简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

KOSPI Falls, South Korea GDP Contracts. Euro Stoxx 50 Uptrend at Risk

บทคัดย่อ:Equities traded mixed in Asia with the KOSPI weighed down after South Korean GDP unexpectedly contracted. Before Amazon earnings, the Euro Stoxx 50 uptrend is facing indecision.

Asia Pacific Markets Wrap Talking Points

Equities mixed in Asia as Nikkei 225 climbs, KOSPI falls

Anti-risk Japanese Yen gains ahead of Amazon earnings

Euro Stoxx 50 shows indecision before its next breakout

Find out what retail traders equities buy and sell decisions say about the coming price trend!

Equities traded mixed during the Asia Pacific trading session following a lackluster performance on Wall Street. There, investors digested mixed earnings reports with foreign exchange markets showing signs of risk aversion.

The Nikkei 225 traded more than 0.5% higher heading into the close, guided higher by communication service shares. Meanwhile, the ASX 200 was up about 1% with financials leading higher. This sector of the index makes up for about a third of its weighting.

Stocks in China and South Korea fared worse on the other hand. The Shanghai Composite was down about 0.7% while the KOSPI dropped over 0.3%. South Korean GDP unexpectedly contracted according to preliminary estimates for the first quarter, likely souring sentiment.

Looking at currencies, the anti-risk Japanese Yen was narrowly outperforming against its major counterparts despite the Bank of Japan trimming growth and inflation estimates. Meanwhile, the pro-risk Australian and New Zealand Dollars traded relatively flat.

S&P 500 futures are pointing higher which suggests that there may be an uptick in overall optimism over the remaining 24 hours. US earnings are still in full swing with Amazon a notable contender ahead. Do watch for US durable goods orders which may disappoint given disappointing trends in economic data performance since February.

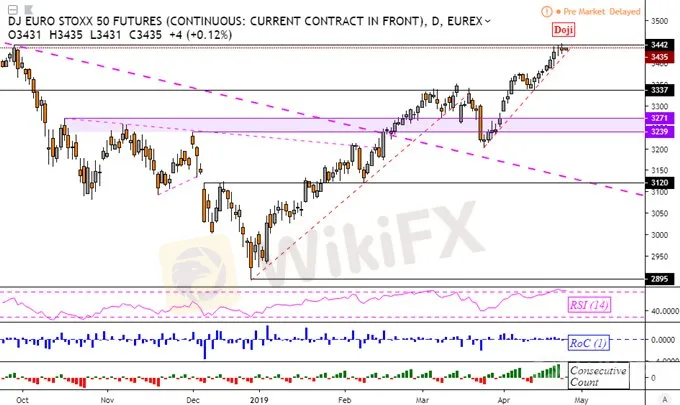

Euro Stoxx 50 Technical Analysis

Looking at Euro Stoxx 50 futures to show after-hours trade, the index formed a doji candle at the recent peak. This is a warning sign of indecision below resistance at 3442. Meanwhile, the rising support line from late March is directly below it. Keep an eye out for a breakout in either direction which ideally needs confirmation.

Euro Stoxx 50 Daily Chart

ข้อจำกัดความรับผิดชอบ:

มุมมองในบทความนี้แสดงถึงมุมมองส่วนตัวของผู้เขียนเท่านั้นและไม่ถือเป็นคำแนะนำในการลงทุน สำหรับแพลตฟอร์มนี้ไม่รับประกันความถูกต้องครบถ้วนและทันเวลาของข้อมูลบทความ และไม่รับผิดชอบต่อการสูญเสียใด ๆ ที่เกิดจากการใช้ข้อมูลในบทความ

WikiFX โบรกเกอร์

FXTM

EC Markets

Trive

FXCM

Pepperstone

Saxo

FXTM

EC Markets

Trive

FXCM

Pepperstone

Saxo

WikiFX โบรกเกอร์

FXTM

EC Markets

Trive

FXCM

Pepperstone

Saxo

FXTM

EC Markets

Trive

FXCM

Pepperstone

Saxo

ข่าวล่าสุด

หน่วยงาน DOGE ตั้งเป้าที่จะลดต้นทุนของรัฐบาลกลาง 1 ล้านล้านดอลลาร์ภายในไม่กี่สัปดาห์

ใช้เวลา 15 ปี ตามล่าตัว ‘Satoshi Nakamoto’ แต่จบด้วยความพีค

ทองปิดพุ่ง $38.50 วิตกภาษีทรัมป์หนุนแรงซื้อสินทรัพย์ปลอดภัย

คำนวณอัตราแลกเปลี่ยน