简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Pound May Celebrate Brexit Deal Defeat as US Dollar Gains on PPI

บทคัดย่อ:The British Pound may celebrate the defeat of a Brexit deal championed by Prime Minister Theresa May. The US Dollar may rise as wholesale inflation

- British Pound may rise as MPs vote down UK governments Brexit plan

- US Dollar might recover as PPI data encourages rethink of Fed outlook

- Yen down, Aussie and NZ Dollars up as sentiment firms in APAC trade

The markets were in a chipper mood in Asia Pacific trade. The sentiment-geared Australian and New Zealand Dollars rose alongside regional stocks while the anti-risk Japanese Yen and Swiss Franc declined. Perhaps most curiously, the British Pound traded broadly higher ahead of a vote in the UK parliament that looks likely to doom the Brexit deal struck by Prime Minister Theresa May.

While the uncertainty unleashed by such an outcome might have been expected to weigh on Sterling, price action is clearly showing otherwise. That might reflect investors‘ thinking that this Brexit deal’s demise just might – by the Prime Ministers own admission – set the stage for the undoing of the 2016 referendum result that initiated the UK/EU divorce in the first place.

Ms May will have a brief window to offer a “plan B” after a defeat, but it any such effort seems like a long shot at best. Members of Parliament have been busy trying to wrest control of the post-vote aftermath from the government for weeks. If they succeed, opposition to a “no-deal” Brexit among most MPs may set the stage for a delay – which will probably need unanimous EU approval – or a do-over referendum.

In the latter scenario, those favoring a status quo within the EU might prevail. A composite of recent polls puts support for remaining within the regional bloc at 53 percent versus 47 percent favoring an exit. An opportunity to exploit this shift in public sentiment might well be the very thing that financial markets are hoping for, making a defeat of the administrations Brexit deal a GBP-positive development.

US DOLLAR MAY RISE AS WHOLESALE INFLATION SURGESLater in the day, the spotlight turns to US PPI data. The core wholesale inflation rate is expected to rise to 3 percent, the highest since August 2011. If the markets are truly starting to on-board the Feds message about “data dependence”, such figures might encourage a rethink of the recent dovish shift in the priced-in policy outlook. If this is so, the US Dollar has scope for broad-based recovery.

See our market forecasts to learn what will drive currencies, commodities and stocks in Q1!

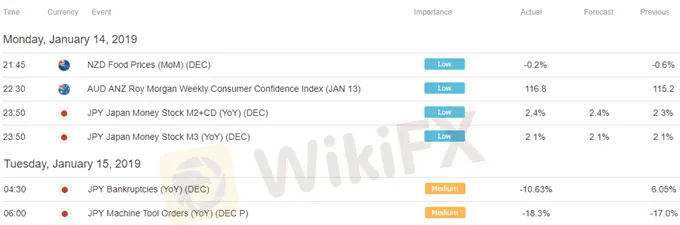

ASIA PACIFIC TRADING SESSION

EUROPEAN TRADING SESSION

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES- Just getting started? See our beginners‘ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinarand have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter

ข้อจำกัดความรับผิดชอบ:

มุมมองในบทความนี้แสดงถึงมุมมองส่วนตัวของผู้เขียนเท่านั้นและไม่ถือเป็นคำแนะนำในการลงทุน สำหรับแพลตฟอร์มนี้ไม่รับประกันความถูกต้องครบถ้วนและทันเวลาของข้อมูลบทความ และไม่รับผิดชอบต่อการสูญเสียใด ๆ ที่เกิดจากการใช้ข้อมูลในบทความ

WikiFX โบรกเกอร์

FxPro

ATFX

Exness

Pepperstone

IC Markets Global

OANDA

FxPro

ATFX

Exness

Pepperstone

IC Markets Global

OANDA

WikiFX โบรกเกอร์

FxPro

ATFX

Exness

Pepperstone

IC Markets Global

OANDA

FxPro

ATFX

Exness

Pepperstone

IC Markets Global

OANDA

ข่าวล่าสุด

ทรัมป์ยังไม่หยุด เตรียมประกาศภาษีนำเข้าอีกหลายรายการ “ในเดือนหน้าหรือเร็วกว่านั้น”

ออมทองต้องเสียภาษีไหม? ข้อควรรู้ก่อนลงทุนทองคำ

ทองปิดบวก $20 ทำนิวไฮ กังวลภาษีทรัมป์หนุนแรงซื้อสินทรัพย์ปลอดภัย

10 อันดับค่าเงินที่ถูกที่สุดในโลก ปี 2025

5 ประเทศศูนย์กลางของการเทรด FX จะมีประเทศอะไรบ้าง?

ดอลล์แข็งค่า นลท.รุกซื้อสกุลเงินปลอดภัยหลังทรัมป์ขู่รีดภาษี

กรมสรรพากรสหรัฐฯ เลิกจ้างพนักงานราว 6,000 ตำแหน่งตามนโยบายทรัมป์

ประสบการณ์เจ็บลืมไม่ลง “หมอฟรัง” ลงทุนคริปโตจาก 2 ล้านเหลือ 6 แสน!

คำนวณอัตราแลกเปลี่ยน