简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

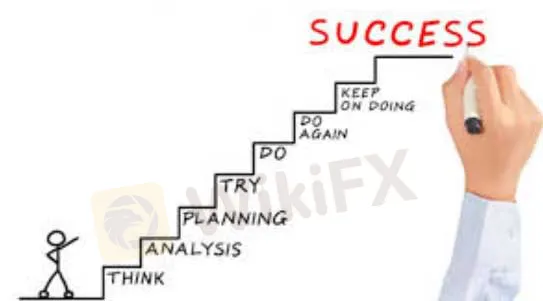

Key to Successful Forex Trading!

요약:How can traders be aware of their trading abilities?

Although many virtuosos strut their stuff in the forex market, others tell a different story. How can traders be aware of their trading abilities? WikiFX has summarized several points herein for your reference to help you have a better understanding of your competence and incompetence, assisting you to improve your transactions!

1. Outstanding traders observe trading charts and review their transactions every day. They verify their ideas and trading patterns based on markets at any time.

2. Brilliant traders theoretically understand signals and relevant risks, equipping themselves with methods of avoiding risks, even if the number of signals they are specialized in is not numerous. As for mediocre ones, they know plenty of signals and are prone to cutting-edge techniques instantly used in practice, but they only have a smattering of understanding in this regard.

3. Effective trading systems are more significant than countless approaches from the perspective of excellent traders as high-quality systems are conducive to emotional stability and the exclusion of wrong signals.

4. Virtuosos clearly understand the risk tolerance of their positions, strictly setting up stop-profit and stop-loss points. They decidedly exit the market when it is unfavorable.

5. Standouts have clear plans before trading because they are on their guard against losses. Mediocrities often conduct operations in face of signals, thus discarding their plans!

Download WikiFX to get lessons from experts who have traded forex for over 20 years. (bit.ly/wikifxIN)

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

최신 뉴스

WikiFX "3·15 외환 권리 보호의 날" – 블랙리스트 공식 발표

한국 경제, ‘반짝 성장’ 후 둔화… 원·달러 환율 어디로 갈까?

제1회 WikiFX Korea 모의 투자 대회 시작! 벚꽃이 흩날리는 봄, WikiFX와 함께

외환 투자에서 사기 브로커의 위험을 피하는 방법 | WikiFX, 규제 라이선스를 통해 리스크 식별 지원

환율 계산기