简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

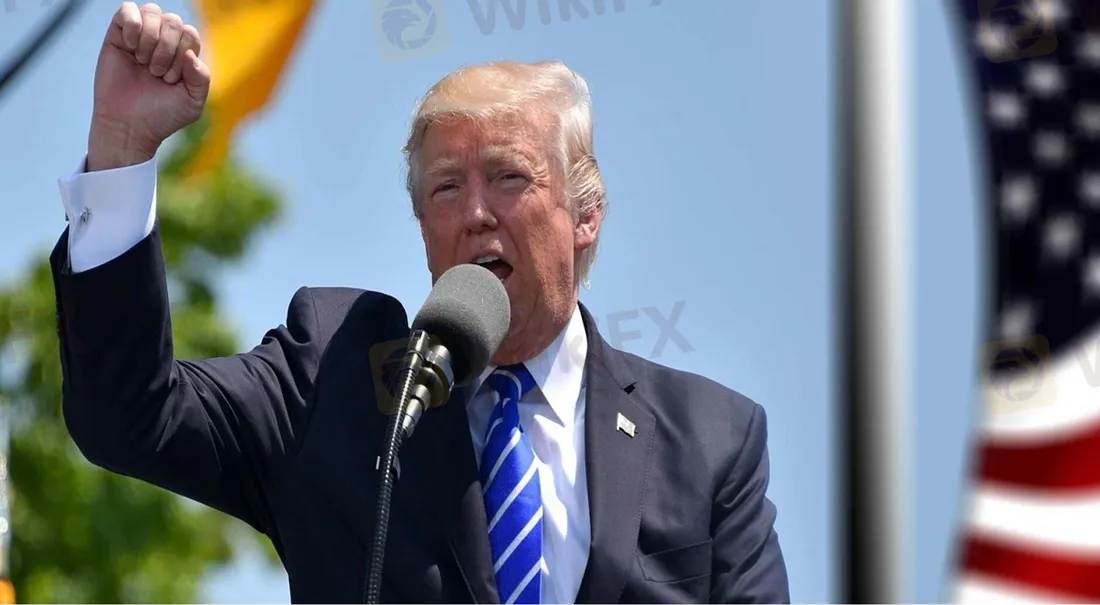

What Project 2025 Means for Tariffs and Trade on April 2

Abstract:On April 2, 2025, the United States will enact one of the most aggressive trade overhauls in modern history under Project 2025—a policy blueprint spearheaded by former Trump advisor Peter Navarro. The plan imposes reciprocal tariffs exceeding 10-25% on imports from China, India, the EU, Vietnam, and Taiwan, citing "economic aggression" and non-tariff barriers as justification.

Core Takeaways

• Project 2025, a conservative policy blueprint, mandates sweeping U.S. tariff hikes starting April 2, 2025, targeting China, India, the EU, and key Asian economies.

• Automotive, agriculture, and tech sectors face immediate disruption, with tariffs escalating to “mirror” nonreciprocal rates imposed by trade partners.

• The U.S. trade deficit reduction from these measures is projected to be marginal (4-5%), but market volatility and inflationary pressures are expected to surge.

• Supply chain reshoring, retaliatory tariffs, and potential Border Adjustment Tax (BAT) implementation add layers of complexity for forex and equity markets.

• Chinas 2025 tariff adjustments and EU countermeasures signal a fragmented global trade landscape, amplifying currency fluctuations.

On April 2, 2025, the United States will enact one of the most aggressive trade overhauls in modern history under Project 2025—a policy blueprint spearheaded by former Trump advisor Peter Navarro. The plan imposes reciprocal tariffs exceeding 10-25% on imports from China, India, the EU, Vietnam, and Taiwan, citing “economic aggression” and non-tariff barriers as justification. These measures, designed to slash the U.S. trade deficit by up to 10.2%, risk triggering retaliatory actions, supply chain chaos, and forex market turbulence, with analysts warning of inflationary spikes and prolonged dollar strength.

________________________________________

Project 2025‘s Tariff Blueprint: Navarro’s Playbook for Economic Warfare

The Mechanics of Reciprocal Tariffs

Project 2025s trade agenda, detailed in a 30-page section authored by Peter Navarro, hinges on the United States Reciprocal Trade Act (USRTA) framework. The policy empowers the President to unilaterally raise tariffs to match those of trading partners without congressional approval, leveraging the International Emergency Economic Powers Act (IEEPA). Key targets include:

• China: 10% baseline tariff on all goods, escalating to 60% if Beijing challenges dollar dominance.

• EU: 25% auto tariffs unless bloc increases U.S. energy imports.

• India and Vietnam: Tariffs mirroring their average rates of 13.8% and 9.6%, respectively.

Navarro argues that asymmetric tariffs—where U.S. exporters face 467,015 instances of higher foreign tariffs versus 141,736 cases domestically—constitute an “existential threat.” The 2019 White House report estimates a meager 4-5% reduction in the bilateral trade deficit, yet Project 2025 doubles down, prioritizing national security over economic efficiency.

________________________________________

Automotive: A $200 Billion Battleground

The EU and China face 25% auto tariffs, threatening $78 billion in annual EU vehicle exports and $52 billion from China. U.S. Automakers like GM and Ford, reliant on Mexican and Canadian parts, will absorb 25% input cost hikes. Project 44 warns of North American supply chain “disintegration,” with reshoring timelines stretching beyond 2027.

Agriculture: Subsidies vs. Tariffs

Malaysia‘s rice tariffs (20%) and EU dairy protections draw retaliatory U.S. duties. Navarro’s plan pressures India to lower farm subsidies or face 18% average tariffs—a move that could destabilize rupee forex markets. The USDA projects 12-15% price inflation for staples like avocados and beef.

Tech and Energy: Rare Earth Flashpoint

A 100% tariff on BRICS nations challenging dollar dominance puts Chinas rare earth exports ($5.3B/year) at risk. Intel, Apple, and Tesla face component shortages, while U.S. Shale oil exporters gain leverage as EU energy tariffs hinge on LNG purchases.

________________________________________

Forex and Equity Implications: Navigating the Storm

Dollar Dominance—At a Cost

Tariffs historically strengthen the dollar by 3-5% (per Wells Fargo), but BAT implementation could amplify gains. However, emerging market currencies—particularly Mexican peso (-8% projected) and Vietnamese dong (-12%)—face devaluation risks as exports contract.

Equity Sector Vulnerabilities

• Consumer Discretionary: Target and Walmart face 17% margin compression from $1,700/year household cost hikes (Peterson Institute).

• Small Caps: Russell 2000s 90-day volatility spikes to 32%, double S&P 500 levels.

• Tech: NASDAQs China-exposed firms (30% of revenue) could see 15-20% EPS downgrades.

As Biden warns of “economic disaster,” markets are pricing in a 68% probability of 2025 recessions in tariff-exposed economies. The only certainty? Uncertainty itself.

You could also join our exclusive Telegram group by searching for WikiFX India on Telegram. It is a group where you'll stay informed with no spam, just the latest Forex updates, insights, and news. No unnecessary advice or signals—just real, valuable info to keep you ahead in the market. Download WikiFX now and trade smarter, safer, and more informed!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Trade, Compete, Win: Enter the WikiFX World Elite Trading Championship

Kraken Eyes $1.5B Acquisition of NinjaTrader for Futures Trading

Dark Side of Finfluencers: They Aren’t Your Financial Friends!!

GCash Adds USDC to GCrypto for Secure Crypto Trading in Philippines

Kraken Acquires NinjaTrader for $1.5B to Lead US Futures Market

Vanishing Fortunes: RM1.9 Million Lost in a Crypto Scam

DFA Rescues Over 100 Filipinos from Myanmar Scam Hubs

What Project 2025 Means for Tariffs and Trade on April 2

FX vs Crypto Trading: Which Strategy is Best for You in 2025?

SILEGX Scam Investigation Uncovers 46 Cases and RM41.5 Million Losses

Currency Calculator