explained Simply

A Beginner’s Guide to Trading Forex During News Releases

Ultima Markets enters the UK and gains the FCA license

LSEG Announces £1 Billion Share Buyback Program

SEC Lawsuit Targets Real Estate Fraud Scheme by Joseph Nantomah

XS.com Broker Partnership Expands Liquidity with Centroid Integration

ASIC Regulated Forex Brokers: Why Licensing Still Matters in 2025

FCA Publishes New Warning List! Check It Now to Stay Safe

Currency Calculator